Adidas 1997 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 1997 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

In contrast, positive exchange rate effects

amounted to only DM 2 million in 1997 as

compared to DM 21 million in 1996. This sig-

nificant decline is primarily due to a change

in the accounting treatment with effect from

January 1, 1997. In 1996 unrealized exchange

gains and losses on outstanding hedging

contracts were reflected in exchange rate

effects. As, however, adidas enters into

hedging contracts to protect the cost of

future product purchases, it is more appro-

priate to reflect the gains/losses on these

instruments at the same time as the under-

lying commercial transactions. Accordingly

for 1997 unrealized exchange gains and/or

losses on such outstanding hedging con-

tracts are carried at historical values and

recognized as part of the cost base of the

hedged transactions.

If the Company’s previous accounting treat-

ment for currency options had been contin-

ued in 1997, the net financial result would

have been a net gain of DM 6 million, reflect-

ing the market values of outstanding hedging

contracts.

EXTRAORDINARY INCOME HAS

NO IMPACT ON RESULTS

The recorded extraordinary income in the

amount of DM 22 million has no net impact

on income before taxes, as offsetting ex-

penses

of the same amount are included in

the selling,

general and administrative ex-

penses. The expense and extraordinary

income are directly related to a special reward

and incentive plan for Management sponsored

by two shareholders (Robert Louis-Dreyfus

and Christian Tourres), who supply the shares

which are required to fulfil the Company’s

obligations under the plan.

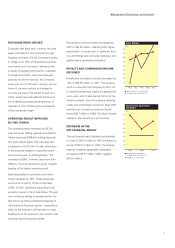

INCOME BEFORE TAXES INCREASED

BY MORE THAN HALF

Income before taxes (IBT) increased by 52%

to DM 677 million. As a consequence, IBT in

per cent of net sales rose to 10.1% in 1997

(1996: 9.4%). This increase in profit is due

solely to the improvement of the operating

result, as there was a decrease in both royal-

ty and commission income and the net finan-

cial result.

RETURN ON SALES IMPROVED TO 6.9%

For the first time since the initial public offer-

ing in 1995, adidas is able to report double-

digit earnings per ordinary share, which

reached DM 10.25 in 1997.

Indeed, net income rose by 48%, reaching

DM 465 million. Despite the negative impact

from increased income taxes and minority

interests, net income for the year also grew

at a faster rate than net sales. Return on

sales developed accordingly, improving by

0.2 percentage points to 6.9% in 1997.

Minority interests increased from DM 23 mil-

lion in 1996 to DM 26 million in 1997, as a

result of

improved profits at joint venture

companies.

Income taxes increased by 74.1% to DM 186

million in 1997 (1996: DM 107 million). This

has led to an increase in the effective tax rate

for the group, up by 3.5 percentage points to

27.5%. The main reason for the significant

increase in income taxes is the phase-out

of tax losses carried forward in some of the

European subsidiaries and the increased

profitability of subsidiaries in countries with

higher tax rates such as Italy.

1993 1994 1995 1996 1997

Profit Margin on Turnover

(%)

10

9

8

7

6

5

4

3

2

1

nbefore taxes

nnet

n

n

n

n

n

n

n

n

n

1993 1994 1995 1996 1997

Earnings per Share

(DM)

10

9

8

7

6

5

4

3

2

1

n

n

n

n

n

n