Adidas 1997 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 1997 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

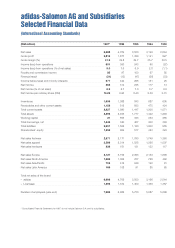

Change

year-over-

DM m year

Total net sales 1,699 +65.6%

of which

Footwear 855 +46.9%

Apparel 834 +90.8%

Gross margin 38.3% +7.6 PP

Order backlog* 1,363 +100.5%

Change

year-over-

DM m year

Total net sales 4,127 +30.7%

of which

Footwear 1,561 +19.2%

Apparel 2,406 +42.0%

Gross margin 42.4% –1 PP

Order backlog* 1,735 +34.6%

9

Whilst the 1997 group tax rate again was

sheltered

by tax losses carried forward in the

German operations and, to a lesser extent, in

some other countries, it is anticipated that

remaining losses carried forward in Germany

will be used up during 1998.

MARKET SHARE IN EUROPE

FURTHER EXPANDED

Europe’s sporting goods markets again saw

only moderate growth in 1997. As in 1996,

above-average increases were recorded in

only a few markets such as the U.K. and

Spain.

In this overall climate, adidas managed to

increase net sales by 31% to DM 4,127 mil-

lion in total, thereby gaining further market

share in the key European markets. In Europe,

apparel sold better than footwear, as clearly

shown by growth of 42% in apparel com-

pared to 19% in footwear. Nevertheless, the

increase in footwear is still well above overall

market performance.

The highest growth rates for adidas were

achieved in the U.K. (+91%), Poland (+68%),

Spain (+63%) and Norway (+52%). In Ger-

many, where consumption in the private

sector is soft and the market for sporting goods

is more or less flat, net sales increased by

a further 11%, clearly demonstrating the

strength of the brand.

adidas subsidiaries in the Middle East, which

are included in Region Europe, generated

combined sales growth of 60%. With the

foundation of a new subsidiary in the United

Arab Emirates in mid 1997, adidas will be

able to leverage its brand recognition in this

market more effectively.

A well-developed sales network in Eastern

Europe has again proved to be a competitive

advantage, which is reflected by a combined

34% growth rate in 1997.

In October, the former joint venture company

in the Benelux countries was transformed

into a wholly-owned subsidiary, creating the

basis for further penetration of this market.

In order to further build and promote the

European activities, adidas signed new spon-

sorship and license agreements or extended

and upgraded the level of existing contracts

in 1997. For example, adidas will be a main

sponsor of the 1998 Soccer World Cup in

France.

DYNAMIC GROWTH

IN NORTH AMERICA

The North American market for branded ath-

letic footwear grew at about 10% in 1997.

It

can be assumed that development of the

overall market for sporting goods was on a

comparable level. adidas, in contrast, in-

creased its sales by 66% in 1997, to DM 1.7

billion, clearly outperforming the general

market and raising its market share.

In addition to excellent volume growth, adidas

was also able to increase gross margin to

38.3%. This improvement is directly linked

to a favorable product mix, lower clearance

sales with higher margins achieved from

these clearance sales, and progress made in

increasing average price points.

In footwear, net sales in North America

increased 47% to DM 855 million in 1997.

The increase in footwear was primarily driven

by the running category, which clearly out-

performed the success of the preceding year.

Management Discussion and Analysis

* first half of 1998

* first half of 1998

Europe

North America