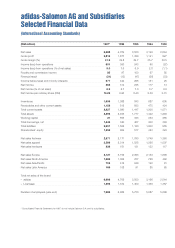

Adidas 1997 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1997 Adidas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

Management Discussion and Analysis

ADIDAS CLOSES 1997

WITH RECORD RESULTS

vNet sales increased by 42%

to DM 6.7 billion

vIncome before taxes rose by 52%

to DM 677 million

vEarnings per ordinary share (after

taxes) reached DM 10.25, achieving

a growth rate of 48% year-on-year

ACQUISITION OF SALOMON

IMPACTS BALANCE SHEET

vAs a result of the acquisition, there

has been a substantial increase in

borrowings, and investments have

risen by the same amount

vAt the same time, financial leverage

increased by 69 percentage points

to 107%

POSITIVE DEVELOPMENTS

IN THE MARKETPLACE

In 1997, the market for sporting goods showed

continuing positive development. Although

exact figures are not yet available for individu-

al countries, there are indications that the

sports shoe market in the United States has

grown by more than 10%. Growth rates in

Europe were probably substantially below

this level. Emerging markets in Asia/Pacific,

due to their strong income levels, were also

performing positively until this development

was abruptly halted with the onset of the

financial and economic crisis. It is safe to

assume, despite all of these uncertainties,

that demand for sporting goods again showed

stronger growth than gross national product

and private consumption worldwide.

SIGNIFICANT GROWTH IN

CONSOLIDATED SALES

In this overall climate, adidas’ net sales in-

creased by DM 2 billion, or 42%, to DM 6.7

billion in 1997. adidas not only gained market

share worldwide but also advanced to be-

come the second-largest sporting goods

company measured by consolidated net

sales. As in the preceding years, this strong

sales performance was primarily driven by

volume growth, with an 18% increase in

footwear pairs and 44% increase in apparel

pieces in 1997.

A smaller proportion of the growth in sales

resulted from the positive effects of an im-

proved product and price mix. Currency

effects, primarily the strength of the US dollar

and pound sterling, contributed 10% to the

growth in sales. In 1997, sales generated

by the joint venture in South Korea were

included for the first time for a full fiscal year.

CONTINUED DECREASE

IN LICENSEE SALES

The establishment of new group companies

is, in most circumstances, accompanied by

the termination of former license and/or dis-

tribution agreements. As a consequence, net

sales by licensees continued to decrease as

in 1996, by about 6%, reaching DM 1.3 bil-

lion. These sales, which are not included

in the consolidated company sales, now

account for only 16.2% of total brand sales.

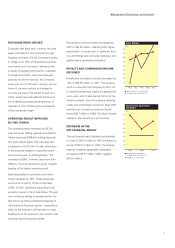

1993 1994 1995 1996 1997

Return on Equity

(%)

50

40

35

30

25

20

15

10

5

nn

n

n

n

nNet income divided by

shareholders’ equity

1993 1994 1995 1996 1997

Total Net Sales of the Brand

(Change year-over-year in %)

50

40

30

20

10

0

– 10

– 20

n

n

n

nadidas

nLicensees

nn

nnn

1993 1994 1995 1996 1997

Income

(DM m)

800

700

600

500

400

300

200

100

10

8

6

4

2

0

nIncome before taxes and minority interests

nNet income nNet income per share (DM)

n

n

n

n

n

n

n