Aarons 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Store-Based Operations

As of December 31, 2015, the Company had two senior vice presidents that provide executive leadership of the Aaron's Sales & Lease Ownership and

HomeSmart divisions. Our Sales & Lease Ownership division has 11 divisional vice presidents and one Canadian director who are responsible for the overall

performance of their respective divisions. HomeSmart has two directors responsible for that division’s performance. Each division is subdivided into

geographic groupings of stores overseen by a total of 155 Aaron’s Sales & Lease Ownership regional managers, including two Canadian regional managers,

and 12 HomeSmart regional managers.

At the individual store level, the store manager is primarily responsible for managing and supervising all aspects of store operations, including (i) customer

relations and account management, (ii) deliveries and pickups, (iii) warehouse and inventory management, (iv) partial merchandise selection, (v) employment

decisions, including hiring, training and terminating store employees and (vi) certain marketing initiatives. Store managers also administer the processing of

lease return merchandise including making determinations with respect to inspection, repairs, sales, reconditioning and subsequent leasing.

Our business philosophy emphasizes safeguarding of Company assets, strict cost containment and financial controls. All personnel are expected to monitor

expenses to contain costs. We pay all material invoices from Company headquarters in order to enhance financial accountability. We believe that careful

monitoring of lease merchandise as well as operational expenses enables us to maintain financial stability and profitability.

We use computer-based management information systems to facilitate customer orders, collections, merchandise returns and inventory monitoring. Through

the use of proprietary software, each of our stores is network linked directly to corporate headquarters enabling us to monitor single store performance on a

daily basis. This network system assists the store manager in (i) tracking merchandise on the showroom floor and warehouse, (ii) minimizing delivery times,

(iii) assisting with product purchasing and (iv) matching customer needs with available inventory.

Lease Agreement Approval, Renewal and Collection

One of the factors in the success of our store-based operations is timely cash collections, which are monitored by store managers. Customers are contacted

within a few days after their lease payment due dates to encourage them to keep their agreement current. Careful attention to cash collections is particularly

important in sales and lease ownership operations, where the customer typically has the option to cancel the agreement at any time and each contractually

due payment is generally considered a renewal of the agreement.

We generally perform no formal credit check with third party service providers with respect to store-based sales and lease ownership customers. We do,

however, verify employment or other reliable sources of income and personal references supplied by the customer. Generally our agreements for merchandise

require payments in advance and the merchandise normally is recovered if a payment is significantly in arrears. We currently do not extend credit to our

customers at store-based operations.

Our Progressive business uses a proprietary decisioning algorithm to determine which customers would meet our leasing qualifications. The transaction is

completed through our online portal or through a point of sale integration with our retail partners. Contractual renewal payments are based on a customer’s

pay frequency and are typically originated through automated clearing house payments. If the payment is unsuccessful, collections are managed in-house

through our call center and proprietary lease management system. The call center contacts customers within a few days of the lease payment due date to

encourage them to keep their agreement current. If the customer chooses to return the merchandise, arrangements are made to receive the merchandise from

the customer, either through our retail partners, our Draper location, our customer service hubs or our Company-operated stores.

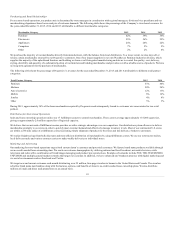

Company-wide lease merchandise adjustments (or "shrinkage") as a percentage of combined lease revenues were 5.1%, 4.5% and 3.3% in 2015, 2014 and

2013, respectively. We believe that our collection and recovery policies materially comply with applicable law and we discipline any employee we

determine to have deviated from such policies.

Credit Agreement Approval and Collection

DAMI offers a variety of financing programs to below-prime customers that are originated through a federally insured bank. We believe DAMI provides the

following strategic benefits when combined with Progressive's product offerings:

•Enhanced product for retail partners - DAMI will enhance Progressive's best-in-class point-of-sale product with an integrated solution for below-

prime customers. DAMI has a centralized, scalable decisioning model with a long operating history, deployed through its established bank partner,

and a sophisticated receivable management system.

8