Aarons 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

purchase laws limit the total amount that a customer may be charged for an item, or regulate the "cost-of-rental" amount that lease-to-own companies may

charge on lease-to-own transactions, generally defining "cost-of-rental" as lease fees paid in excess of the "retail" price of the goods. Our long-established

policy in all states is to disclose the terms of our lease purchase transactions as a matter of good business ethics and customer service. We believe we are in

material compliance with the various state lease purchase laws in those states where we use a lease purchase form of agreement. At the present time, no federal

law specifically regulates the lease-to-own industry. Federal legislation to regulate the industry has been proposed from time to time.

There has been increased legislative attention in the United States, at both the federal and state levels, on consumer debt transactions in general, which may

result in an increase in legislative regulatory efforts directed at the lease-to-own industry. We cannot predict whether any such legislation will be enacted and

what the impact of such legislation would be on us. Although we are unable to predict the results of any regulatory initiatives, we do not believe that existing

and currently proposed regulations will have a material adverse impact on our sales and lease ownership or other operations.

Our sales and lease ownership franchise program is subject to Federal Trade Commission, or FTC, regulation and various state laws regulating the offer and

sale of franchises. Several state laws also regulate substantive aspects of the franchisor-franchisee relationship. The FTC requires us to furnish to prospective

franchisees a franchise disclosure document containing prescribed information. A number of states in which we might consider franchising also regulate the

sale of franchises and require registration of the franchise disclosure document with state authorities. We believe we are in material compliance with all

applicable franchise laws in those states in which we do business and with similar laws in Canada.

DAMI is subject to various federal and state laws that address lending regulations, consumer information, consumer rights, and certain credit card specific

requirements, among other things. In addition, DAMI issues credit cards through a bank partner and therefore is subject to the bank's Federal Deposit

Insurance Corporation regulators. Several regulations affecting DAMI have been updated in recent years through The Credit Card Act and The Dodd-Frank

Wall Street Reform and Consumer Protection Act (the Dodd-Frank Act). Additional regulations are being developed, as the attention placed on consumer

debt transactions has grown significantly. We believe we are in material compliance with all applicable laws and regulations. While we are unable to predict

the results of any regulatory initiatives, we do not believe that existing and currently proposed regulations will have a material adverse impact on our

operations.

Section 1502 of the Dodd-Frank Act was adopted to further the humanitarian goal of ending the violent conflict and human rights abuses in the Democratic

Republic of the Congo and adjoining countries ("DRC"). This conflict has been partially financed by the exploitation and trade of tantalum, tin, tungsten and

gold, often referred to as conflict minerals, which originate from mines or smelters in the region. Securities and Exchange Commission ("SEC") rules adopted

pursuant to the Dodd-Frank Act require reporting companies to disclose annually, among other things, whether any such minerals that are necessary to the

functionality or production of products they manufactured during the prior calendar year originated in the DRC and, if so, whether the related revenues were

used to support the conflict and/or abuses.

Some of the products manufactured by Woodhaven Furniture Industries, our manufacturing division, may contain tantalum, tin, tungsten and/or gold.

Consequently, in compliance with SEC rules, we have adopted a policy on conflict minerals, which can be found on our website. We have also implemented

a supply chain due diligence and risk mitigation process with reference to the Organisation for Economic Co-operation and Development, or the OECD,

guidance approved by the SEC to assess and report annually whether our products are conflict free.

We expect our suppliers to comply with the OECD guidance and industry standards and to ensure that their supply chains conform to our policy and the

OECD guidance. We plan to mitigate identified risks by working with our suppliers and may alter our sources of supply or modify our product design if

circumstances require.

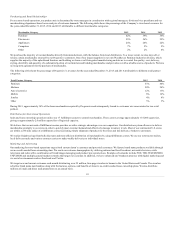

At December 31, 2015, the Company had approximately 12,700 employees. None of our employees are covered by a collective bargaining agreement and we

believe that our relations with employees are good.

We make available free of charge on our Internet website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K

and amendments to those reports and the Proxy Statement for our Annual Meeting of Shareholders. Our Internet address is investor.aarons.com.

13