Aarons 2015 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2015 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Higher consumer credit quality - DAMI primarily serves customers with FICO scores between 600 and 700, which make up approximately a quarter

of the U.S. population. These customers generally have greater purchasing power with stronger credit profiles than Progressive's current customers.

• Expanded customer base - In addition to complementing Progressive's traditional offering for existing and prospective retail partners, DAMI's

strong relationships in customer services offer an additional channel for longer-term growth.

DAMI uses an underwriting model that provides standardized credit decisions, including borrowing limit amounts. Credit decisions are primarily based on

the customer’s credit rating and ability-to-pay ratio. Customer credit terms are based on the underlying agreement with the merchant. Loans receivable are

unsecured, and collections on loans receivable are managed in-house through DAMI's call center and proprietary loans receivable management system.

Customer Service

A critical component of the success in our operations is our commitment to developing good relationships with our customers. Building a relationship with

the customer that ensures customer satisfaction is critical because customers of store-based operations and Progressive have the option of returning the leased

merchandise at any time or after a very short initial term. Our goal, therefore, is to develop positive associations about the Company and our products,

service, and support in the minds of our customers from the moment they enter our showrooms and the showrooms of our retail partners. We demonstrate our

commitment to superior customer service by providing customers with access to product through multiple channels, including Aarons.com and Progressive's

network of retail partner locations, rapid delivery of leased merchandise (often on same or next day delivery) and investments in technology that improve the

customer experience. Our Progressive business offers centralized customer and retailer support through contact centers located in Draper, Utah and Glendale,

Arizona.

Through Aaron’s Service Plus, customers receive multiple service benefits. These benefits vary according to applicable state law but generally include the

120-day same-as-cash option, merchandise repair service, lifetime reinstatement and other discounts and benefits. In order to increase leasing at existing

stores, we foster relationships with existing customers to attract recurring business, and many new agreements are attributable to repeat customers. Similarly,

we believe our strong focus on customer satisfaction at Progressive and DAMI generates repeat business and long-lasting relationships with our retail and

merchant partners.

In the third quarter of 2015, the Company announced the launch of Approve.Me, which is a proprietary platform that integrates with retailers' point-of-sale

systems and provides a single interface for all customers seeking credit approval or lease options, from prime to second-look financing, or to Progressive's

lease offering. The platform combines multiple credit and leasing providers into one application using a single interface. Approve.Me is compatible with

most primary or secondary providers and is designed to give retailers a faster and more efficient way to service customers seeking to finance transactions or

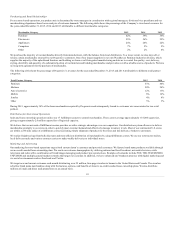

secure a lease option. We believe Approve.Me provides the following benefits to retail partners:

•Established product - Approve.Me has been successfully piloted and is currently being used in over 7,200 retail doors.

•Increased sales - Approve.Me's streamlined approach sends customer applications through each option, from prime to second-look financing, or to

Progressive's no-credit-needed lease option, quickly and seamlessly. This more efficient process typically results in more applications and higher

overall approval rates.

•Ease of use - The time a customer spends going through the application and approval process is reduced from about an hour (for multiple

applications) to just a few minutes.

•Improved analytics - Approve.Me gives retail partners access to a comprehensive view of credit decisioning and lease options thereby allowing

partners to better analyze and improve their overall financing/leasing flow.

Our emphasis on customer service requires that we develop skilled, effective employees who value our customers and project a genuine desire to serve their

needs. To meet this requirement, we have developed a field development program, one of the most comprehensive employee training programs in the

industry. Our field development program is designed to provide a uniform customer service experience. The primary focus of the field development program

is equipping new associates with the knowledge and skills needed to build strong relationships with our customers. Our learning and development coaches

provide live interactive instruction via webinars and by facilitating hands-on training in designated training stores. The program is also complemented with a

robust e-learning library. Additionally, Aaron’s has a management development program that offers development for current and future store managers. Also,

we periodically produce video-based communications on a variety of topics pertinent to store associates and regional managers regarding current Company

initiatives.

9