Aarons 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HomeSmart

Our HomeSmart operation began in 2010 and was developed to serve customers who prefer the flexibility of weekly payments and renewals. The consumer

goods we provide in our HomeSmart division are substantially similar to those available in our Aaron’s Sales & Lease Ownership stores.

The typical HomeSmart store layout is a combination showroom and warehouse of 4,000 to 6,000 square feet, with an average of approximately 5,000 square

feet. Store site selection, delivery capabilities and lease merchandise product mix are generally similar to those described above for our Aaron’s Sales & Lease

Ownership stores.

We believe that our HomeSmart stores offer prices that are lower than the prices for similar items offered by traditional weekly lease-to-own operators.

Approximately 71% of our HomeSmart agreements have weekly terms, 4% are semi-monthly and the remaining 25% are monthly. We may also offer an up-

front purchase option at prices we believe are competitive. At December 31, 2015, we had 82 Company-operated HomeSmart stores in 11 states.

DAMI

DAMI was founded in 1983 and primarily serves customers that may not qualify for traditional prime lending who desire to purchase goods and services from

participating merchants. DAMI, which operates as a wholly-owned subsidiary of Progressive, offers customized programs, with services that include

revolving loans, private label cards and access to a unique processing platform. DAMI’s current network of merchants includes medical markets, beds and

fitness equipment. The Company believes the DAMI product offerings are complementary to those of Progressive and expects to expand the markets and

merchants that DAMI serves.

We extend or decline credit to an applicant through our bank partner based upon the customer's credit rating. Our bank partner originates the loan by

providing financing to the merchant at the point of sale and acquiring the receivable at a discount from the face value, which represents a pre-negotiated fee

between DAMI and the merchant. DAMI then acquires the receivable from the bank.

Qualifying customers receive a credit card to finance their initial purchase and to use in subsequent purchases at the merchant or other participating

merchants for an initial two year period, which we will renew if the cardholder remains in good standing. The customer is required to make periodic minimum

payments and pay certain annual and other periodic fees.

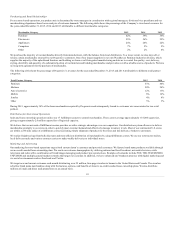

Franchise

We franchise our Aaron’s Sales & Lease Ownership and HomeSmart stores in markets where we have no immediate plans to enter. Our franchise program adds

value to our Company by allowing us to (i) recognize additional revenues from franchise fees and royalties, (ii) strategically grow without incurring direct

capital or other expenses, (iii) lower our average costs of purchasing, manufacturing and advertising through economies of scale and (iv) increase customer

recognition of our brands.

Franchisees are approved on the basis of the applicant’s business background and financial resources. We enter into agreements with our franchisees to

govern the opening and operations of franchised stores. Under our standard agreement, we receive a franchise fee from $15,000 to $50,000 per store

depending upon market size. Our standard agreement is for a term of ten years, with one ten-year renewal option. Franchisees are also obligated to remit to us

royalty payments of 5% or 6% of the weekly cash revenue collections from their franchised stores. Most franchisees are involved in the day-to-day operations

of their stores.

Because of the importance of location to our store strategy, we assist each franchisee in selecting the proper site for each store. We typically will visit the

intended market and provide guidance to the franchisee through the site selection process. Once the franchisee selects a site, we provide support in designing

the floor plan, including the proper layout of the showroom and warehouse. In addition, we assist the franchisee in the design and decor of the showroom to

ensure consistency with our requirements. We also lease the exterior signage to the franchisee and provide support with respect to pre-opening advertising,

initial inventory and delivery vehicles.

Qualifying franchisees may take part in a financing arrangement we have established with several financial institutions to assist the franchisee in establishing

and operating their store(s). Although an inventory financing plan is the primary component of the financing program, we have also arranged, in certain

circumstances, for the franchisee to receive a revolving credit line, allowing them to expand operations. We provide guarantees for amounts outstanding

under this franchise financing program.

6