Aarons 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Aaron’s sponsors event broadcasts at various levels along with select professional and collegiate sports, such as NFL and NBA teams. As a long-time

supporter of NASCAR, Aaron’s wrapped up its 17th year of sponsoring the Aaron's Dream Machine in several NASCAR series, which in recent years has

included Michael Waltrip Racing in the NASCAR Sprint Cup Series. In early 2016, Aaron’s announced continued support of NASCAR with a new, multi-

year agreement with Michael Waltrip as a spokesperson. All of Aaron’s sports partnerships are supported with advertising, promotional, marketing and brand

activation initiatives that we believe significantly enhance the Company’s brand awareness and customer loyalty.

Progressive and DAMI execute their marketing strategy in partnership with retailers and other merchants. This is typically accomplished through in-store

signage and marketing material, direct marketing activities, and the education of sales associates.

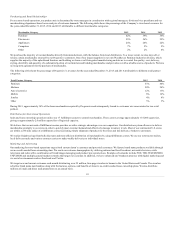

The lease-to-own industry is highly competitive. Our largest competitor for store-based operations is Rent-A-Center, Inc. ("Rent-A-Center"). Aaron’s and

Rent-A-Center, which are the two largest lease-to-own industry participants, account for approximately 4,900 of the 8,900 lease-to-own stores in the United

States, Canada and Mexico. Our stores compete with other national and regional lease-to-own businesses, as well as with rental stores that do not offer their

customers a purchase option. We also compete with retail stores for customers desiring to purchase merchandise for cash or on credit. Competition is based

primarily on store location, product selection and availability, customer service and lease rates and terms.

Although an emerging market, the virtual lease-to-own industry is also competitive. Progressive's largest competitor is Acceptance Now, a division of Rent-

A-Center. Other competition is fragmented and includes regional participants.

We are required to maintain significant levels of lease merchandise in order to provide the service demanded by our customers and to ensure timely delivery

of our products. Consistent and dependable sources of liquidity are required to maintain such merchandise levels. Failure to maintain appropriate levels of

merchandise could materially adversely affect our customer relationships and our business. We believe our operating cash flows, credit availability under our

financing agreements and other sources of financing are adequate to meet our normal liquidity requirements.

The principal raw materials we use in furniture manufacturing are fabric, foam, fiber, wire-innerspring assemblies, plywood, oriented strand board and

hardwood. All of these materials are purchased in the open market from unaffiliated sources. We are not dependent on any single supplier. None of the raw

materials we use are in short supply.

Our revenue mix is moderately seasonal for both our store-based operations and our Progressive business. The first quarter of each year generally has higher

revenues than any other quarter. This is primarily due to realizing the full benefit of business that historically gradually increases in the fourth quarter as a

result of the holiday season, as well as the receipt by our customers in the first quarter of federal and state income tax refunds. Our customers will more

frequently exercise the early purchase option on their existing lease agreements or purchase merchandise off the showroom floor during the first quarter of the

year. We tend to experience slower growth in the number of agreements on lease in the third quarter for store-based operations and in the second quarter for

our Progressive business when compared to the other quarters of the year. We expect these trends to continue in future periods.

The Lease-to-Own Industry

The lease-to-own industry offers customers an alternative to traditional methods of obtaining electronics, computers, home furnishings and appliances. In a

standard industry lease-to-own transaction, the customer has the option to acquire ownership of merchandise over a fixed term, usually 12 to 24 months,

normally by making weekly, semi-monthly, or monthly lease payments. Upon making regular periodic lease payments, the customer may cancel the

agreement at any time by returning the merchandise to the store. If the customer leases the item through the completion of the full term, he or she then obtains

ownership of the item. The customer may also purchase the item at any time by tendering the contractually specified payment.

11