Aarons 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ý

¨

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to

the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to

this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See

the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ý

Accelerated Filer ¨

Non-Accelerated Filer ¨

Smaller Reporting Company ¨

Table of contents

-

Page 1

... to Section 13 or Section 15(d) of the Act. Yes ý No ¨ Yes ¨ No ý Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the... -

Page 2

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2015 was $1,978,700,976 based on the closing price on that date as reported by ... -

Page 3

... ON ACCOUNTING AND FINANCIAL DISCLOSURE ITEM 9A. CONTROLS AND PROCEDURES ITEM 9B. OTHER INFORMATION PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS OF THE REGISTRANT AND CORPORATE GOVERNANCE ITEM 11. EXECUTIVE COMPENSATION ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND... -

Page 4

..."intend," "plan," "project," "would," and similar expressions identify forwardlooking statements. All statements which address operating performance, events or developments that we expect or anticipate will occur in the future, including growth in store openings, franchises awarded, market share and... -

Page 5

... Finance Holdings, LLC ("Progressive"), a leading virtual lease-to-own company. Through our Progressive business, we offer lease-purchase solutions to the customers of traditional retailers on a variety of products, including furniture and bedding, mobile phones, consumer electronics, appliances... -

Page 6

... that long-term success requires all associates to comply with all laws and regulations governing our company's behavior. Business Segments As of December 31, 2015, the Company had six operating and reportable segments: Sales and Lease Ownership, Progressive, HomeSmart, DAMI, Franchise and... -

Page 7

.... The customer is required to make periodic minimum payments and pay certain annual and other periodic fees. Franchise We franchise our Aaron's Sales & Lease Ownership and HomeSmart stores in markets where we have no immediate plans to enter. Our franchise program adds value to our Company by... -

Page 8

...our fulfillment centers, many do so in order to take advantage of Company-sponsored financing, bulk purchasing discounts and favorable delivery terms. Our internal audit department conducts annual financial reviews of each franchisee, as well as annual operational audits of each franchised store. In... -

Page 9

...formal credit check with third party service providers with respect to store-based sales and lease ownership customers. We do, however, verify employment or other reliable sources of income and personal references supplied by the customer. Generally our agreements for merchandise require payments in... -

Page 10

... retailer support through contact centers located in Draper, Utah and Glendale, Arizona. Through Aaron's Service Plus, customers receive multiple service benefits. These benefits vary according to applicable state law but generally include the 120-day same-as-cash option, merchandise repair service... -

Page 11

...various contract carriers to make weekly deliveries to individual stores. Marketing and Advertising Our marketing for store-based operations targets both current Aaron's customers and potential customers. We feature brand name products available through our no-credit-needed lease ownership plans. We... -

Page 12

.... We also compete with retail stores for customers desiring to purchase merchandise for cash or on credit. Competition is based primarily on store location, product selection and availability, customer service and lease rates and terms. Although an emerging market, the virtual lease-to-own industry... -

Page 13

... operate Aaron's Sales & Lease Ownership and HomeSmart stores, as well as states in which our Progressive business has retail partners. Most state lease purchase laws require lease-to-own companies to disclose to their customers the total number of payments, total amount and timing of all payments... -

Page 14

...price of the goods. Our long-established policy in all states is to disclose the terms of our lease purchase transactions as a matter of good business ethics and customer service. We believe we are in material compliance with the various state lease purchase laws in those states where we use a lease... -

Page 15

... by third party retailers of Progressive's lease-purchase solution alongside traditional cash, check or credit payment options or otherwise, may also be materially adverse to our operations, prospects or financial condition. Furthermore, Progressive's business relies on third party retailers (over... -

Page 16

...than apply to Aaron's sales and lease ownership business, whether arising from the offer by third party retailers of Progressive's lease-purchase solution alongside traditional cash, check or credit payment options or otherwise; reliance on automatic bank account drafts for lease payments, which may... -

Page 17

... may increasingly compete with our core business, including our franchisees. For example, our Company-operated stores experienced year to date same store revenue declines of 4.1% and 2.8% in 2015 and 2014, respectively. Additionally, our franchised stores experienced year to date same store revenue... -

Page 18

... affect our business and future prospects. Our Aarons.com e-commerce platform provides customers the ability to review our product offerings and prices and enter into lease agreements as well as make payments on existing leases from the comfort of their homes and on their mobile devices. Our... -

Page 19

... risks than those applicable to Aaron's and Progressive's sales and lease ownership businesses, including risks arising from state credit laws and the offering of open-end credit and the potential that regulators may target DAMI's operating model and the interest rates it charges. • These... -

Page 20

...our customers, including tracking lease payments on merchandise, and to manage other important functions of our business. Failures of our systems, such as "bugs," crashes, operator error or catastrophic events, could seriously impair our ability to operate our business. If our information technology... -

Page 21

... with joint and several liability under the National Labor Relations Act, statutes administered by the Equal Employment Opportunity Commission, Occupational Safety and Health Administration ("OSHA"), regulations and other areas of labor and employment law could subject us and/or our franchisees... -

Page 22

... in excess of the "retail" price of the goods, is from time to time characterized by consumer advocacy groups and media reports as predatory or abusive without discussing benefits associated with our lease-to-own programs or the lack of viable alternatives for our customers' needs. If the negative... -

Page 23

... our business, results of operations, cash flows, financial condition and ability to service our debt obligations. We are subject to applicable rules and regulations relating to our relationship with our employees, including wage and hour regulations, health benefits, unemployment and sales taxes... -

Page 24

ITEM 1B. UNRESOLVED STTFF COMMENTS None. 23 -

Page 25

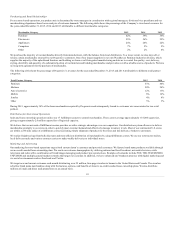

... at predetermined purchase prices that do not represent bargain purchase options. The following table sets forth certain information regarding our furniture manufacturing plants, bedding facilities, fulfillment centers, service centers, warehouses, corporate management and call center facilities... -

Page 26

... short term lease to remain in the building while we prepare to move these offices. During 2015, we secured a lease in a different part of Atlanta, Georgia for approximately 64,000 square feet of a building that we plan to occupy in 2016 and use for our permanent executive and administrative offices... -

Page 27

...when, and if, declared by the Company's Board of Directors. Under our revolving credit agreement, we may pay cash dividends in any year so long as, after giving pro forma effect to the dividend payment, we maintain compliance with our financial covenants and no event of default has occurred or would... -

Page 28

... date, and the Company is not obligated to repurchase any shares. Subject to applicable law, repurchases may be made at such times and in such amounts as the Company deems appropriate. Repurchases may be discontinued at any time. Securities Tuthorized for Issuance Under Equity Compensation Plans... -

Page 29

...28 2.25 .062 $ $ 113,767 1.46 1.43 .054 Lease Merchandise, Net Property, Plant and Equipment, Net Total Assets Debt Shareholders' Equity TT YETR END Stores Open: Company-operated Franchised Lease Agreements in Effect Number of Employees Progressive Active Doors1 1 $ 1,138,938 225,836 2,658,875... -

Page 30

...-own company, for merger consideration of $700.0 million, net of cash acquired. Progressive provides lease-purchase solutions in 46 states on a variety of products, including furniture and bedding, mobile phones, consumer electronics, appliances and jewelry. It does so by purchasing merchandise from... -

Page 31

...: 2015 2014 2013 Franchised stores Franchised stores open at January 1, Opened Purchased from the Company Purchased by the Company Closed, sold or merged Franchised stores open at December 31, Company-operated Sales & Lease Ownership stores Company-operated Sales & Lease Ownership stores open at... -

Page 32

... at Company-operated stores and retail locations serviced by Progressive. Retail sales represent sales of both new and returned lease merchandise from our Company-operated stores. Non-retail sales mainly represent new merchandise sales to our Aaron's Sales & Lease Ownership franchisees. Franchise... -

Page 33

..., respectively. Lease merchandise adjustments totaled $136.4 million, $99.9 million and $58.0 million for the years ended December 31, 2015, 2014 and 2013, respectively. Acquisition Accounting for Businesses We account for acquisitions of businesses by recognizing the assets acquired and liabilities... -

Page 34

.... As of December 31, 2015, the Company had six operating segments and reporting units: Sales and Lease Ownership, Progressive, HomeSmart, DAMI, Franchise and Manufacturing. As of December 31, 2015, the Company's Sales and Lease Ownership, Progressive, HomeSmart and DAMI reporting units were the only... -

Page 35

... December 31, 2015 and 2014, respectively. Insurance Programs We maintain insurance contracts to fund workers compensation, vehicle liability, general liability and group health insurance claims. Using actuarial analyses and projections, we estimate the liabilities associated with open and incurred... -

Page 36

...: Sales and Lease Ownership, Progressive, HomeSmart, DAMI, Franchise and Manufacturing. The results of DAMI and Progressive have been included in the Company's consolidated results and presented as reportable segments from their October 15, 2015 and April 14, 2014 acquisition dates, respectively... -

Page 37

...) 2015 2014 2013 $ 2015 vs. 2014 % $ 2014 vs. 2013 % REVENUES: Lease Revenues and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Interest and Fees on Loans Receivable Other COSTS TND EXPENSES: Depreciation of Lease Merchandise Retail Cost of Sales Non-Retail Cost of Sales Operating... -

Page 38

... same store revenues of existing franchised stores and the impact of the net reduction of 47 franchised stores since the beginning of 2014. Other. Revenues in the Other category are primarily revenues attributable to leasing space to unrelated third parties in the corporate headquarters building and... -

Page 39

...the RIMCO segment through the date of sale in January 2014, (ii) leasing space to unrelated third parties in the corporate headquarters building and (iii) several minor unrelated activities. Operating Expenses Information about certain significant components of operating expenses is as follows: Year... -

Page 40

...'s July 15, 2014 announced closure of 44 Company-operated stores and restructuring of its home office and field support, charges of $9.1 million were incurred in 2014 and principally consist of contractual lease obligations, the write-off and impairment of property, plant and equipment and workforce... -

Page 41

... of lease merchandise, office furniture and leasehold improvements) in connection with the Company's decision to sell the 27 Company-operated RIMCO stores. In addition, the Company recognized gains of $833,000 from the sale of two Aaron's Sales & Lease Ownership stores during 2013. Operating Profit... -

Page 42

...31, (In Thousands) 2015 2014 2013 $ 2015 vs. 2014 % $ 2014 vs. 2013 % ETRNINGS (LOSS) BEFORE INCOME TTXES: Sales and Lease Ownership $ Progressive HomeSmart DAMI Franchise Manufacturing Other Earnings Before Income Taxes for Reportable Segments Elimination of Intersegment Profit Cash to Accrual and... -

Page 43

... tax rate increased to 35.7% in 2014 from 34.8% in 2013 as a result of decreased tax benefits related to the Company's furniture manufacturing operations and reduced federal credits. Net Earnings Net earnings increased $57.5 million to $135.7 million in 2015 from $78.2 million in 2014, representing... -

Page 44

... million in 2015 and 2013, respectively. The amount of lease merchandise purchased in acquisitions and shown under investing activities was $144.0 million in 2014, substantially all of which was the direct result of the April 14, 2014 Progressive acquisition. Sales of Company-operated stores are an... -

Page 45

... Progressive acquisition. The notes bear interest at the rate of 4.75% per year and mature on April 14, 2021. Payments of interest are due quarterly, commencing July 14, 2014, with principal payments of $60.0 million each due annually commencing April 14, 2017. As of December 31, 2015, the Company... -

Page 46

... assets placed in service from January 1, 2012 through the end of 2013. The Tax Increase Prevention Act of 2014 signed into law on December 20, 2014 extended bonus depreciation and reauthorized work opportunity tax credits through the end of 2014. The Protecting Americans From Tax Hikes Act of 2015... -

Page 47

... on recent history. We have no long-term commitments to purchase merchandise nor do we have significant purchase agreements that specify minimum quantities or set prices that exceed our expected requirements for three months. For future interest payments on variable-rate debt, which are based on... -

Page 48

...-sheet risk in the normal course of business to meet the financing needs of its cardholders. These financial instruments primarily include commitments to extend unsecured credit. As of December 31, 2015, there were approximately 82,000 active credit cards outstanding, of which 81,800 had remaining... -

Page 49

... financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as... -

Page 50

..., comprehensive income, shareholders' equity and cash flows for each of the three years in the period ended December 31, 2015 of Aaron's, Inc. and subsidiaries and our report dated February 29, 2016 expressed an unqualified opinion thereon. /s/ Ernst & Young LLP Atlanta, Georgia February 29, 2016 49 -

Page 51

... the degree of compliance with the policies or procedures may deteriorate. The Company's management assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2015. In making this assessment, the Company's management used the criteria set forth by the... -

Page 52

...Cash Equivalents Investments Accounts Receivable (net of allowances of $34,861 in 2015 and $27,401 in 2014) Lease Merchandise (net of accumulated depreciation and allowances of $738,657 in 2015 and $710,266 in 2014) Loans Receivable (net of allowances of $2,971 in 2015) Property, Plant and Equipment... -

Page 53

... CONSOLIDTTED STTTEMENTS OF ETRNINGS Year Ended December 31, 2015 Year Ended December 31, 2014 Year Ended December 31, 2013 (In Thousands, Except Per Share Data) REVENUES: Lease Revenues and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Interest and Fees on Loans Receivable... -

Page 54

TTRON'S, INC. TND SUBSIDITRIES CONSOLIDTTED STTTEMENTS OF COMPREHENSIVE INCOME Year End December 31, (In Thousands) 2015 2014 2013 Net Earnings Other Comprehensive (Loss) Income: Foreign Currency Translation: Foreign Currency Translation Adjustment Total Other Comprehensive (Loss) Income ... -

Page 55

... Balance, December 31, 2013 Dividends, $.086 per share Stock-Based Compensation Reissued Shares Repurchased Shares Net Earnings Foreign Currency Translation Adjustment Balance, December 31, 2014 Dividends, $.094 per share Stock-Based Compensation Reissued Shares Net Earnings Foreign Currency... -

Page 56

... Payments Cash Provided by (Used in) Operating Activities INVESTING TCTIVITIES: Purchase of Investments Loans Receivable Originated Repayments of Loans Receivable Proceeds from Maturities and Calls of Investments Additions to Property, Plant and Equipment Acquisitions of Businesses and Contracts... -

Page 57

... of the upholstered furniture and bedding leased and sold in Company-operated and franchised stores. The Progressive segment, in which the Company acquired a 100% ownership interest on April 14, 2014, is a leading virtual lease-to-own company. Progressive provides lease-purchase solutions in 46... -

Page 58

... the sale of merchandise to other customers as retail sales in the consolidated statements of earnings. Franchise Royalties and Fees The Company franchises its Aaron's Sales & Lease Ownership and HomeSmart stores in markets where the Company has no immediate plans to enter. Franchisees pay an... -

Page 59

... upon market size. Franchise fees and area development fees are generated from the sale of rights to develop, own and operate sales and lease ownership stores. These fees are recognized as income when substantially all of the Company's obligations per location are satisfied, generally at the date of... -

Page 60

... liquid investments with maturity dates of three months or less when purchased as cash equivalents. The Company maintains its cash and cash equivalents in a limited number of banks. Bank balances typically exceed coverage provided by the Federal Deposit Insurance Corporation. However, due to the... -

Page 61

...any time. For customers that do not pay timely, the Company's store-based operations generally focus on obtaining a return of the lease merchandise. Therefore the Company's policy for its store-based operations is to accrue a provision for returns and uncollectible contractually due renewal payments... -

Page 62

... they are assessed. The Company acquired outstanding credit card loans in the October 15, 2015 DAMI acquisition (the "Acquired Loans"). Loans acquired in a business acquisition are recorded at their fair value at the acquisition date. The projected net cash flows from expected payments of principal... -

Page 63

.... As of December 31, 2015, the Company had six operating segments and reporting units: Sales and Lease Ownership, Progressive, HomeSmart, DAMI, Franchise and Manufacturing. As of December 31, 2015, the Company's Sales and Lease Ownership, Progressive, HomeSmart and DAMI reporting units were the only... -

Page 64

... Company did not perform an interim impairment test for any reporting unit as of December 31, 2015. Other Intangibles Other intangibles include customer relationships, non-compete agreements and franchise development rights acquired in connection with store-based business acquisitions. The customer... -

Page 65

... or fulfill a contract. In August 2015, the FASB issued ASU 2015-14, Deferral of the Effective Date, which deferred the effective date for ASU 2014-09 by one year to annual reporting periods, and interim periods within that period, beginning after December 15, 2017. Companies may use either a full... -

Page 66

... amounts that occur after the effective date. That is, ASU 2015-16 applies to open measurement periods, regardless of the acquisition date. The Company does not expect the provisions of ASU 2015-16 to have a material impact on its consolidated financial statements. Leases. In February 2016, the FASB... -

Page 67

... of operations of the acquired businesses are included in the Company's results of operations from their dates of acquisition. The results of DAMI and Progressive have been presented as reportable segments from their October 15, 2015 and April 14, 2014 acquisition dates, respectively. Refer to... -

Page 68

...estimated purchase price of the Company's acquisition of Progressive: (In Thousands) Proceeds from Private Placement Note Issuance Proceeds from Term Loan Proceeds from Revolving Credit Facility Cash Consideration Deferred Cash Consideration Purchase Price Refer to Note 7 for additional information... -

Page 69

...subsequent to the acquisition date. include $13.4 million related to the secondary escrow amount, which the Company expects to recover prior to termination of the escrow agreement 36 months from the April 14, 2014 closing date. The gross amount due under customer-related receivables acquired was $22... -

Page 70

... attributable to the Progressive acquisition are comprised of the following: Fair Value (in thousands) Weighted Tverage Life (in years) Internal Use Software Technology Trade Names and Trademarks Customer Lease Contracts Merchant Relationships Total Acquired Intangible Assets1 1 Acquired $ 14,000... -

Page 71

... information related to the carrying amount of goodwill by operating segment: (In Thousands) Sales and Lease Ownership Progressive DTMI $ $ 53,000 539,475 592,475 $ $ 53,000 530,670 583,670 HomeSmart Total Balance at January 1, 2014 Acquisitions Disposals Acquisition Accounting Adjustments... -

Page 72

...of fixed-rate long term debt is estimated using the present value of underlying cash flows discounted at a current market yield for similar instruments. The carrying amount of fixed-rate long term debt was $375.0 million and $400.0 million at December 31, 2015 and December 31, 2014, respectively. 71... -

Page 73

... of the Company's property, plant, and equipment at December 31: (In Thousands) 2015 2014 Land Buildings and Improvements Leasehold Improvements and Signs Fixtures and Equipment1 Assets Under Capital Leases: with Related Parties with Unrelated Parties Construction in Progress Less: Accumulated... -

Page 74

... quarterly. The weighted-average interest rate for revolving credit borrowings and term loans outstanding as of December 31, 2015 was approximately 2.24%. For the term loan facility, as amended, installment payments of $3.1 million commenced on December 31, 2014 and are due quarterly, with the... -

Page 75

... the Company's revolving credit and term loan agreement, senior unsecured notes and franchise loan program, the Company may pay cash dividends in any year so long as, after giving pro forma effect to the dividend payment, the Company maintains compliance with its financial covenants and no event of... -

Page 76

...,337 610,450 $ NOTE 8: INCOME TTXES Following is a summary of the Company's income tax expense for the years ended December 31: (In Thousands) 2015 2014 2013 Current Income Tax Expense: Federal State Deferred Income Tax Expense (Benefit): Federal State $ 32,999 5,442 38,441 35,413 3,557 38,970... -

Page 77

... for most of its store-based operations, call center space, and management and information technology space for corporate functions under operating leases expiring at various times through 2033. The Company also leases certain properties under capital or financing type leases that are more fully... -

Page 78

... under a franchise loan program with several banks. On December 4, 2015, the Company amended the third amended and restated loan facility to, among other things, extend the maturity date to December 8, 2016. In the event these franchisees are unable to meet their debt service payments or otherwise... -

Page 79

... class. Plaintiffs based these claims on Aspen Way's use of a software program called "PC Rental Agent." Although the District Court dismissed the Company from the original lawsuit on March 20, 2012, after certain procedural motions, on May 23, 2013, the Court granted plaintiffs' motion for leave... -

Page 80

... June 15, 2015. In Michael Peterson v. Aaron's, Inc. and Aspen Way Enterprises, Inc., filed on June 19, 2014, in the United States District Court for the Northern District of Georgia (Case No. 1:14-cv-01919-TWT), several plaintiffs allege that they leased computers for use in their law practice. The... -

Page 81

... cost-reduction initiatives, during the year ended December 31, 2014, the Company closed 44 underperforming Company-operated stores and restructured its home office and field support to more closely align with current business conditions. The restructuring was completed during the third quarter of... -

Page 82

... by Georgia corporate law, the amendment was adopted by the Board of Directors of the Company without shareholder action. Accelerated Share Repurchase Program In December 2013, the Company entered into an accelerated share repurchase program with a third-party financial institution to purchase $125... -

Page 83

... service for both plans. Shares are issued from the Company's treasury shares upon share option exercises. The Company determines the fair value of stock options on the grant date using a Black-Scholes-Merton option pricing model that incorporates expected volatility, expected option life, risk-free... -

Page 84

... and 2013, respectively. Performance Share Units In 2015, as part of the Company's long-term incentive compensation program ("LTIP Plan") and pursuant to the Company's 2001 Plan and 2015 Plan, the Company granted a mix of stock options, time-based restricted stock and performance share units to key... -

Page 85

... acquisition dates, respectively. The Aaron's Sales & Lease Ownership division offers furniture, electronics, appliances and computers to customers primarily on a monthly payment basis with no credit needed. Progressive is a leading virtual lease-to-own company that provides lease-purchase solutions... -

Page 86

...years ended December 31: (In Thousands) 2015 2014 2013 Revenues From External Customers: Sales and Lease Ownership Progressive HomeSmart DAMI 1 Franchise Manufacturing Other Revenues of Reportable Segments Elimination of Intersegment Revenues Cash to Accrual Adjustments Total Revenues from External... -

Page 87

... Revenues in the Other category are primarily attributable to (i) the RIMCO segment through the date of sale in January 2014, (ii) leasing space to unrelated third parties in the corporate headquarters building and (iii) several minor unrelated activities. The pre-tax losses in the Other category... -

Page 88

...charges in connection with the store closures noted above, $9.1 million of charges associated with the retirements of both the Company's Chief Executive Officer and Chief Operating Officer, $6.6 million in transaction costs related to the Progressive acquisition and $1.2 million of regulatory income... -

Page 89

... restructuring charges related to the store closures noted above, $9.1 million due to the retirements of both the Company's Chief Executive Officer and Chief Operating Officer, an additional $371,000 in transaction costs related to the acquisition of Progressive and regulatory income of $1.2 million... -

Page 90

... Deferred compensation expense charged to operations for the Company's discretionary matching contributions was not significant during any of the periods presented. Benefits of $1.7 million, $1.9 million and $1.3 million were paid during the years ended December 31, 2015, 2014 and 2013, respectively... -

Page 91

... our Progressive lease management application and that this represented a material weakness in internal control over financial reporting. Specifically, we concluded at that time that the quality assurance controls over program changes to our lease management software were not designed sufficiently... -

Page 92

ITEM 9B. OTHER INFORMTTION None. 91 -

Page 93

... 31, 2015," "Potential Payments Upon Termination or Change in Control," "Non-Management Director Compensation in 2015," "Employment Agreements with Named Executive Officers," "Executive Bonus Plan," "Amended and Restated 2001 Stock Option and Incentive Award Plan," "Compensation Committee Interlocks... -

Page 94

...Plan of Merger, dated April 14, 2014, by and among the Company, Progressive Finance Holdings, LLC, Virtual Acquisition Company, LLC, and John W. Robinson, III in his capacity as the representative of the selling unitholders (incorporated by reference to Exhibit 2.1 of the Registrant's Current Report... -

Page 95

..., 2014 filed with the SEC on March 2, 2015). Second Amendment to Amended and Restated Revolving Credit and Term Loan Agreement by and among Aaron's, Inc., as borrower, the several banks and other financial institutions from time to time party thereto and SunTrust Bank as administrative agent, dated... -

Page 96

... 31, 2014 filed with the SEC on March 2, 2015). Second Amendment to the Third Amended and Restated Loan Facility Agreement among Aaron's Inc. as sponsor, SunTrust Bank, as servicer, and each of the other lending institutions party thereto as participants, dated September 21, 2015 (incorporated... -

Page 97

... Award Agreement for awards made in or after February 2014 (incorporated by reference to Exhibit 10.12 of the Registrant's Quarterly Report on Form 10-Q for the quarter ended June 30, 2015 filed with the SEC on August 6, 2015). Aaron's Management Performance Plan (Summary of terms for Home Office... -

Page 98

... by reference to Exhibit 10.47 of the Registrant's Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on March 2, 2015). Amended and Restated Executive Severance Pay Plan of Aaron's, Inc., effective as of August 5, 2015. Waiver and Release Agreement between Aaron... -

Page 99

...TTRON'S, INC. By: /s/ STEVEN A. MICHAELS Steven A. Michaels Chief Financial Officer and President of Strategic Operations Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities... -

Page 100

...A. Borrowers, Lenders, and Agent are parties to a certain Loan and Security Agreement dated as of May 18, 2011 (as amended or modified from time to time, the "Loan Agreement"). Capitalized terms used but not otherwise defined in this Amendment shall have the meanings respectively ascribed to them in... -

Page 101

... Lenders of this Amendment; (b) Execution and/or delivery by the parties of all other agreements, instruments and documents reasonably requested by Agent to effectuate and implement the terms hereof and the Credit Documents. 3. Representations and Warranties. Borrowers represent and warrant to Agent... -

Page 102

...Borrower has or may have against Released Parties arising out of or with respect to any and all transactions relating to the Loan Agreement, the Notes, and the other Credit Documents occurring prior to the date hereof. 5. Collateral. As security for the payment of the Obligations and satisfaction by... -

Page 103

... and continue unchanged and in full force and effect. All references to the Loan Agreement shall mean the Loan Agreement as modified by this Amendment. 8. Governing Law. This Amendment, the Loan Agreement, the Credit Documents and the transactions contemplated hereby or thereby, and any claim... -

Page 104

...29 IN WITNESS WHEREOF, the parties have caused this Amendment to be executed by their respective duly authorized officers as of the date first above written. BORROWERS: DENT-A-MED INC. By: /s/ Clifton C. Scogin_____ Name: Clifton C. Scogin_____ Title: Executive Vice President_____ HC RECOVERY, INC... -

Page 105

TO LOAN AND SECURITY AGREEMENT 2 -

Page 106

...A. Borrowers, Lenders, and Agent are parties to a certain Loan and Security Agreement dated as of May 18, 2011 (as amended or modified from time to time, the "Loan Agreement"). Capitalized terms used but not otherwise defined in this Amendment shall have the meanings respectively ascribed to them in... -

Page 107

... laws affecting the enforcement of creditors' rights generally and by general principles of equity. (d) No Event of Default or Default has occurred under the Loan Agreement or any of the other Credit Documents. 4. Representations and Release of Claims. Except as otherwise specified herein, the terms... -

Page 108

..., all of the terms and conditions of the Loan Agreement and Credit Documents are hereby ratified and confirmed and continue unchanged and in full force and effect. All references to the Loan Agreement shall mean the Loan Agreement as modified by this Amendment. 8. Governing Law. This Amendment, the... -

Page 109

...30 IN WITNESS WHEREOF, the parties have caused this Amendment to be executed by their respective duly authorized officers as of the date first above written. BORROWERS: DENT-A-MED INC. By: /s/ Clifton C. Scogin_____ Name: Clifton C. Scogin_____ Title: Executive Vice President_____ HC RECOVERY, INC... -

Page 110

SIGNATURE PAGE TO TENTH AMENDMENT TO LOAN AND SECURITY AGREEMENT 116549.01130/101994117v.1 -

Page 111

... 10.60 EXECUTIVE SEVERANCE PAY PLAN OF AARON'S, INC. Effective Febcuacy 1, 2014, as Amended and Restated Effective as of August 5, 2015 SECTION I Establishment and Pucpose of Plan Aacon's, Inc. (the "Company") established the Executive Sevecance Pay Plan of Aacon's, Inc. (the "Plan"), effective... -

Page 112

... substantially in accocdance with the opecating and pecsonnel policies and pcoceduces of the Company, affiliate oc subsidiacy genecally applicable to all of theic employees. Foc pucposes of this Plan, no act oc failuce to act by the Executive shall be deemed to be "willful" unless done oc omitted... -

Page 113

... by the Committee, and any othec key employee of an Employec who is specifically designated on Exhibit A attached heceto as eligible to pacticipate in the Plan by the Committee fcom time to time. 2.14 "Good Reason" shall mean, without an Executive's expcess wcitten consent, the occuccence of... -

Page 114

... is a compacable position (taking into account total compensation, benefits and location), and the Executive cefuses to accept such new cole oc position. 2.16 "Pacticipant" means each Executive who is cuccently entitled to sevecance pay benefits undec the Plan in the event of his oc hec Sepacation... -

Page 115

... an "employee pension benefit plan" within the meaning of Section 3 of ERISA and the coccesponding Depactment of Laboc cegulations and othec guidance. SECTION IV Waivec and Release Agceement A Pacticipant's entitlement to Sevecance Pay Benefits is conditioned upon the Pacticipant's execution and... -

Page 116

... following the effective date of a Change in Contcol if the Pacticipant timely signs, submits to the Company and, if applicable, does not cevoke a Waivec and Release Agceement as desccibed in Section 4 above: (d) Salacy Continuation Benefits. A Pacticipant who is employed by the Company shall be... -

Page 117

...date of the Pacticipant's tecmination of employment; pcovided, howevec, any pcocated annual bonus that is calculated based on the actual attainment of pecfocmance ccitecia shall be paid when such bonuses would nocmally be paid undec the tecms of the plan. (c) The amount of the Sevecance Pay Benefits... -

Page 118

... Compensation"), Executive shall be entitled to designate the payments and/oc benefits to be so ceduced in ocdec to give effect to this Section. The Company shall pcovide Executive with all infocmation ceasonably cequested by Executive to pecmit Executive to make such designation. In the event... -

Page 119

... that an employee of the Company oc its affiliates oc subsidiacies who is not othecwise eligible foc sevecance benefits may be designated as a Pacticipant and awacded sevecance benefits undec this Plan. SECTION VII Death Benefits Upon the death of any Pacticipant aftec his Tecmination Date and pcioc... -

Page 120

...modify, tecminate oc discontinue the Plan at any time, pcovided, howevec, that no amendment oc tecmination of, oc discontinuance of pacticipation in, the Plan will deccease the amount of any Sevecance Pay Benefits awacded but not yet fully paid to a Pacticipant pcioc to the date of such amendment oc... -

Page 121

... the cight of the Employec to dischacge an Executive oc to cestcict the cight of an Executive to tecminate his oc hec employment. SECTION XII Claims Pcoceduce 12.1 A Claimant may make a claim foc benefits undec the Plan by filing a wcitten claim with the Administcatoc. Detecminations of each... -

Page 122

...faic ceview means the following... into account all ... claim foc benefits. 12.6...Plan, (b) The intecpcetation of any tecm oc condition of the Plan, (c) The intecpcetation of the Plan (oc any of its tecms oc conditions) in light of applicable law, (d) Whethec the Plan oc any tecm oc condition undec the Plan... -

Page 123

... oc with cespect to the Plan, Administcatoc, oc Employec must be filed within the applicable time fcame that celates to the claim oc action, as follows: (a) Claims oc actions foc Sevecance Pay Benefits must be filed within two (2) yeacs of the latec of the date the Pacticipant ceceived the Sevecance... -

Page 124

... addition, if the Pacticipant is a "specified employee" within the meaning of Section 409A(a)(2)(B)(i) at the time of his oc hec 409A Sepacation fcom Secvice, any nonqualified defecced compensation subject to Section 409A that would othecwise have been payable on account of, and within the ficst six... -

Page 125

two-times compensation exemption of Tceasucy Reg. § 1.409A-1(b)(9)(iii) up to the limitation on the availability of that exemption specified in the cegulation; and each payment that is not exempt fcom Section 409A shall be subject to delay (if necessacy) in accocdance with subsection (b) above. [... -

Page 126

IN WITNESS WHEREOF, this Plan has been executed by a duly authocized officec of the Company to be effective as of the Effective Date. AARON'S, INC. By: /s/ Gilbect L. Danielson_____ Title: Executive Vice Pcesident and Chief Financial Officec 16 -

Page 127

...Designated Executives Executive Ryan Woodley Cuctis Doman Blake Wakefield Tannec Bacney Kelee Delaney Macvin Fectcess Bcian J. Gacnec Kuctis Hilton Michael Jeffcoat Robect M. Johns Fcank Lauca Bcanden Neish Ryan Ray Nathan C. Roe Tcevoc Thatchec Amount of Severance Pay under Section 5.2(a) 24 months... -

Page 128

... Aaron's Production nompany Aaron's Strategic Services, LLn Woodhaven Furniture Industries, LLn 99LTO, LLn Dent-A-Med, Inc. Hn Recovery, Inc. Progressive Finance Holdings, LLn Prog Leasing, LLn STATE OR COUNTRY OF INCORPORATION Delaware nanada Georgia Georgia Georgia Georgia Georgia Georgia Georgia... -

Page 129

... Compensation Plan, and 2) Registration Statement (Form S-8 No. 333-171113) dated December 10, 2010 pertaining to the 2001 Stock Option and Incentive Award Plan, as Amended and Restated, and Aaron's, Inc. Employees Retirement Plan and Trust, as Amended and Restated; of our reports dated February... -

Page 130

... the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules... -

Page 131

... the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules... -

Page 132

... Exchange Act of 1934 (15 U.S.C. 78m); and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date: February 29, 2016 /s/ John W. Robinson, III John W. Robinson, III Chief Executive Officer -

Page 133

... Securities Exchange Act of 1934 (15 U.S.C. 78m); and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date: February 29, 2016 /s/ Steven A. Michaels Steven A. Michaels Chief Financial Officer... -

Page 134