Washington Post 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

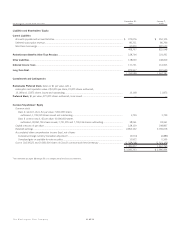

for 2001 was increased to $5.60 per share, from $5.40 per share in

2000, $5.20 per share in 1999, and $5.00 per share in 1998.

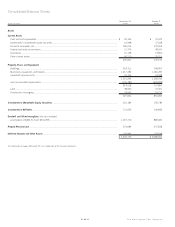

Liquidity. At December 31, 2000, the Company had $20.3 million in

cash and cash equivalents.

At December 31, 2000, the Company had $525.4 million in com-

mercial paper borrowings outstanding at an average interest rate of

6.6 percent with various maturities throughout the first and second

quarter of 2001. In addition, the Company had outstanding $397.9

million of 5.5 percent, 10 year unsecured notes due February 2009.

These notes require semiannual interest payments of $11.0 million

payable on February 15 and August 15.

The Company utilizes a five-year $500 million revolving credit

facility and a one-year $250 million revolving credit facility to support

the issuance of its short-term commercial paper, and to provide for

general corporate purposes.

At December 31, 2000, the Company has classified $475.4 million

of its commercial paper borrowings as long-term debt in its Consolidated

Balance Sheets as the Company has the ability and intent to finance

such borrowings on a long-term basis under its credit agreements.

During 2000, the Company’s borrowings, net of repayments,

increased by $38.0 million. The net increase is principally attributable

to the acquisition of Quest Education Corporation in July 2000, par-

tially offset by cash generated by operations.

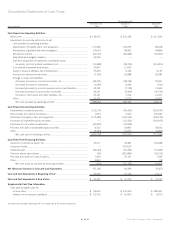

The Company expects to fund its estimated capital needs prima-

rily through internally generated funds and, to a lesser extent, com-

mercial paper borrowings. In management’s opinion, the Company will

have ample liquidity to meet its various cash needs in 2001.

Subsequent Events. On January 12, 2001, the Company sold a cable

system serving about 15,000 subscribers in Greenwood, Indiana, for

$61.9 million. In a related transaction, on March 1, 2001, the

Company completed a cable system exchange with AT&T Broadband

whereby the Company exchanged its cable systems in Modesto and

Santa Rosa, California, and approximately $42.0 million to AT&T

Broadband for cable systems serving approximately 155,000 sub-

scribers principally located in Idaho. For income tax purposes, these

transactions qualify as like-kind exchanges and are substantially tax

free in nature. However, the Company will record a book accounting

gain of approximately $195.3 million ($20.50 per share) in its earnings

for the first quarter of 2001.

On February 28, 2001, the Company acquired Southern Maryland

Newspapers, a division of Chesapeake Publishing Corp. Southern

Maryland Newspapers publishes the Maryland Independent in Charles

County, Maryland; the Lexington Park Enterprise in St. Mary’s County,

Maryland; and the Recorder in Calvert County, Maryland. The acquired

newspapers have a combined total paid circulation of 50,000.

Forward-looking Statements. This annual report contains certain for-

ward-looking statements that are based largely on the Company’s cur-

rent expectations. Forward-looking statements are subject to certain

risks and uncertainties that could cause actual results and achieve-

ments to differ materially from those expressed in the forward-looking

statements. For more information about these forward-looking state-

ments and related risks, please refer to the section titled “Forward-

looking Statements” in Part 1 of the Company’s Annual Report on

Form 10-K.

32 The Washington Post Company