Washington Post 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Washington Post Company 31

to BrassRing, which is in the development and marketing phase of its

operations.

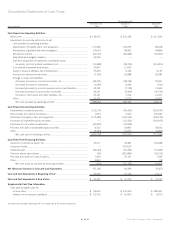

Non-operating Items. In 1999, the Company incurred net interest

expense of $25.7 million, compared to $10.4 million of net interest

expense in 1998. The 1999 increase in net interest expense is attrib-

utable to borrowings executed by the Company to fund capital

improvements, acquisition activities, and share repurchases.

The Company recorded other non-operating income of $21.4 mil-

lion in 1999, compared to $304.7 million in 1998. The Company’s 1999

other non-operating income consists principally of gains on the sale of

marketable equity securities (mostly various Internet-related securities).

The Company’s 1998 other non-operating income consisted mostly of

the non-recurring gains resulting from the Company’s disposition of its

28 percent interest in Cowles Media Company, sale of 14 small cable

systems, and disposition of its investment interest in Junglee.

Income Taxes. The effective tax rate in 1999 was 39.9 percent, as com-

pared to 37.5 percent in 1998. The increase in the effective tax rate

is principally due to the 1998 disposition of Cowles Media Company

being subject to state income tax in jurisdictions with lower tax rates.

FINANCIAL CONDITION: CAPITAL RESOURCES AND LIQUIDITY

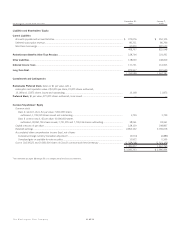

Acquisitions. During 2000, the Company spent $212.3 million on busi-

ness acquisitions. These acquisitions included $177.7 million for

Quest Education Corporation, a provider of post-secondary education;

$16.2 million for two cable systems serving 8,500 subscribers; and

$18.4 million for various other small businesses (principally consisting

of educational services companies).

During 1999, the Company acquired various businesses for about

$90.5 million, which included, among others, $18.3 million for cable

systems serving approximately 10,300 subscribers and $61.8 million

for various educational and training companies to expand Kaplan,

Inc.’s business offerings.

In 1998, the Company acquired various businesses for about

$320.6 million, which principally included $209.0 million for cable

systems serving approximately 115,400 subscribers and $100.4 million

for educational, training, and career services companies.

Dispositions. There were no significant business dispositions in 2000.

The Company sold Legi-Slate in June 1999; no significant gain or

loss resulted.

In March 1998, the Company received $330.5 million in cash

and 730,525 shares of McClatchy Newspapers, Inc. Class A common

stock as a result of a merger of Cowles Media Company and McClatchy.

The market value of the McClatchy stock received was $21.6 million.

During 1998 and 1999, the Company sold the McClatchy common

stock for $24.3 million.

In July 1998, the Company completed the sale of 14 small cable

systems in Texas, Missouri, and Kansas serving approximately 29,000

subscribers for $41.9 million. In August 1998, the Company received

202,961 shares of Amazon.com common stock as a result of the

merger of Amazon.com and Junglee Corporation. At the time of the

merger transaction, the Company owned a minority investment inter-

est in Junglee Corporation, a facilitator of Internet commerce. The

market value of the Amazon.com stock received was $25.2 million.

During 1999 and 1998, the Company sold the Amazon.com common

stock for $31.5 million.

Capital Expenditures. During 2000, the Company’s capital expendi-

tures totaled $172.4 million, about half of which related to plant

upgrades at the Company’s cable division. The Company’s capital

expenditures for 2000, 1999, and 1998 are itemized by operating

division in Note L to the Consolidated Financial Statements.

The Company estimates that in 2001 it will spend approximately

$200 million for property and equipment. Approximately 60 percent

of this spending is earmarked for the cable division in connection with

its rollout of new digital and cable modem services. If the rate of cus-

tomer acceptance for these new services is slower than anticipated,

then the Company will consider slowing its capital expenditures in this

area to a level consistent with customer demand.

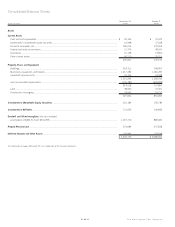

Investments in Marketable Equity Securities. At December 31, 2000,

the fair value of the Company’s investments in marketable equity

securities was $221.1 million, which includes $210.2 million in

Berkshire Hathaway Inc. Class A and B common stock and $10.9 mil-

lion of various common stocks of publicly traded companies with

e-commerce business concentrations.

At December 31, 2000, the gross unrealized gain related to the

Company’s Berkshire Hathaway Inc. stock investment totaled $25.3

million; the gross unrealized loss on this investment was $19.1 million

at January 2, 2000. The Company presently intends to hold the

Berkshire Hathaway stock long term.

Cost Method Investments. At December 31, 2000 and January 2, 2000,

the Company held minority investments in various non-public companies.

The companies represented by these investments have products or

services that in most cases have potential strategic relevance to the

Company’s operating units. The Company records its investment in

these companies at the lower of cost or estimated fair value. During

2000 and 1999, the Company invested $42.5 million and $33.5 million,

respectively, in various cost method investees. At December 31, 2000

and January 2, 2000, the carrying value of the Company’s cost method

investments totaled $48.6 million and $30.0 million, respectively.

Common Stock Repurchases and Dividend Rate. During 2000, 1999,

and 1998, the Company repurchased 200, 744,095, and 41,033

shares, respectively, of its Class B common stock at a cost of $0.1

million, $425.9 million, and $20.5 million. The annual dividend rate