Washington Post 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Washington Post Company 41

Cost Method Investments. The Company’s cost method investments

consist of minority investments in non-public companies where the

Company does not have significant influence over the investees’ oper-

ating and management decisions. Most of the companies represented

by these cost method investments have concentrations in Internet-

related business activities. At December 31, 2000 and January 2, 2000,

the carrying value of the Company’s cost method investments was

$48,617,000 and $30,009,000, respectively. Cost method investments

are included in Deferred Charges and Other Assets in the Consolidated

Balance Sheets.

During 2000 and 1999, the Company invested $42,459,000 and

$33,549,000, respectively, in companies constituting cost method

investments and recorded charges of $23,097,000 and $13,555,000,

respectively, to write-down cost method investments to estimated fair

value. The company made no significant investments in cost method

investments during 1998. Charges recorded to write-down cost

method investments are included in “Other (expense) income, net”

in the Consolidated Statements of Income.

During 2000, proceeds from sales of cost method investments

were $7,070,000, and gross realized gains on such sales were

$6,570,000. There were no sales of cost method investments in 1999

or 1998. Gross realized gains or losses upon the sale of cost method

investments are included in “Other (expense) income, net” in the

Consolidated Statements of Income.

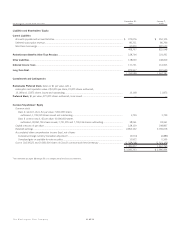

ID IINCOME TAXES

The provision for income taxes consists of the following (in thousands):

Current Deferred

2000

U.S. Federal ..................................................... $ 77,517 $ 4,854

Foreign ............................................................. 1,033 75

State and local.................................................. 22,593 (12,672)

$ 101,143 $ (7,743)

1999

U.S. Federal ..................................................... $ 94,609 $ 30,346

Foreign ............................................................. 1,306 (22)

State and local.................................................. 23,697 (336)

$ 119,612 $ 29,988

1998

U.S. Federal ..................................................... $ 200,898 $ 20,446

Foreign ............................................................. 1,233 255

State and local.................................................. 21,682 6,286

$ 223,813 $ 26,987

The provision for income taxes exceeds the amount of income tax

determined by applying the U.S. Federal statutory rate of 35 percent

to income before taxes as a result of the following (in thousands):

2000 1999 1998

U.S. Federal statutory taxes .......... $ 80,455 $ 131,385 $ 233,821

State and local taxes,

net of U.S. Federal

income tax benefit...................... 6,449 15,185 18,179

Amortization of goodwill

not deductible for

income tax purposes.................. 5,011 4,178 5,644

IRS approved accounting

change....................................... — — (3,550)

Other, net...................................... 1,485 (1,148) (3,294)

Provision for income taxes ............ $ 93,400 $ 149,600 $ 250,800

Deferred income taxes at December 31, 2000 and January 2,

2000 consist of the following (in thousands):

2000 1999

Accrued postretirement benefits ....................... $ 55,280 $ 53,819

Other benefit obligations ................................... 60,676 54,101

Accounts receivable.......................................... 17,296 14,016

State income tax loss carryforwards .................. 12,013 4,767

Other ................................................................ 20,693 12,081

Deferred tax asset............................................. 165,958 138,784

Property, plant, and equipment......................... 90,391 77,907

Prepaid pension cost ........................................ 152,609 140,640

Affiliate operations ............................................ 18,365 21,741

Unrealized gain on available-

for-sale securities ........................................... 8,476 3,379

Amortized goodwill............................................ 12,050 8,513

Other ................................................................ 1,798 607

Deferred tax liability .......................................... 283,689 252,787

Deferred income taxes...................................... $ 117,731 $ 114,003

IE IDEBT

At December 31, 2000, the Company had $923,267,000 in total debt

outstanding, which was comprised of $525,386,000 of commercial

paper borrowings and $397,881,000 of 5.5 percent unsecured notes

due February 15, 2009. At December 31, 2000, the Company has

classified $475,386,000 of its commercial paper borrowings as Long-

Term Debt in its Consolidated Balance Sheets as the Company has

the ability and intent to finance such borrowings on a long-term basis

under its credit agreements.

Interest on the 5.5 percent unsecured notes is payable semi-

annually on February 15 and August 15.