Washington Post 2000 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2000 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cable Television Division. Revenue at the cable division rose 7 percent

to $358.9 million in 2000, compared to $336.3 million in 1999. Basic,

tier, and advertising revenue categories each showed improvement over

1999. The increase in subscriber revenue is attributable to higher rates.

The number of basic subscribers at the end of 2000 totaled 735,000,

a 1 percent decline from 739,850 basic subscribers at the end of 1999.

Cable operating cash flow (operating income excluding deprecia-

tion and amortization expense) increased 2 percent to $143.7 million,

from $140.2 million in 1999; operating cash flow margins totaled

40 percent and 42 percent, for 2000 and 1999, respectively.

Operating income at the cable division for 2000 and 1999 totaled

$66.0 million and $67.1 million, respectively. The decline in operating

income is primarily attributable to an increase in programming

expense, additional costs associated with the launch of new services,

and higher depreciation expense, offset in part by higher revenue.

The increase in depreciation expense is due to recent capital

spending for continuing system rebuilds and upgrades, which will

enable the cable division to offer new digital and high-speed cable

modem services to its subscribers. The cable division began its rollout

plan for these services in the second and third quarters of 2000.

The rollout plan for the new digital cable services includes an

offer to provide services free for one year. Accordingly, management

does not believe the cable division’s financial operating performance

will materially benefit from these new services in 2001; however,

financial benefits are expected in 2002 and thereafter.

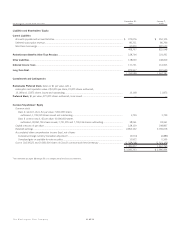

Education Division. Excluding the operating results of the career fair and

HireSystems businesses from 1999 (these businesses were contributed to

BrassRing at the end of the third quarter of 1999), 2000 education divi-

sion operating results compared with 1999 are as follows (in thousands):

2000 1999 % change

Revenue

Test prep and professional

training....................................... $ 244,865 $ 209,964 17%

Quest post-secondary education .... 56,908 — n/a

New business development

activities..................................... 52,048 30,175 72%

$ 353,821 $ 240,139 47%

Operating income (loss)

Test prep and professional

training....................................... $ 30,399 $ 25,733 18%

Quest post-secondary education ... 8,359 — n/a

New business development

activities..................................... (56,155) (20,128) 179%

Kaplan corporate overhead........... (8,365) (7,153) 17%

Stock-based incentive

compensation ............................ (6,000) (7,250) (17%)

Goodwill and other intangible

amortization ............................... (10,084) (6,861) 47%

$ (41,846) $ (15,659) 167%

Approximately 50 percent of the 2000 increase in test preparation

and professional training revenue is attributable to acquisitions; the

remaining increase is due to higher enrollments and tuition increases.

Post-secondary education represents the results of Quest Education

Corporation from the date of its acquisition in August 2000. New busi-

ness development activities represent the results of Score!, eScore.com

and The Kaplan Colleges. The increase in new business development

revenue is attributable mostly to new learning centers opened by

Score!, which operated 142 centers at the end of 2000 versus 100

centers at the end of 1999. The increase in new business development

losses is attributable to start-up period spending at eScore.com

and kaplancollege.com (part of The Kaplan Colleges) and to losses

associated with the early operating periods of new Score! centers.

Management presently expects new business development losses in

2001 will be 35 percent to 45 percent less than the losses in 2000

that resulted from these activities.

Corporate overhead represents unallocated expenses of Kaplan,

Inc.’s corporate office.

Stock-based incentive compensation represents expense arising

from a stock option plan established for certain members of Kaplan’s

management (the general provisions of which are discussed in Note G

to the Consolidated Financial Statements). Under this plan, the amount

of stock-based incentive compensation expense varies directly with the

estimated fair value of Kaplan’s common stock.

Including the operating results of the career fair and HireSystems

businesses for the first nine months of 1999 (these businesses were

contributed to BrassRing at the end of the third quarter of 1999),

education division revenue increased 37 percent to $353.8 million for

2000, compared to $257.5 million for 1999. Operating losses increased

10 percent in 2000 to $41.8 million, from $38.0 million in 1999.

Other Businesses and Corporate Office. For 2000, other businesses

and corporate office includes the expenses of the Company’s corpo-

rate office. For 1999, other businesses and corporate office includes

the expenses associated with the corporate office and the operating

results of Legi-Slate through June 30, 1999, the date of its sale.

Operating losses for 2000 totaled $25.2 million, representing a

7 percent improvement over 1999. The reduction in 2000 losses is

primarily attributable to the absence of losses generated by Legi-Slate

and reduced spending at the Company’s corporate office.

Equity in Losses of Affiliates. The Company’s equity in losses of affili-

ates for 2000 was $36.5 million, compared to losses of $8.8 million for

1999. The Company’s affiliate investments consist of a 42 percent

effective interest in BrassRing, Inc. (formed in late September 1999),

a 50 percent interest in the International Herald Tribune, and a 49

percent interest in Bowater Mersey Paper Company Limited. The

decline in 2000 affiliate results is attributable to BrassRing, Inc.,

which is in the integration and marketing phase of its operations.

28 The Washington Post Company