Washington Post 1999 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hathaway, Inc. Class A and B common stock and $37.2 million of

various publicly traded common stocks of companies with Internet

business concentrations.

During 1999 the Company spent $20.0 million for 9,820 shares

of Berkshire Hathaway, Inc. Class B common stock. The Company

spent $165.0 million for 2,634 and 25 shares of Berkshire Hathaway,

Inc. Class A and B common stock, respectively, during 1998. At

February 25, 2000, the gross unrealized loss on the Company’s

Berkshire Hathaway, Inc. stock holdings totaled $51.5 million. The

Company intends to hold the Berkshire Hathaway stock long-term and

views the unrealized loss position at February 25, 2000 as temporary.

During 1999, the Company sold various of its common stock

holdings (most of which were Internet-related) netting proceeds of

$54.8 million.

Common Stock Repurchases and Dividend Rate. During 1999,

1998 and 1997, the Company repurchased 744,095, 41,033 and

846,290 shares, respectively, of its Class B common stock at a cost

of $425.9 million, $20.5 million and $368.6 million, respectively.

The annual dividend rate for 2000 was increased to $5.40 per

share, from $5.20 per share in 1999, $5.00 per share in 1998

and $4.80 per share in 1997.

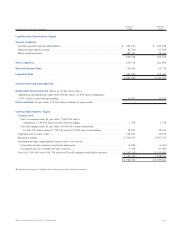

Liquidity. At January 2, 2000, the Company had $75.5 million in

cash and cash equivalents. At January 2, 2000, the Company had

$487.7 million in short-term commercial paper borrowings out-

standing at an average interest rate of 6.4 percent with various

maturities throughout the first quarter of 2000.

Additionally, at January 2, 2000 the Company had outstanding

$400.0 million of 5.5 percent, 10 year unsecured notes, due in

February 2009. The $400.0 million, 10 year notes were issued on

February 15, 1999, netting approximately $395.0 million in pro-

ceeds after discount and fees. The notes require semiannual interest

payments of $11.0 million payable on February 15th and August

15th. The Company used the proceeds from the issuance of the notes

to repay an equal amount of short-term commercial paper borrow-

ings then outstanding.

The Company utilizes a $500.0 million revolving credit facility

to support the issuance of its short-term commercial paper and to

provide for general corporate purposes.

The Company expects to fund its estimated capital needs

primarily through internally generated funds, and, to a lesser

extent, commercial paper borrowings. In management’s opinion,

the Company will have ample liquidity to meet its various cash

needs in 2000.

Year 2000. The Company did not experience any significant malfunc-

tions or errors in its operating or business systems when the date

changed from 1999 to 2000. Based on operations since January 1,

2000, the Company does not expect any significant impact to its

ongoing business as a result of the “Year 2000 issue.” However, it

is possible that the full impact of the date change, which was of con-

cern due to computer programs that use two digits instead of four

digits to define years, has not been fully recognized. For example, it

is possible that the Year 2000 or similar issues such as leap year-

related problems may occur with billing, payroll, or financial closings

at month, quarterly, or year-end. The Company believes that any

such problems are likely to be minor and correctable. In addition,

the Company could still be negatively affected if its customers or

suppliers are adversely affected by the Year 2000 or similar issues.

The Company currently is not aware of any significant Year 2000

or similar problems that have arisen for its customers and suppliers.

The Company spent about $25 million on Year 2000 readi-

ness efforts; $15 million related to assessment, repair and testing

efforts and was expensed as incurred (approximately $8 million in

1999 and $7 million in 1998) and $10 million related to the

replacement of non-compliant systems which have been capitalized

and will be amortized over a period ranging between five and

seven years.

Forward-Looking Statements. This annual report contains certain for-

ward-looking statements that are based largely on the Company’s

current expectations. Forward-looking statements are subject to cer-

tain risks and uncertainties that could cause actual results and

achievements to differ materially from those expressed in the for-

ward-looking statements. For more information about these forward-

looking statements, and related risks, please refer to the section

titled “Forward-looking Statements” in Part 1 of the Company’s

Annual Report on Form 10-K.

38 THE WASHINGTON POST COMPANY