Washington Post 1999 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

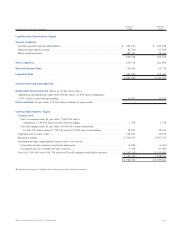

issuable under outstanding stock options. Basic and diluted weighted

average share information for 1999, 1998 and 1997 is as follows:

Basic Dilutive Diluted

Weighted Effect of Weighted

Average Stock Average

Shares Options Shares

1999 ...........................10,060,578 21,206 10,081,784

1998 ...........................10,086,786 42,170 10,128,956

1997 ...........................10,699,713 33,278 10,732,991

I. PENSIONS AND OTHER POSTRETIREMENT PLANS

The Company maintains various pension and incentive savings plans

and contributes to several multi-employer plans on behalf of certain

union represented employee groups. Substantially all of the

Company’s employees are covered by these plans.

The Company also provides health care and life insurance bene-

fits to certain retired employees. These employees become eligible

for benefits after meeting age and service requirements.

The following table sets forth obligation, asset and funding infor-

mation for the Company’s defined benefit pension and postretirement

plans at January 2, 2000 and January 3, 1999 (in thousands):

Pension Plans Postretirement Benefits

1999 1998 1999 1998

Change in benefit obligation

Benefit obligation at beginning

of year ........................... $ 338,045 $ 284,278 $ 107,779 $ 101,255

Service cost ........................ 14,756 11,335 3,585 3,764

Interest cost ....................... 23,584 21,344 6,039 7,417

Amendments ....................... 3,205 4,690 2,379 —

Actuarial (gain) loss ............... (22,281) 26,871 (27,981) 155

Benefits paid ....................... (12,698) (10,473) (4,863) (4,812)

Benefit obligation at end

of year .......................... $ 344,611 $ 338,045 $ 86,938 $ 107,779

Change in plan assets

Fair value of assets at beginning

of year .......................... $ 1,308,418 $ 1,014,531 — —

Actual return on plan assets ....... (175,804) 304,360 — —

Employer contributions ............ — — $ 4,863 $ 4,812

Benefits paid ....................... (12,698) (10,473) (4,863) (4,812)

Fair value of assets at end of year ... $ 1,119,916 $ 1,308,418 $ — —

Funded status ...................... $ 775,305 $ 970,373 $ (86,938) $ (107,779)

Unrecognized transition asset ..... (22,941) (30,606) — —

Unrecognized prior service cost ... 18,930 17,835 (825) (3,366)

Unrecognized actuarial gain ....... (433,476) (701,468) (36,528) (11,433)

Net prepaid (accrued) cost ........ $ 337,818 $ 256,134 $ (124,291) $ (122,578)

The total (income) cost arising from the Company’s defined benefit

pension and postretirement plans for the years ended January 2,

2000, January 3, 1999 and December 28, 1997, consists of the

following components (in thousands):

Pension Plans Postretirement Plans

1999 1998 1997 1999 1998 1997

Service cost....... $ 14,756 $ 11,335 $ 10,567 $3,585 $ 3,764 $ 3,511

Interest cost....... 23,584 21,344 19,433 6,039 7,417 6,973

Expected return

on assets ......... (92,566) (71,814) (51,842) — — —

Amortization of

transition asset... (7,665) (7,665) (7,665) — — —

Amortization of

prior service cost.. 2,110 1,679 1,512 (162) (378) (378)

Recognized

actuarial gain .... (21,902) (16,876) (2,232) (2,886) (1,379) (1,576)

Total (benefit) cost

for the year ....... $(81,683) $ (61,997) $ (30,227) $6,576 $ 9,424 $ 8,530

The cost for the Company’s defined benefit pension and postre-

tirement plans are actuarially determined. Key assumptions utilized

at January 2, 2000, January 3, 1999 and December 28, 1997

include the following:

Pension Plans Postretirement Plans

1999 1998 1997 1999 1998 1997

Discount rate ......... 7.5% 7.0% 7.5% 7.5% 7.0% 7.5%

Expected return on

plan assets ......... 9.0% 9.0% 9.0% — — —

Rate of compensation

increase ........... 4.0% 4.0% 4.0% — — —

The assumed health care cost trend rate used in measuring the

postretirement benefit obligation at January 2, 2000 was 7.6 per-

cent for pre-age 65 benefits ( 7.1 percent for post-age 65 benefits)

decreasing to 5 percent in the year 2005 and thereafter.

Assumed health care cost trend rates have a significant effect

on the amounts reported for the health care plans. A one-percentage

point change in the assumed health care cost trend rates would have

the following effects (in thousands):

1% 1%

Increase Decrease

Benefit obligation at end of year ...... $12,944 $ (12,091)

Service cost plus interest cost .......... 1,510 (1,464)

49THE WASHINGTON POST COMPANY