Washington Post 1999 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Equity in (Losses) Earnings of Affiliates. The Company’s equity in

losses of affiliates in 1998 was $5.1 million, compared with income

of $10.0 million in 1997. The $15.1 million decline in affiliate

earnings resulted from increased spending at new media joint

ventures (principally Classified Ventures and CareerPath.com) and

the absence of affiliate earnings that were provided in the prior

year from the Company’s investment interest in the Bear Island

Partnerships (sold in November 1997) and Cowles Media Company

(disposed of in March 1998).

Non-Operating Items. In 1998, the Company incurred net interest

expense of $10.4 million, compared to $2.2 million of net interest

income in 1997. The average short-term borrowings outstanding in

1998 was $231.8 million, as compared to $10.7 million in average

borrowings outstanding in 1997.

Other income, net, in 1998 was $304.7 million, compared to

$69.5 million in 1997. For 1998, other income, net, includes

$309.7 million arising from the disposition of the Company’s 28

percent interest in Cowles Media Company, the sale of 14 small

cable systems and the disposition of the Company’s interest in

Junglee, a facilitator of Internet commerce. For 1997, other income,

net, includes $74.8 million in gains arising from the sale of the

Bear Island partnerships and the sale of the assets of the Company’s

PASS regional cable sports network.

Income Taxes. The effective tax rate in 1998 was 37.5 percent, as

compared to 39 percent in 1997. The decrease in the effective

income tax rate is principally the result of the disposition of Cowles

Media Company being subject to state income tax in jurisdictions

with lower tax rates, and to a lesser extent, from a favorable IRS-

approved income tax change in the fourth quarter of 1998.

FINANCIAL CONDITION: CAPITAL RESOURCES AND LIQUIDITY

Acquisitions. During 1999, the Company acquired various businesses

for about $90.5 million, which included, among others, $18.3 mil-

lion for cable systems serving approximately 10,300 subscribers

and $61.8 million for various educational and training companies to

expand Kaplan, Inc.’s business offerings.

During 1998, the Company acquired various businesses for about

$320.6 million, which included, among others, $209.0 million for

cable systems serving approximately 115,400 subscribers and $100.4

million for educational, training and career services companies.

In 1997, the Company spent $118.9 million on business acqui-

sitions. These acquisitions included, among others, $23.9 million

for cable systems serving approximately 16,000 subscribers and

$84.5 million for the publishing rights to two computer services

industry periodicals and the rights to conduct two computer industry

trade shows.

On February 10, 2000, BrassRing, Inc. announced an agree-

ment to acquire from Central Newspapers, Inc. the Westech Group

of Companies in exchange for BrassRing, Inc. stock representing a

23 percent equity ownership in BrassRing, Inc. Westech provides

Internet recruitment services and high-tech career fairs. Upon the

closing of this transaction, the Company’s ownership in BrassRing,

Inc. will decline from 54 percent to 42 percent.

Exchanges. During 1997, the Company exchanged the assets of

certain cable systems with Tele-Communications, Inc., resulting in

an increase of about 21,000 subscribers for the Company. The

Company also completed, in 1997, a transaction with Meredith

Corporation whereby the Company exchanged the assets of WFSB-

TV, the CBS affiliate in Hartford, Connecticut, and $60.0 million

in cash for the assets of WCPX-TV (renamed WKMG), the CBS

affiliate in Orlando, Florida.

Dispositions

In March 1998, the Company received $330.5 million in cash and

730,525 shares of McClatchy Newspapers, Inc. Class A common

stock as a result of the merger of Cowles and McClatchy. The market

value of the McClatchy stock received was $21.6 million, based upon

publicly quoted market prices. During the last three quarters of

1998, the Company sold 464,700 shares of the McClatchy stock (64

percent of the total shares received) for $15.4 million.

In July 1998, the Company completed the sale of 14 small cable

systems in Texas, Missouri and Kansas serving approximately 29,000

subscribers for $41.9 million. In August 1998, the Company received

202,961 shares of Amazon.com common stock as a result of the

merger of Amazon.com and Junglee Corporation. At the time of the

merger transaction, the Company owned a minority investment inter-

est in Junglee Corporation, a facilitator of Internet commerce. The

market value of the Amazon.com stock received was $25.2 million.

In November 1997, the Company sold its 35 percent interest

in Bear Island Paper Company, L.P., and Bear Island Timberlands

Company, L.P., for approximately $92.8 million. In September

1997, the Company sold the assets of its PASS regional cable sports

network for $27.4 million.

Capital Expenditures. During 1999, the Company’s capital expendi-

tures totaled $130.0 million, about half of which related to plant

upgrades at the Company’s cable subsidiary. The Company estimates

that in 2000 it will spend approximately $145.0 million for prop-

erty and equipment, primarily for various projects at the cable,

broadcasting and newspaper divisions.

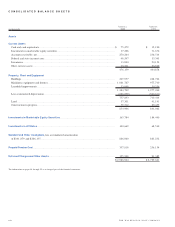

Investments in Marketable Equity Securities. At January 2, 2000, the

fair value of the Company’s investments in marketable equity securities

was $203.0 million, which includes $165.8 million of Berkshire

37THE WASHINGTON POST COMPANY