Washington Post 1999 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ing realized gains and losses, the cost basis of securities sold is

determined by specific identification.

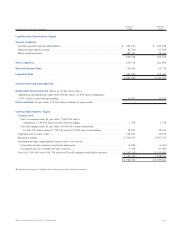

D. INVESTMENTS IN AFFILIATES

The Company’s investments in affiliates at January 2, 2000 and

January 3, 1999 include the following (in thousands):

1999 1998

BrassRing, Inc. ..................................$75,842 —

Bowater Mersey Paper Company............... 39,885 $ 40,121

International Herald Tribune.................... 19,890 23,026

Other ................................................ 5,052 5,383

$140,669 $ 68,530

The Company’s investments in affiliates consist of a 54 percent

non-controlling interest in BrassRing, Inc., a recently established

company which provides recruiting, career development and hiring

management services for employers and job candidates; a 49 percent

interest in the common stock of Bowater Mersey Paper Company

Limited, which owns and operates a newsprint mill in Nova Scotia;

a 50 percent common stock interest in The International Herald

Tribune Newspaper, published near Paris, France; and a 50 percent

common stock interest in the Los Angeles Times-Washington Post

News Service, Inc.

Operating costs and expenses of the Company include newsprint

supplied by Bowater, Inc. (parent to Bowater Mersey Paper Company

Limited), the cost of which was approximately $36,300,000 in 1999,

$39,800,000 in 1998 and $40,100,000 in 1997.

The following table summarizes the status and results of the

Company’s investments in affiliates (in thousands):

1999 1998

Beginning investment ............................$68,530 $154,791

BrassRing, Inc. ................................... 83,493 —

Additional investment............................ 8,734 15,187

Equity in losses ................................... (8,814) (5,140)

Dividends and distributions received............ (930) (1,587)

Foreign currency translation..................... (3,289) (1,134)

Sale of interest in Cowles ........................ —(93,587)

Other .............................................. (7,055) —

Ending investment ................................$140,669 $ 68,530

On September 29, 1999, the Company merged its career fair

and HireSystems businesses together and renamed the combined

operations BrassRing, Inc. On the same date, BrassRing issued

stock representing a 46 percent equity interest to two parties under

two separate transactions for cash and businesses with an aggre-

gate fair value of $87,000,000. As a result of this transaction, the

Company’s ownership of BrassRing was reduced to 54 percent and

the minority investors were granted certain participatory rights.

As such, the Company has prospectively de-consolidated BrassRing

and recorded its investment under the equity method of accounting.

The increase in the basis of the Company’s investment in BrassRing

resulting from this transaction of $34,571,000, net of taxes, has

been recorded as contributed capital.

E. INCOME TAXES

The provision for income taxes consists of the following (in thousands):

Current Deferred

1999

U.S. Federal.......................................$94,609 $ 30,346

Foreign ............................................. 1,306 (22)

State and local .................................... 23,697 (336)

$119,612 $ 29,988

1998

U.S. Federal.......................................$200,898 $ 20,446

Foreign ............................................. 1,233 255

State and local .................................... 21,682 6,286

$223,813 $ 26,987

1997

U.S. Federal.......................................$149,003 $ 2,210

Foreign ............................................. 915 (165)

State and local .................................... 28,493 1,044

$ 178,411 $ 3,089

The provision for income taxes exceeds the amount of income tax

determined by applying the U.S. Federal statutory rate of 35 percent

to income before taxes as a result of the following (in thousands):

1999 1998 1997

U.S. Federal statutory taxes...... $131,385 $233,821 $162,076

State and local taxes,

net of U.S. Federal

income tax benefit ............... 15,185 18,179 19,199

Amortization of goodwill

not deductible for

income tax purposes............. 4,178 5,644 2,492

IRS approved accounting

change............................. —(3,550) —

Other, net ........................... (1,148) (3,294) (2,267)

Provision for income taxes ....... $149,600 $250,800 $181,500

46 THE WASHINGTON POST COMPANY