Washington Post 1999 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1999 Washington Post annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

temporary differences between the carrying amounts and tax

bases of assets and liabilities.

Foreign Currency Translation. Gains and losses on foreign currency

transactions and the translation of the accounts of the Company’s

foreign operations where the U.S. dollar is the functional currency

are recognized currently in the Consolidated Statements of Income.

Gains and losses on translation of the accounts of the Company’s

foreign operations where the local currency is the functional cur-

rency and the Company’s equity investments in its foreign affiliates

are accumulated and reported as a separate component of equity

and comprehensive income.

Stock-Based Compensation. The Company accounts for stock-based

compensation using the intrinsic value method prescribed by

Accounting Principles Board Opinion No. 25, “Accounting for Stock

Issued to Employees.” Pro forma disclosures of net income and

earnings per share as if the fair-value based method prescribed by

Statement of Financial Accounting Standards (SFAS) No. 123,

“Accounting for Stock-Based Compensation” had been applied in

measuring compensation expense are provided in Note H.

Sale of Subsidiary Securities. The Company’s policy is to record

investment basis gains arising from the sale of equity interests in

subsidiaries that are in the early stages of building their operations

as additional paid in capital, net of taxes.

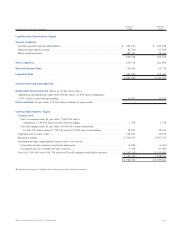

B. ACCOUNTS RECEIVABLE AND ACCOUNTS PAYABLE

AND ACCRUED LIABILITIES

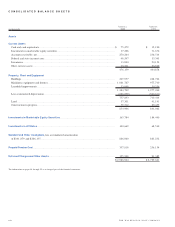

Accounts receivable at January 2, 2000 and January 3, 1999

consist of the following (in thousands):

1999 1998

Trade accounts receivable, less estimated

returns, doubtful accounts and

allowances of $60,621 and $55,050 .........$248,279 $216,500

Other accounts receivable........................ 21,985 20,014

$ 270,264 $ 236,514

Accounts payable and accrued liabilities at January 2, 2000

and January 3, 1999 consist of the following (in thousands):

1999 1998

Accounts payable and accrued expenses .......$158,197 $170,018

Accrued payroll and related benefits............ 58,420 55,133

Deferred tuition revenue ......................... 28,060 13,166

Due to affiliates (newsprint)...................... 9,428 6,751

$ 254,105 $ 245,068

C. INVESTMENTS IN MARKETABLE EQUITY SECURITIES

Investments in marketable equity securities at January 2, 2000 and

January 3, 1999 consist of the following (in thousands):

1999 1998

Total cost ..........................................$194,364 $187,297

Net unrealized gains .............................. 8,648 68,819

Total fair value ....................................$203,012 $256,116

At January 2, 2000, the Company’s ownership of 2,634 shares

of Berkshire Hathaway, Inc. (“Berkshire”) Class A common stock

and 9,845 shares of Berkshire Class B common stock accounted for

$165,800,000 or 82 percent of the total fair value of the Company’s

investments in marketable equity securities. The remaining invest-

ments in marketable equity securities at January 2, 2000 consist

of common stock investments in various publicly traded companies,

most of which have concentrations in Internet business activities.

In most cases, the Company obtained ownership of these common

stocks as a result of merger or acquisition transactions in which

these companies merged or acquired various small Internet related

companies in which the Company held minor investments.

Berkshire is a holding company owning subsidiaries engaged in

a number of diverse business activities; the most significant of which

consist of property and casualty insurance business conducted on

both a direct and reinsurance basis. Berkshire also owns approxi-

mately 18 percent of the common stock of the Company. The chair-

man, chief executive officer and largest shareholder of Berkshire,

Mr. Warren Buffett, is a member of the Company’s Board of

Directors. Neither Berkshire nor Mr. Buffett participated in the

Company’s evaluation, approval or execution of its decision to invest

in Berkshire common stock. The Company’s investment in Berkshire

common stock is less than 1 percent of the consolidated equity of

Berkshire. At present, the Company intends to hold the Berkshire

common stock investment long-term; thus this investment has been

classified as a non-current asset in the Consolidated Balance Sheets.

At January 2, 2000, net unrealized gains consisted of unrealized

gains totaling $27,782,000 on various common stock investments off-

set in part by $19,134,000 in unrealized losses on the company’s

investment in Berskshire common stock. The company intends to hold

the Berkshire common stock investment long-term and views the

unrealized loss position at January 2,000 as temporary.

During 1999 and 1998, proceeds from sales of marketable

equity securities were $54,805,000 and $38,246,000, respectively,

and gross realized gains on such sales were $38,799,000 and

$2,168,000, respectively. There were no sales of marketable equity

securities during 1997. Gross realized gains or losses upon the sale

of marketable equity securities are included in “Other income, net”

in the Consolidated Statements of Income. For purposes of comput-

45THE WASHINGTON POST COMPANY