Unum 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Unum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

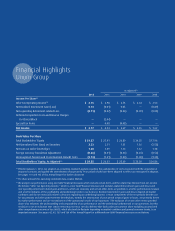

us a great deal of flexibility, which last year was used to

repurchase $500 million of our stock and increase our

dividend by 24 percent. Since the fourth quarter of 2007,

we have repurchased approximately $2.2 billion in stock,

or 26 percent of our outstanding shares, and increased

our dividend by 73 percent.

While I was not satisfied with our stock’s performance last

year, I am very confident that the approach we have taken

to managing the business can continue to create long-term

value for shareholders. Over the last five years, our total

return to shareholders has significantly outperformed our

industry. Steady, profitable growth is something not only

important to investors but also to our rating agencies,

and I am obviously very pleased that both Moody’s and

Standard & Poor’s had the confidence in our company to

upgrade our financial strength ratings in 2012.

Although there are still challenges ahead and more we

wish to accomplish, we were pleased with our performance

this past year and are well-positioned for 2013. Each year

brings its own unique challenges and changes, but what

A CEO’s Perspective on the

Value of Financial Protection

A Message from Tom Watjen

The need for financial protection benefits has

steadily grown as financial foundations have

shifted, government resources have been strained,

and costs have climbed.

When people need them most, benefits such

as disability, accident, critical illness and life

insurance protect against financial hardships that

can derail the stability of individuals and families.

Few people understand that the average worker

has a one in three chance of becoming disabled

from illness or injury for six months or more

during his or her working life. Most of us are

unprepared for the consequences of losing an

income, even for a short period of time.

In fact, 40 percent of working Americans live

paycheck-to-paycheck. Half of all households could

not raise $2,000 within a month if they needed to,

according to the Bureau of Economic Research.

The need for and the value of financial protection

benefits are growing topics of conversation. Over

the last two years, Unum has worked to quantify

the tangible value of disability benefits in particular

and, in the process, built partnerships that can move

us toward the goal of protecting the financial

security of working people and families.

Our industry must continue to do its part by

helping educate consumers about the need

for financial protection and by seeking ways to

simplify our products and make them more

Operating Earnings Per Share

9.3% CAGR

2005 2006 2007

CAGR – Compound Annual Growth Rate.

2008 2009 2010 2011 2012

$1.69 $1.85

$2.25

$2.54 $2.64 $2.73

$2.98 $3.15

Continued on page 5

UNUM 2012 ANNUAL REPORT 3