United Healthcare 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Secretaria da Receita Federal), the U.S. Department of Labor, the Federal Deposit Insurance Corporation, the

Defense Contract Audit Agency and other governmental authorities. Certain of the Company’s businesses have

been reviewed or are currently under review, including for, among other things, compliance with coding and

other requirements under the Medicare risk-adjustment model. The Company has produced documents,

information and witnesses to the Department of Justice in cooperation with a current review of the Company’s

risk-adjustment processes, including the Company’s patient chart review and related programs. CMS has selected

certain of our local plans for risk adjustment data validation (RADV) audits to validate the coding practices of

and supporting documentation maintained by health care providers and such audits may result in retrospective

adjustments to payments made to our health plans.

The Company cannot reasonably estimate the range of loss, if any, that may result from any material government

investigations, audits and reviews in which it is currently involved given the status of the reviews, the wide range

of possible outcomes and inherent difficulty in predicting regulatory action, fines and penalties, if any, the

Company’s legal and factual defenses and the various remedies and levels of judicial review available to the

Company in the event of an adverse finding.

Guaranty Fund Assessments

Under state guaranty association laws, certain insurance companies can be assessed (up to prescribed limits) for

certain obligations to the policyholders and claimants of impaired or insolvent insurance companies (including

state health insurance cooperatives) that write the same line or similar lines of business. In 2009, the

Pennsylvania Insurance Commissioner placed long term care insurer Penn Treaty Network America Insurance

Company and its subsidiary (Penn Treaty), neither of which is affiliated with the Company, in rehabilitation and

petitioned a state court for approval to liquidate Penn Treaty. In 2012, the court denied the liquidation petition

and ordered the Insurance Commissioner to submit a rehabilitation plan. The court held a hearing in July 2015 to

begin its consideration of the latest proposed rehabilitation plan. The hearing is scheduled to continue in the

spring of 2016.

If the current proposed rehabilitation plan, which contemplates the partial liquidation of Penn Treaty, is approved

by the court, the Company’s insurance entities and other insurers may be required to pay a portion of Penn

Treaty’s policyholder claims through state guaranty association assessments. The Company continues to

vigorously challenge the proposed rehabilitation plan. The Company is currently unable to estimate losses or

ranges of losses because the Company cannot predict when or to what extent Penn Treaty will ultimately be

liquidated, the amount of the insolvency, the amount and timing of any associated guaranty fund assessments or

the availability and amount of any premium tax and other potential offsets.

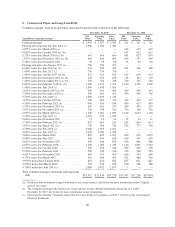

14. Segment Financial Information

Factors used to determine the Company’s reportable segments include the nature of operating activities,

economic characteristics, existence of separate senior management teams and the type of information used by the

Company’s chief operating decision maker to evaluate its results of operations. Reportable segments with similar

economic characteristics, products and services, customers, distribution methods and operational processes that

operate in a similar regulatory environment are combined.

The following is a description of the types of products and services from which each of the Company’s four

reportable segments derives its revenues:

•UnitedHealthcare includes the combined results of operations of UnitedHealthcare Employer & Individual,

UnitedHealthcare Medicare & Retirement, UnitedHealthcare Community & State and UnitedHealthcare

Global. The U.S. businesses share significant common assets, including a contracted network of physicians,

health care professionals, hospitals and other facilities, information technology infrastructure and other

resources. UnitedHealthcare Employer & Individual offers an array of consumer-oriented health benefit

89