United Healthcare 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.liabilities. These increases were partially offset by an increase in pharmacy rebates, which increased other

receivables, the increase in the payment of the 2015 Health Insurance Industry Tax and the payment of

Reinsurance Program fees in 2015.

Other significant changes in sources or uses of cash year-over-year included increased cash paid for acquisitions

and net debt issuances and decreased share repurchases, all due to the Catamaran acquisition.

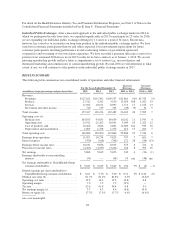

2014 Cash Flows Compared to 2013 Cash Flows

Cash flows provided by operating activities in 2014 increased primarily due to an increased level of accounts

payable and other liabilities, including the collection of Reinsurance Program fees in advance of remittance in

2015, partially offset by an increase in government receivables.

Other significant changes in sources or uses of cash year-over-year included: (a) a change in investment activity

from net purchases in 2013 to net sales in 2014; (b) an increase in Part D subsidy receivables causing a change in

customer funds administered; and (c) increased levels of cash used to repurchase common stock.

Financial Condition

As of December 31, 2015, our cash, cash equivalent and available-for-sale investment balances of $31.2 billion

included $10.9 billion of cash and cash equivalents (of which $286 million was available for general corporate

use), $18.6 billion of debt securities and $1.6 billion of investments in equity securities consisting of investments

in non-U.S. dollar fixed-income funds; employee savings plan related investments; venture capital funds; and

dividend paying stocks. Given the significant portion of our portfolio held in cash equivalents, we do not

anticipate fluctuations in the aggregate fair value of our financial assets to have a material impact on our liquidity

or capital position. Other sources of liquidity, primarily from operating cash flows and our commercial paper

program, which is supported by our bank credit facilities, reduce the need to sell investments during adverse

market conditions. See Note 5 of Notes to the Consolidated Financial Statements included in Part II, Item 8,

“Financial Statements” for further detail concerning our fair value measurements.

Our available-for-sale debt portfolio had a weighted-average duration of 3.4 years and a weighted-average credit

rating of “AA” as of December 31, 2015. When multiple credit ratings are available for an individual security,

the average of the available ratings is used to determine the weighted-average credit rating.

Capital Resources and Uses of Liquidity

In addition to cash flows from operations and cash and cash equivalent balances available for general corporate

use, our capital resources and uses of liquidity are as follows:

Commercial Paper and Bank Credit Facilities. Our revolving bank credit facilities provide liquidity support for

our commercial paper borrowing program, which facilitates the private placement of unsecured debt through

third-party broker-dealers, and are available for general corporate purposes. For more information on our

commercial paper and bank credit facilities, see Note 9 of Notes to the Consolidated Financial Statements

included in Part II, Item 8, “Financial Statements.”

Our revolving bank credit facilities contain various covenants, including covenants requiring us to maintain a

defined debt to debt-plus-stockholders’ equity ratio of not more than 55%. As of December 31, 2015, our debt to

debt-plus-stockholders’ equity ratio, as defined and calculated under the credit facilities was approximately 47%.

Long-Term Debt. Periodically, we access capital markets and issue long-term debt for general corporate

purposes, for example, to meet our working capital requirements, to refinance debt, to finance acquisitions or for

45