Union Pacific 2002 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2002 Union Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

LETTER TO SHAREHOLDERS

In all, our yield strategy is lever-

aging greater value and improved

returns from our superior rail

franchise.

Service Reliability and Efficiency

Service reliability and efficiency

are the linchpins of the yield

strategy. Through a combination

of new product development,

corridor initiatives and alliances,

we’re building service reliability

in an effort to capture market

share from trucks. The economies

of rail beat truck almost every

time. Our challenge is to provide

“truck-like” service and reliability.

We continually work to improve

reliability. We’re narrowing the

service gap and customers are

rewarding us with their business.

Some of the statistics we use to

evaluate our service reached

record levels for the “new” Union

Pacific in 2002: Service Delivery

Index, Train Plan Compliance,

Customer Satisfaction Index and

To/From Industry Compliance.

Our record service performance

was coupled with record business

volumes – transporting 6.1 million

vehicles, 1.5 billion board feet of

lumber, 241 million tons of coal,

32.3 million tons of rock, and nearly

1.6 million international steamship

containers. And, in keeping with

our great history of productivity

improvements, these volumes

were moved with fewer resources.

During a time of increased car-

loadings, cycle-time improvements

actually enabled a 7,000-car

reduction in freight cars on line.

Quality Focus

We’r e building our reputation

as a quality service provider.

During 2002, we became a three-

time winner of Toyota’s

President’s Logistics Award and

DaimlerChrysler’s Gold Award.

UPS Autogistics named us

“Carrier of the Year” for our service

to Ford, and we won GM’s Mark

of Excellence Award and Supplier

of the Year Award. In early 2003,

GM recognized Union Pacific as

one of only eight suppliers, world-

wide, for outstanding service.

Through our Cost of Quality

program, we proactively monitor

the cost of not doing things right

the first time (failure costs). We

work daily to eliminate these

unnecessary expenses. Using

quality and process improve-

ments, we identified failure cost

savings of $133 million in 2002 –

furthering our belief that it costs

less to run a quality company. And,

our quality efforts were recognized

by our selection as a finalist for

the Malcolm Baldrige National

Quality Award for the second

straight year.

Corporate Responsibility

Not only are we raising the bar

operationally, Union Pacific is

also setting itself apart in the cor-

porate governance arena. Over

the past several years, we’ve

adopted corporate governance

“best practices” and we will con-

tinue to examine our policies to

promote effective governance.

(continued on page 4)

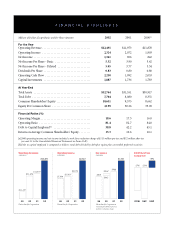

UP’s Energy

business generated 22 percent of all revenue. In 2002, UP hauled 241

million tons of coal, an all-time best.

GTM (MIL) PER EMPLOYEE

Employee Productivity

Union Pacific Railroad

99

17.3

00

18.7

01

20.0

02

21.4

Union Pacific’s stock price increased for the third straight

year – rising 5 percent from $57 to nearly $60 per share,

compared to a 23 percent decrease in the S&P 500.