Union Pacific 2002 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2002 Union Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

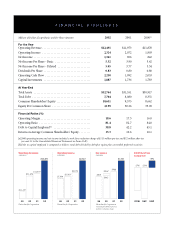

$ MILLIONS

Net Income

Union Pacific Corporation

*excluding $72 million after-tax

work force reduction charge

99 00 01 02

$810

$914*

$842

$966

$1,341

$ MILLIONS

Operating Income

Union Pacific Corporation

99 00 01 02

$1,804 $1,903

$2,072

$2,324

$ MILLIONS

Operating Revenues

Union Pacific Corporation

99 00 01 02

$11,237

$11,878 $11,973

$12,491

2002 Stock Price

Comparison

UNPDOW S&P

-17% -23%

+5%

Millions of Dollars, Except Ratios and Per Share Amounts 2002 2001 2000[a]

For the Year

Operating Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,491 $11,973 $11,878

Operating Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,324 2,072 1,903

Net Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,341 966 842

Net Income Per Share - Basic . . . . . . . . . . . . . . . . . . . . . . . . . 5.32 3.90 3.42

Net Income Per Share - Diluted . . . . . . . . . . . . . . . . . . . . . . . 5.05 3.77 3.34

Dividends Per Share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.83 0.80 0.80

Operating Cash Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,250 1,992 2,053

Capital Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,887 1,736 1,783

At Year-End

Total Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $32,764 $31,551 $30,917

Total Debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,704 8,080 8,351

Common Shareholders’ Equity . . . . . . . . . . . . . . . . . . . . . . . . 10,651 9,575 8,662

Equity Per Common Share . . . . . . . . . . . . . . . . . . . . . . . . . . . 41.99 38.26 35.09

Financial Ratios (%)

Operating Margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.6 17.3 16.0

Operating Ratio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81.4 82.7 84.0

Debt to Capital Employed[b] . . . . . . . . . . . . . . . . . . . . . . . . . . 38.8 42.2 45.1

Return on Average Common Shareholders’ Equity . . . . . . . . 13.3 10.6 10.1

[a]2000 operating income and net income included a work force reduction charge of $115 million pre-tax and $72 million after-tax

(see note 13 to the Consolidated Financial Statements in Form 10-K).

[b]Debt to capital employed is computed as follows: total debt divided by debt plus equity plus convertible preferred securities.

FINANCIAL HIGHLIGHTS