Union Pacific 2002 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2002 Union Pacific annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1UNION PACIFIC

Our annual report will detail the

accomplishments of 2002, but let

me share some of the highlights:

Commitments Made and Kept

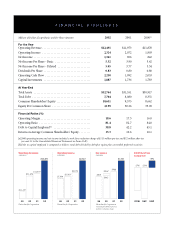

Our targets for 2002 were to

achieve 1 to 3 percent revenue

growth, a rail-operating ratio below

80 percent, free cash flow of $350

million to $450 million, and

improved returns. I’m pleased to

report Union Pacific met every goal.

‚

Revenues grew 4 percent to a

record $12.5 billion, with solid

increases at both the railroad

and Overnite.

‚

Excluding Overnite, the company

lowered its operating ratio to

79.8 percent – the first year

we’ve been below 80 percent

since the SP merger.

‚

Free cash flow after dividends

totaled $528 million.

‚

Return on total capital improved.

These achievements resulted in

record net income of $1.34 billion

or $5.05 diluted earnings per share.

Even excluding land sales to the

Utah Transit Authority and Santa

Clara Valley Transportation

Authority, as well as various tax

adjustments, diluted earnings per

share rose by 14 percent. We are

building value for our shareholders

by using increased profits to

reduce debt levels and raise our

dividend by 15 percent.

The stock market was turbulent

in 2002, buffeted by the sluggish

economy and several inexcusable

instances of corporate fraud. Still,

Union Pacific’s stock price

increased for the third straight year

– rising 5 percent from $57 to nearly

$60 per share, compared to a 23

percent decrease in the S&P 500.

Defining the Yield Strategy

Union Pacific’s revenue growth

has outpaced the nation’s Gross

Domestic Product (GDP) every

year since 1999. The key has been

the implementation of our Yield

Strategy. The strategy’s major

components are simple:

‚

provide premium service for a

premium price,

‚

achieve a mix of business that

maximizes profitability,

‚

leverage volume across the system,

‚

increase productivity by working

smarter, and

‚

maximize asset utilization.

(continued on page 2)

In 2002, Union Pacific raised the bar – celebrating our 140th

anniversary with a record performance. We remained true to

our corporate vision and, as a result, we had a tremendous year.

From left,

Leo Suggs, chairman, Overnite Corporation, Dick Davidson, chairman

and chief executive officer, Union Pacific Corporation, and Ike Evans, president and

chief operating officer, Union Pacific Railroad.

FELLOW SHAREHOLDERS