Unilever 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unilever Annual Report and Accounts 2007 7

Report of the Directors continued

About Unilever continued

Our D&E businesses continue to show strong growth, in Asia,

Africa, Central and Eastern Europe and Latin America, and now

make up 44% of our total turnover. Our D&E strategy is focused

on leveraging and further strengthening our existing leading

positions in many D&E markets, such as India and Brazil, as well

as building our brands and business in countries where we

currently have a relatively smaller presence, notably China and

Russia. Our sustained growth is reflecting the strength of our D&E

business model which is characterised by a differentiated portfolio

of strong global and regional brands addressing the needs of the

different income groups, high quality innovation and

communication, scale and depth in distribution, and an excellent

track record and reputation for developing management talent.

Our focus on our best global and regional brands, with increased

investment in advertising and faster roll-out of innovation, has

resulted in a focused portfolio, with 12 brands having a

worldwide turnover in excess of €1 billion and our top 25 brands

collectively delivering 73% of our turnover in 2007.

We also monitor the development of our brands through market

information that gives us insights into our leading positions versus

our direct competitors. In our section on Operating environment

on page 8 below we indicate the product areas in which we have

leading or key strategic positions.

Key indicators – people and sustainability

Unilever has for many years recognised the significance of social

and environmental issues as a critical dimension of its operations,

and has established many indicators to track its performance in

these areas.

We regard safety as an essential element of a successful and

sustainable business and take seriously our responsibility to

provide a safe workplace. We aim to improve continuously the

health, safety and well-being of everyone working for or on

behalf of Unilever to a standard on a par with the very best of our

peers. A key measure of our progress in this area is our total

recordable accident frequency rate which counts all workplace

accidents except those requiring only simple first aid treatment. In

2007 this decreased to 0.26 accidents per 100 000 hours worked,

declining from 0.46 in 2004.

We are committed to meeting the needs of customers and

consumers in an environmentally sound and sustainable

manner, through continuous improvement in environmental

performance in all our activities. We exercise the same concern

for the environment wherever we operate and aim to reduce

the environmental footprint of our business and brands. The

environmental measures that we regard as the most significant in

relation to our business are those relating to the amounts of CO2

from energy that we produce, the water that we consume as part

of our production processes, and the amount of waste that we

generate. We continue to improve our performance across these

measures, having reduced our CO2emissions from energy by

33.5%, our water use by 58.6% and our total waste by 69.3%

per tonne of production over the period 1995 – 2006. In 2007

we set ourselves the further goal of achieving a 25% reduction in

CO2emissions by 2012 (from a 2004 baseline), to give a total

reduction of around 43% since 1995.

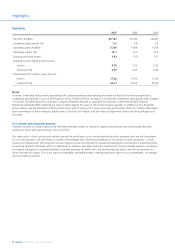

The table below shows the results for these indicators for the last

three years for which independently assured (performed by firms

other than Unilever’s external auditors) data are available:

2006 2005 2004

Total recordable accident frequency rate

per 100 000 hours 0.33 0.39 0.46

CO2 from energy per tonne of

production (kg) 164.59 171.75 185.67

Water per tonne of production (m3) 3.29 3.52 3.67

Total waste per tonne of production (kg) 7.46 8.74 9.79

The type of assurance undertaken has been limited to enquiries of

company personnel and analytical procedures together with

review on a sample basis of the operation of processes relating to

performance data noted in the table above. Assurance of this

nature is substantially less in scope than a financial audit and does

not include detailed sample testing of source data, processes or

internal controls.

A comprehensive review of Unilever’s social and environmental

performance can be found in our annual Sustainable

Development Report, available online at www.unilever.com

Published in May 2008, our next Report will contain updated and

independently assured results for 2007 for the measures above, as

well as trend information that demonstrates our consistent

performance over the longer term.

Please refer also to the Corporate responsibility and sustainability

section on page 12 which highlights a number of key issues and

activities in this area in 2007. Our Operating Review starting on

page 15 also gives examples of the ways in which our brands are

addressing consumers’ social and environmental concerns.

Ten-year trends in many of the measures described above,

together with a range of other indicators, are included in the

document ‘Unilever Charts’ which can be found on our website at

www.unilever.com/ourcompany/investorcentre/annual_reports

Organisation

The three building blocks of our organisation are regions,

categories and functions.

Three regions – Europe, the Americas and Asia Africa – are

responsible for managing Unilever’s business and local market

operations in their regions. They are primarily responsible for

building relationships with customers, managing supply chain

networks, and deploying brands and innovations effectively,

focused on excellent execution in the marketplace. The regions

are accountable for the delivery of in-year financial results

including growth, profits and cash flow, and in-year development

of market shares. The Europe region includes our operations in

Western Europe and Central and Eastern Europe, and in 2007

accounted for approximately 38% of turnover. The Americas

region includes our operations in North America and Latin

America and represented around 33% of turnover. The Asia

Africa region accounted for 29% of turnover, and includes our

operations in the Middle East, Africa, South Asia, South East Asia,

North East Asia and Australasia.

During 2008 changes will be made to the regional structures.

Notably Central and Eastern Europe, will be managed as part of

the Asia Africa region - further concentrating our focus on

emerging markets.