Unilever 2007 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2007 Unilever annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6Unilever Annual Report and Accounts 2007

Report of the Directors continued

About Unilever

Description of business

Unilever is one of the world’s leading suppliers of fast moving

consumer goods across Foods and Home and Personal Care

categories. Unilever’s portfolio includes some of the world’s best

known and most loved brands.

Strategy and long-term financial targets

At the heart of Unilever's strategy is a concentration of resources

on areas where we have leading category and brand positions

and which offer excellent opportunities for profitable growth,

especially in personal care, developing and emerging markets and

Vitality. The focus is primarily on developing the business

organically, but acquisitions and disposals can also play a role in

accelerating the portfolio development.

To execute this strategy we have reorganised the business to

simplify the organisation and management structure and to

improve capabilities in marketing, customer management, and

research and development. The result is better allocation of

resources, faster decision-making and a lower cost level. This

transformation, known as the One Unilever programme, allows us

to leverage our scale both globally and locally.

Unilever's long-term ambition is to be in the top third of our peer

group in terms of total shareholder return. We expect underlying

sales growth of 3-5% per annum and an operating margin in

excess of 15% by 2010 after a normal level of restructuring

charges of 0.5 to 1 percent of turnover. Return on invested capital

is targeted to increase over the 2004 base of 11%. Over the

period 2005 – 2010, we aim to deliver ungeared free cash flow of

€25-30 billion. It should be noted that previous and planned

disposals and the additional restructuring plans will have reduced

ungeared free cash flow by about €2.5 billion over this period,

while enhancing the ongoing cash generating capacity of the

business.

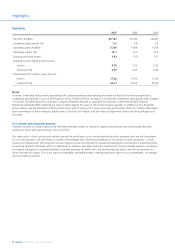

Key indicators – performance and portfolio

These long-term financial targets determine the scope of our key

financial performance indicators. The values for these indicators

for the last three reporting years are as follows:

2007 2006 2005

Underlying sales growth (%) 5.5 3.8 3.4

Operating margin (%) 13.1 13.6 13.2

Ungeared free cash flow (€ billion) 3.8 4.2 4.0

Return on invested capital (%) 12.7 14.6 12.5

Total shareholder return (ranking) 813 14

Underlying sales growth (USG), ungeared free cash flow (UFCF)

and return on invested capital (ROIC) are not recognised measures

under IFRS. The IFRS measure most comparable with USG is

turnover. In our Financial Review on page 32 we reconcile USG

with changes in turnover. There is no IFRS measure directly

comparable with either UFCF or ROIC. In our Financial Review we

reconcile ROIC to net profit, and UFCF to both net profit and cash

flow from operations. The values of turnover, net profit and cash

flow from operating activities for the last three reporting years are

as follows:

€ million € million € million

2007 2006 2005

Turnover 40 187 39 642 38 401

Net profit 4 136 5 015 3 975

Cash flow from operating activities 5 188 5 574 5 924

In 2007, we set out simultaneously to deliver a higher and more

consistent level of underlying sales growth in combination with an

underlying improvement in operating margin. Underlying sales

growth has indeed shown a marked increase to 5.5% in 2007,

driven by better innovation rolled out faster to more countries

and better execution in local markets.

We also achieved an underlying improvement in operating margin

of 0.2 percentage points in 2007, as the combination of volume

leverage, higher prices, cost savings and mix improvement

successfully offset a sharp rise in commodity costs and other

inflation.

Our reported operating margin declined by 0.5 percentage points,

due to a significantly higher level of restructuring charges related

to our plans to accelerate change, which were announced in

August 2007. These plans aim to deliver a reduction in our annual

cost base by around €1.5 billion by the end of 2010, compared

with our 2006 cost base, through the creation of multi-country

organisations (MCOs), the closure or streamlining of 50-60

factories, and a further reduction in regional and global

overheads.

Ungeared free cash flow was €3.8 billion, which was €0.4 billion

lower than a year earlier, including the effect of the higher cash

restructuring costs and increased capital expenditure. Return on

invested capital was 12.7% in 2007. This represented an

improvement from 11.5% in 2006, when adjusted for the profit

on the disposal of frozen foods. Before allowing for this

adjustment, return on invested capital in 2006 was 14.6%.

On our three-year average Total Shareholder Return key

performance measure, which forms part of the basis for top

management remuneration, we remained just outside the top

third of our peer group, although we further improved our

position to the 8th place out of 21 companies.

Further information about these measures, including definitions

and, where appropriate, reconciliation to GAAP measures, can be

found in our Financial Review starting on page 29.

In addition to these financial indicators, we track other measures

in support of our strategic goals. We believe that the share of our

business that is generated in developing and emerging (D&E)

markets, and the proportion of our turnover that is generated by

our top 25 brands are particularly relevant. In the latter context

we group together brands that have a common consumer

proposition and are supported by common innovation

programmes, although in some cases the brand names may vary

between countries. The results for these measures for the last

three reporting years are as follows:

2007 2006 2005

Share of turnover in D&E markets (%) 44 42 40

Share of turnover in top 25 brands (%) 73 73 72