US Bank 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4 U.S. BANCORP

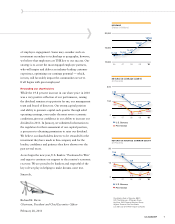

FELLOW SHAREHOLDERS

Differentiating U.S. Bancorp

In 2010, U.S. Bancorp continued to differentiate itself

from its peer banks through its industry leading financial

performance, prudent risk profile, balance sheet and business

line growth, and ongoing investments in the company’s

franchise and future. Thanks to our low-risk operating

model, strong balance sheet and diversified businesses,

U.S. Bancorp has been profitable every single quarter

during the past three years spanning this recession. In fact,

we have further differentiated ourselves by being the only

bank in our peer group to have generated a profit every

quarter for the past 20 years. U.S. Bancorp, again, ended

the year as one of the strongest — if not the strongest

— banks in the industry.

We have made good strategic use of our historic strength

as a conservatively managed, efficient, solid performer

to also successfully evolve and transform our company

into a growth-oriented organization.

Throughout this difficult economic cycle, we have remained

focused on what’s fundamental — and what’s right for

our shareholders, our customers, our employees and our

communities. We are building on our strengths and building

for the future.

Growth and investment

Over the past two years, we’ve expanded our banking

franchise through FDIC-assisted bank acquisitions and other

branch purchases in California, Arizona, Nevada, Chicago

and, most recently, New Mexico, which represented our

expansion into the 25th contiguous state in our retail

footprint. These are all attractive markets and each acquisi-

tion reflected our strategy of accretive, market fill-in and

expansion to add density and relevant market share to our

franchise. Other business expansion efforts are highlighted

in the following pages, including our growth in corporate

banking, high-grade bond sales, corporate trust, and

payments portfolios, among others. In fact, since 2007, we

have acquired five corporate trust operations and numerous

payments businesses and portfolios. Our capital generation

capabilities and fundamental strength have allowed us to

take advantage of these attractive acquisition opportunities,

as competitors were distracted by internal issues or choosing

to divest.

As the country emerges from the worst of the downturn

and begins to recover, you will see the results from our

recent strategic investments accelerate. We will continue

to pursue strategic acquisition opportunities that meet or

exceed our stringent financial criteria. This is an organiza-

tion focused on sustainable, repeatable and consistent

organic growth and any acquisition will simply represent

an “opportunity not missed.”

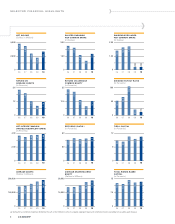

Financial performance

Net income for the year rose 50 percent to $3.3 billion, or

$1.73 per diluted share, from $2.2 billion the year before.

Our performance was driven by record revenue and declin-

ing credit costs, and once again, we were an industry leader

in return on assets, return on common equity and efficiency,

all the while continuing to improve our top-of-class cus-

tomer service. At year end, credit-loss provisions declined for

the fifth consecutive quarter, and loans had risen to a record

$197 billion. These results reflected the benefits of our

06 07 08 09 10

LOANS AND DEPOSITS

(Dollars in Billions)

220

160

100

125 131

159

183

204

125125

2525

55

131131

11

204204

11

131131

11

159159

159159

5959

183183

183183

8383

144

154

185

195

197

Loans

Deposits

Ending balances

Building

always