US Bank 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

U.S. BANCORP 3

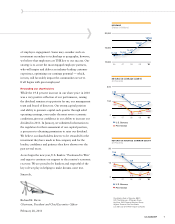

FINANCIAL SUMMARY

Year Ended December 31 2010 2009

(Dollars and Shares in Millions, Except Per Share Data) 2010 2009 2008 v 2009 v 2008

Total net revenue (taxable-equivalent basis) ............................... $ 18,148 $ 16,668 $ 14,677 8.9% 13.6%

Noninterest expense ................................................................... 9,383 8,281 7,348 13.3 12.7

Provision for credit losses ........................................................... 4,356 5,557 3,096 (21.6) 79.5

Income taxes and taxable-equivalent adjustments ...................... 1,144 593 1,221 92.9 (51.4)

Net income .............................................................................. 3,265 2,237 3,012 46.0 (25.7)

Net income attributable to noncontrolling interests ................. 52 (32) (66) * 51.5

Net income attributable to U.S. Bancorp ................................. $ 3,317 $ 2,205 $ 2,946 50.4 (25.2)

Net income applicable to U.S. Bancorp

common shareholders.......................................................... $ 3,332 $ 1,803 $ 2,819 84.8 (36.0)

Per Common Share

Earnings per share ....................................................................... $ 1.74 $.97 $ 1.62 79.4% (40.1)%

Diluted earnings per share ........................................................... $ 1.73 $.97 $ 1.61 78.4 (39.8)

Dividends declared per share ....................................................... $.20 $.20 $ 1.70 — (88.2)

Book value per share .................................................................... $ 14.36 $ 12.79 $ 10.47 12.3 22.2

Market value per share ................................................................. $ 26.97 $ 22.51 $ 25.01 19.8 (10.0)

Average common shares outstanding .......................................... 1,912 1,851 1,742 3.3 6.3

Average diluted common shares outstanding .............................. 1,921 1,859 1,756 3.3 5.9

Financial Ratios

Return on average assets............................................................. 1.16% .82% 1.21%

Return on average common equity .............................................. 12.7 8.2 13.9

Net interest margin (taxable-equivalent basis) ............................. 3.88 3.67 3.66

Efficiency ratio(a) ........................................................................... 51.5 48.4 46.9

Average Balances

Loans ............................................................................................ $193,022 $185,805 $165,552 3.9% 12.2%

Investment securities ................................................................... 47,763 42,809 42,850 11.6 (.1)

Earning assets .............................................................................. 252,042 237,287 215,046 6.2 10.3

Assets ........................................................................................... 285,861 268,360 244,400 6.5 9.8

Deposits ....................................................................................... 184,721 167,801 136,184 10.1 23.2

Total U.S. Bancorp shareholders’ equity ...................................... 28,049 26,307 22,570 6.6 16.6

Period End Balances

Loans ............................................................................................ $197,061 $194,755 $184,955 1.2% 5.3%

Allowance for credit losses .......................................................... 5,531 5,264 3,639 5.1 44.7

Investment securities ................................................................... 52,978 44,768 39,521 18.3 13.3

Assets ........................................................................................... 307,786 281,176 265,912 9.5 5.7

Deposits ....................................................................................... 204,252 183,242 159,350 11.5 15.0

Total U.S. Bancorp shareholders’ equity ...................................... 29,519 25,963 26,300 13.7 (1.3)

Capital ratios

Tier 1 capital ............................................................................ 10.5% 9.6% 10.6%

Total risk-based capital ........................................................... 13.3 12.9 14.3

Leverage ................................................................................... 9.1 8.5 9.8

Tier 1 common equity to risk-weighted assets(b) ..................... 7.8 6.8 5.1

Tangible common equity to tangible assets(b) .......................... 6.0 5.3 3.3

Tangible common equity to risk-weighted assets(b) ................. 7.2 6.1 3.7

* Not meaningful

(a) Computed as noninterest expense divided by the sum of net interest income on a taxable-equivalent basis and noninterest income excluding net securities gains (losses).

(b) See Non-Regulatory Capital Ratios on page 60.