US Bank 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROVEN PERFORMANCE

momentum

U.S. BANCORP 2010 Annual Report

Building

(1,1) -1- 6549_US_Bank_cover_IDCS5.indd 2/28/11 2:46 PM

(1,1) -1- 6549_US_Bank_cover_IDCS5.indd 2/28/11 2:46 PM

Table of contents

-

Page 1

PROVEN PERFORMANCE Building momentum U.S. BANCORP 2010 A n n u a l Report -

Page 2

... Deposits Loans Customers Bank branches ATMs U.S. Bank is 5th largest U.S. commercial bank $308 billion $204 billion $197 billion 17 million 3,031 Payment services and merchant processing Wholesale banking and trust services Consumer and business banking NYSE symbol At year end December 31, 2010... -

Page 3

... and most trusted banking companies in the world. The company offers regional consumer and business banking and wealth management services, national wholesale and trust services, and international payments services to more than 17 million customers. Headquartered in Minneapolis, U.S. Bancorp was... -

Page 4

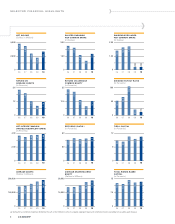

...AR G IN (TAXABLE-EQUIVALENT BASIS) EFFICIENCY RATIO (a) TIER 1 CAPITAL (In Percents) 60 12 (In ...ASSETS (Dollars in Millions) 300,000 285,861 268,360 244,400 AVERAGE SHAREHOLDERS' EQUITY TOTAL RISKED-BASED CAPITAL...securities gains (losses). 2 U.S. BANCORP 12.2 8.3 9.6 10.5 11.5 .200 -

Page 5

...Average Balances Loans ...Investment securities ...Earning assets ...Assets ...Deposits ...Total U.S. Bancorp shareholders' equity ...Period End Balances Loans ...Allowance for credit losses ...Investment securities ...Assets ...Deposits ...Total U.S. Bancorp shareholders' equity ...Capital ratios... -

Page 6

... customers, our employees and our communities. We are building on our strengths and building for the future. L OANS A ND DEPOSITS Over the past two years, we've expanded our banking franchise through FDIC-assisted bank acquisitions and other branch purchases in California, Arizona, Nevada, Chicago... -

Page 7

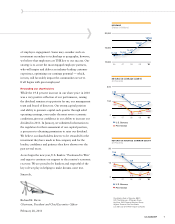

...Commercial utilization levels are at historic lows, and only a continuing and robust recovery will allow that to change. Capital and liquidity positions We continued to generate signiï¬cant capital in 2010, ending the year with a Tier 1 common equity ratio of 7.8 percent and a Tier 1 capital ratio... -

Page 8

... the recovery even stronger. Although we are deï¬ned as a large ï¬nancial services company, we are still, essentially, an uncomplicated, (even "old-fashioned") bank. Our lower-risk business model and focus on consumer and commercial banking, credit cards, quality home mortgages and fee businesses... -

Page 9

... our dividend. We believe our shareholders deserve to be rewarded for the investment they have made in this company and for the loyalty, conï¬dence and patience they have shown over the past several years. As we begin the new year, U.S. Bank is "Positioned to Win" and eager to continue our support... -

Page 10

..., reporting continued improvement in the company's asset quality as net charge-offs, non-performing assets and delinquencies declined. Having credit costs under control positioned the company to be among the ï¬rst banks to rebound in terms of growth. As one of only three banks in our peer group to... -

Page 11

Building on a strong foundation M A I N TA I N I N G O U R S T R E N G T H , S A F E T Y A N D S TA B I L I T Y U.S. Bank's diverse revenue streams and low-cost deposit base differentiate us from many banks... banking activities which impacted our 2010 revenue by more than $415 million. U.S. Bank's... -

Page 12

... market share or higher in key markets over time. We are the nation's fourth-largest branch network overall and number one in in-store branches. Our mortgage banking division is now sixth-largest in the nation in originations and in servicing. Our home mortgage origination market share has grown... -

Page 13

...have enhanced foreign exchange services, restructured our customer derivative business and added high grade ï¬xed income and municipal bond capabilities. Specialized corporate banking and capital markets ofï¬ces are now in New York, Charlotte, Los Angeles and Chicago, among others. U.S. BANCORP 11 -

Page 14

... need to pay bills or when they may be low on funds. It includes showing customers we know and value them by offering tailored services and solutions and streamlined account opening processes. With more than 18 billion smart phone apps downloaded through 2010, it's clear that mobile banking apps and... -

Page 15

... future through investments in technology L E A D I N G T H E W AY I N I N T E R N E T A N D M O B I L E B A N K I N G Internet and mobile channel usage continues to grow dramatically, and U.S. Bank is building new capabilities to meet customer needs. The key driver of our investment priorities... -

Page 16

... also had strong showings in recently released J.D. Power and Associates Customer Satisfaction Studies on home mortgage servicing and credit card customer satisfaction. U.S. Bank owned the lead among traditional bank credit card issuers and was rated third overall in the J.D. Power and Associates... -

Page 17

... ï¬nancial and capital issues, U.S. Bank continued its initiatives to claim the lead position in customer experience. We have the service policies and practices in place to support our employees and their continuous efforts to make the customer experience at U.S. Bank exceptional. U.S. BANCORP 15 -

Page 18

... services, employee volunteerism and other programs. Our Community Development Corporation is one of the nation's largest tax credit investors and provides innovative ï¬nancing solutions to help communities create affordable housing projects, preserve historic buildings and districts and fund... -

Page 19

... value of securities held in its investment securities portfolio; legal and regulatory developments, increased competition from both banks and non-banks; changes in customer behavior and preferences; effects of mergers and acquisitions and related integration, effects of critical accounting policies... -

Page 20

... of the foreclosure practices of 14 large mortgage servicers. As a result of the review, the Company expects the regulators will require the Company to address certain aspects of its foreclosure processes, including developing plans related to control procedures and monitoring of loss mitigation and... -

Page 21

... (taxable-equivalent basis) (a) Efficiency ratio (b) ...Average Balances Loans ...Loans held for sale ...Investment securities ...Earning assets ...Assets ...Noninterest-bearing deposits ...Deposits ...Short-term borrowings ...Long-term debt ...Total U.S. Bancorp shareholders' equity ... $193,022... -

Page 22

... income increased principally due to higher payments-related and commercial products revenue and a decrease in net securities losses, partially offset by lower deposit service charges, trust and investment management fees and mortgage banking revenue. Total noninterest expense in 2010 increased... -

Page 23

...Company's net interest income to changes in interest rates. Average total loans were $193.0 billion in 2010, compared with $185.8 billion in 2009. The $7.2 billion (3.9 percent) increase was driven by growth in residential mortgages, retail loans, commercial real estate loans and acquisition-related... -

Page 24

...U M E ( a ) 2010 v 2009 (Dollars in Millions) Volume Yield/Rate Total Volume 2009 v 2008 Yield/Rate Total Increase (Decrease) in Interest Income Investment securities ...Loans held for sale ...Loans Commercial loans ...Commercial real estate . Residential mortgage . . Retail loans ... ... $ 205 (10... -

Page 25

... homebuilding and related industries, commercial real estate properties, and credit card and other consumer and commercial loans, as the economy weakened and unemployment increased during the period. Refer to "Corporate Risk Profile" for further information on the provision for credit losses, net... -

Page 26

... 2008 2010 v 2009 2009 v 2008 Credit and debit card revenue ...Corporate payment products revenue...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges...Treasury management fees...Commercial products revenue ...Mortgage banking... -

Page 27

... higher merchant processing expenses, growth in mortgage servicing expenses and costs associated with OREO. The Company expects recently enacted legislation will increase deposit insurance expense in future years. Pension Plans Because of the long-term nature of pension plans, the related accounting... -

Page 28

...42,272 Lease financing ...6,126 Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages Residential mortgages ...Home equity loans, first liens ...Total residential mortgages Retail Credit card ...Retail... -

Page 29

... ...$48,398 Geography California ...Colorado ...Illinois ...Minnesota ...Missouri ...Ohio ...Oregon ...Washington ...Wisconsin ...Iowa, Kansas, Nebraska, North Dakota, South Dakota Arkansas, Indiana, Kentucky, Tennessee ...Idaho, Montana, Wyoming ...Arizona, Nevada, Utah ...$ 5,588 . 1,974 . 2,457... -

Page 30

... ...$34,695 Geography California ...Colorado ...Illinois ...Minnesota ...Missouri ...Ohio ...Oregon ...Washington ...Wisconsin ...Iowa, Kansas, Nebraska, North Dakota, South Dakota Arkansas, Indiana, Kentucky, Tennessee ...Idaho, Montana, Wyoming ...Arizona, Nevada, Utah ...$ 7,515 . 1,524 . 1,248... -

Page 31

... 31, 2009 Loans Percent Residential Mortgages California ...Colorado ...Illinois ...Minnesota ...Missouri ...Ohio ...Oregon ...Washington ...Wisconsin ...Iowa, Kansas, Nebraska, North Dakota, South Dakota Arkansas, Indiana, Kentucky, Tennessee ...Idaho, Montana, Wyoming ...Arizona, Nevada, Utah... -

Page 32

... loan demand and is used as collateral for public deposits and wholesale funding sources. While the Company intends to hold its U.S. BANCORP investment securities indefinitely, it may sell available-forsale securities in response to structural changes in the balance sheet and related interest rate... -

Page 33

...taxable equivalent basis under a tax rate of 35 percent. Yields on available-for-sale and held-to-maturity securities are computed based on historical cost balances. Average yield and maturity calculations exclude equity securities that have no stated yield or maturity. 2010 December 31 (Dollars in... -

Page 34

... 31, 2010, the Company had no plans to sell securities with unrealized losses and believes it is more likely than not it would not be required to sell such securities before recovery of their amortized cost. There is limited market activity for structured investment-related and non-agency mortgage... -

Page 35

... balance of a loan, investment or derivative contract when it is due. Residual value risk is the potential reduction in the end-of-term value of leased assets. Operational risk includes risks related to fraud, legal and compliance, processing errors, technology, breaches of internal controls... -

Page 36

...incurred loan losses. Commercial banking operations rely on prudent credit policies and procedures and individual lender and business line manager accountability. Lenders are assigned lending authority based on their level of experience and customer service requirements. Credit officers reporting to... -

Page 37

...and specialized products such as asset-based lending, commercial lease financing, agricultural credit, warehouse mortgage lending, commercial real estate, health care and correspondent banking. The Company also offers an array of retail lending products, including residential mortgages, credit cards... -

Page 38

... network, correspondent relationships and U.S. Bank branch offices. Generally, loans managed by the Company's consumer finance division exhibit higher credit risk characteristics, but are priced commensurate with the differing risk profile. Residential mortgages represent an important financial... -

Page 39

... certain niche lending activities that are nationally focused. Within the Company's retail loan portfolio, approximately 76.0 percent of the credit card balances relate to cards originated through the bank branches or co-branded and affinity programs that generally experience better credit quality... -

Page 40

... loan ratios exclude loans purchased from Government National Mortgage Association ("GNMA") mortgage pools whose repayments are insured by the Federal Housing Administration or guaranteed by the Department of Veterans Affairs. Including the guaranteed amounts, the ratio of residential mortgages... -

Page 41

... information on delinquent and nonperforming loans, excluding covered loans, as a percent of ending loan balances, by channel: Consumer Finance (a) December 31 2010 2009 Other Retail 2010 2009 Residential mortgages 30-89 days ...90 days or more ...Nonperforming ...Total ...Retail Credit card... -

Page 42

... several payment cycles. Short-Term Modifications The Company makes short-term modifications to assist borrowers experiencing temporary hardships. Consumer programs include short-term interest rate reductions (three months or less for residential mortgages and twelve months or less for credit cards... -

Page 43

... in accordance with the modified terms, and therefore continue to accrue interest: December 31 (Dollars in Millions) Amount 2010 2009 As a Percent of Ending Loan Balances 2010 2009 Commercial ...Commercial real estate. . Residential mortgages (a) Credit card ...Other retail ... ... . $ 77 . 15... -

Page 44

... real estate owned. (d) Charge-offs exclude actions for certain card products and loan sales that were not classified as nonperforming at the time the charge-off occurred. (e) Residential mortgage information excludes changes related to residential mortgages serviced by others. 42 U.S. BANCORP -

Page 45

... (residential mortgage, home equity and second mortgage) and commercial (commercial and commercial real estate) loan balances: December 31 (Dollars in Millions) Amount 2010 2009 As a Percent of Ending Loan Balances 2010 2009 Residential Minnesota ...California ...Illinois ...Nevada ...Missouri... -

Page 46

... economy and rising unemployment affecting the residential housing markets, including homebuilding and related industries, commercial real estate properties and credit card and other consumer and commercial loans. Total net charge-offs peaked for the Company in the first quarter of 2010 and have... -

Page 47

...the extent of credit exposure to specific borrowers within the portfolio. In addition, concentration risks associated with commercial real estate and the mix of loans, including credit cards, loans originated through the consumer finance division and residential mortgage balances, and their relative... -

Page 48

... and development ...Total commercial real estate ...Residential mortgages ...Retail Credit card ...Retail leasing ...Home equity and second mortgages . Other retail ... Total retail ...Covered loans (a) ...Total recoveries ... Net Charge-Offs Commercial Commercial ...Lease financing ... 736 91 827... -

Page 49

... 2006 2010 2009 2008 December 31 (Dollars in Millions) Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgage ...Retail Credit card ...Retail leasing ...Home... -

Page 50

... the Company, the execution of unauthorized transactions by employees, errors relating to transaction processing and technology, breaches of the internal control system and compliance requirements, and business continuation and disaster recovery. This risk of loss also includes the potential legal... -

Page 51

...to develop, maintain and test these plans at least annually to ensure that recovery activities, if needed, can support mission critical functions, including technology, networks and data centers supporting customer applications and business operations. While the Company believes that it has designed... -

Page 52

...interest rate swaps and forward commitments to buy residential mortgage loans to mitigate fluctuations in the value of its MSRs, but does not designate those derivatives as accounting hedges. Additionally, the Company uses forward commitments to sell residential mortgage loans at specified prices to... -

Page 53

... & Poor's Fitch Dominion Bond Rating Service U.S. Bancorp Short-term borrowings ...Senior debt and medium-term notes Subordinated debt ...Preferred stock ...Commercial paper ...U.S. Bank National Association Short-term time deposits ...Long-term time deposits ...Bank notes ...Subordinated debt... -

Page 54

...obligations related to the unfunded non-qualified pension plans and post-retirement medical plan. Cayman branch for issuing eurodollar time deposits. In addition, the Company establishes relationships with dealers to issue national market retail and institutional savings certificates and short-term... -

Page 55

... with the ITS exchange, and changes in unrealized gains and losses on available-for-sale investment securities included in other comprehensive income, partially offset by dividends. Banking regulators define minimum capital requirements for banks and financial services holding companies. These... -

Page 56

... Department of Housing and Urban Development, Government National Mortgage Association, Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association. At December 31, 2010, U.S. Bank National Association met these requirements. Table 20 provides a summary of capital ratios... -

Page 57

...the fourth quarter of 2010. LINE OF BUSINESS FINANCIAL REVIEW The Company's major lines of business are Wholesale Banking and Commercial Real Estate, Consumer and Small Business Banking, Wealth Management and Securities Services, Payment Services, and Treasury and Corporate Support. These operating... -

Page 58

... credit losses ...Income before income taxes ...Income taxes and taxable-equivalent adjustment...Net income ...Net (income) loss attributable to noncontrolling interests ...Net income attributable to U.S. Bancorp ...Average Balance Sheet Commercial ...Commercial real estate ...Residential mortgages... -

Page 59

... or benefit to arrive at the consolidated effective tax rate included in Treasury and Corporate Support. Wealth Management and Securities Services 2010 2009 Percent Change 2010 Payment Services 2009 Percent Change Treasury and Corporate Support 2010 2009 Percent Change 2010 Consolidated Company... -

Page 60

... banking offices, telephone servicing and sales, online services, direct mail and ATM processing. It encompasses community banking, metropolitan banking, instore banking, small business banking, consumer lending, mortgage banking, consumer finance, workplace banking, student banking and 24-hour... -

Page 61

... and Corporate Support includes the Company's investment portfolios, most covered commercial and commercial real estate loans and related OREO, funding, capital management, asset securitization, interest rate risk management, the net effect of transfer pricing related to average balances and... -

Page 62

...ratios differ from capital ratios defined by banking regulators principally in that the numerator excludes trust preferred securities and preferred stock, the nature and extent of which varies among different financial services companies. These ratios are not defined in generally accepted accounting... -

Page 63

... allowance for credit losses may not directly coincide with changes in the risk ratings of the credit portfolio reflected in the risk rating process. This is in part due to the timing of the risk rating process in relation to changes in the business cycle, the exposure and mix of loans within risk... -

Page 64

... income (loss) in accordance with applicable accounting principles generally accepted in the United States. These include all of the Company's available-for-sale securities, derivatives and other trading instruments, MSRs and certain mortgage loans held for sale. The estimation of fair value also... -

Page 65

... data related to expected changes in interest rates, assumptions related to probability and severity of credit losses, estimated timing of credit losses including the foreclosure and liquidation of collateral, expected prepayment rates, required or anticipated loan modifications, unfunded loan... -

Page 66

...-15(e) under the Securities Exchange Act of 1934 (the "Exchange Act")). Based upon this evaluation, the principal executive officer and principal financial officer have concluded that, as of the end of the period covered by this report, the Company's disclosure controls and procedures were effective... -

Page 67

...the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. The Board of Directors of the Company has an Audit Committee composed of directors who are independent of U.S. Bancorp. The committee meets... -

Page 68

... December 31, 2010, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), U.S. Bancorp's internal control over financial reporting as of December 31, 2010, based on... -

Page 69

... with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of... -

Page 70

... Millions) 2010 2009 Assets Cash and due from banks ...Investment securities Held-to-maturity (fair value $1,419 and $48, respectively). . Available-for-sale ...Loans held for sale (included $8,100 and $4,327 of mortgage Loans Commercial ...Commercial real estate ...Residential mortgages ...Retail... -

Page 71

...credit losses ...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage... -

Page 72

... Interests Stock Income (Loss) (Dollars and Shares in Millions) Capital Surplus Retained Earnings Total Equity Balance December 31, 2007 ...Change in accounting principle ...Net income ...Changes in unrealized gains and losses on securities available-for-sale ...Unrealized loss on derivative... -

Page 73

...net of cash acquired ...Other, net ...Net cash used in investing activities ...Financing Activities Net increase in deposits ...Net increase (decrease) in short-term borrowings . . Proceeds from issuance of long-term debt ...Principal payments or redemption of long-term debt Fees paid on exchange of... -

Page 74

... Trust & Custody and Fund Services. Payment Services Payment Services includes consumer and business credit cards, stored-value cards, debit cards, corporate and purchasing card services, consumer lines of credit and merchant processing. Treasury and Corporate Support Treasury and Corporate Support... -

Page 75

Changes in fair value and realized gains or losses are reported in noninterest income. Available-for-sale Securities These securities are not trading a discount related to evidence of credit deterioration since date of origination. Originated Loans Held for Investment Loans the Company originates ... -

Page 76

...with mortgage banking activities intended to be held for sale are considered derivatives and recorded on the balance sheet at fair value with changes in fair value recorded in income. All other unfunded loan commitments are generally related to providing credit facilities to customers of the Company... -

Page 77

...modifications may include canceling the customer's available line of credit on the credit card, reducing the interest rate on the card, and placing the customer on a fixed payment plan not exceeding 60 months. The allowance for credit losses on TDRs is determined by discounting the restructured cash... -

Page 78

... Company enters into derivative transactions to manage its interest rate, prepayment, credit, price and foreign currency risk and to accommodate the business requirements of its customers. Derivative instruments are reported in other assets or other liabilities at fair value. Changes in a derivative... -

Page 79

... and services are provided. OTHER SIGNIFICANT POLICIES Intangible Assets The price paid over the net fair value of revenue includes interchange income from credit and debit cards, annual fees, and other transaction and account management fees. Interchange income is a fee paid by a merchant bank to... -

Page 80

... assumed discount rate. The discount rate utilized is based on the investment yield of high quality corporate bonds available in the marketplace with maturities equal to projected cash flows of future benefit payments as of the measurement date. Periodic pension expense (or income) includes service... -

Page 81

... with the FDIC. Under the terms of the loss sharing agreements, the FDIC will reimburse the Company for most of the losses on the covered assets. In 2010, the Company acquired the securitization trust administration business of Bank of America, N.A. This transaction included the acquisition of... -

Page 82

... and accretion of discounts and credit-related other-than-temporary impairment. (b) Available-for-sale securities are carried at fair value with unrealized net gains or losses reported within accumulated other comprehensive income (loss) in shareholders' equity. (c) Prime securities are those... -

Page 83

... of the SIV-related securities evidenced credit deterioration at the time of acquisition by the Company. Investment securities with evidence of credit deterioration at acquisition had an unpaid principal balance and fair value of $485 million and $173 million, respectively, at December 31, 2010, and... -

Page 84

... severity rates ... 4% 3 40 14% 9 55 13% 3 41 1% 1 37 12% 20 71 6% 8 55 Changes in the credit losses on non-agency mortgage-backed securities, including SIV-related securities, and other debt securities are summarized as follows: Year Ended December 31 (Dollars in Millions) 2010 2009 Balance... -

Page 85

... Fair Value Unrealized Losses Total Fair Value Unrealized Losses Held-to-maturity U.S. Treasury and agencies ...Mortgage-backed securities Residential Agency ...Non-agency Non-prime ...Commercial Non-agency ...Asset-backed securities Collateralized debt obligations/Collaterized loan obligations... -

Page 86

... has Consumer and Small Business Banking offices. Collateral for commercial loans may include marketable securities, accounts receivable, inventory and equipment. For details of the Company's commercial portfolio by industry group and geography as of December 31, 2010 and 2009, see Table 7 included... -

Page 87

...: 2010 Purchased impaired loans Purchased nonimpaired loans Other assets Purchased impaired loans 2009 Purchased nonimpaired loans Other assets December 31 (Dollars in Millions) Total Total Commercial loans ...Commercial real estate loans ...Residential mortgage loans ...Retail loans ...Losses... -

Page 88

... credit losses and related loan balances, by portfolio type, for the year ended December 31, 2010, was as follows: Commercial Real Estate Total Loans, Excluding Covered Loans (Dollars in Millions) Commercial Residential Mortgages Credit Card Other Retail Covered Loans Total Loans Allowance... -

Page 89

... provides a summary of loans by portfolio type and the Company's internal credit quality rating: Criticized December 31, 2010 (Dollars in Millions) Pass Special Mention Classified (a) Total Criticized Total Commercial ...Commercial real estate . Residential mortgages . Credit card ...Other retail... -

Page 90

... covered loans, for the year ended December 31, 2010, was as follows: Period-end Recorded Investment Unpaid Principal Balance Valuation Allowance Average Recorded Investment Interest Income Recognized (Dollars in Millions) Commercial ...Commercial real estate Residential mortgages. Credit card... -

Page 91

... Company sells financial assets in the normal course of business. The majority of the Company's financial asset sales are residential mortgage loan sales primarily to governmentsponsored enterprises through established programs, the sale or syndication of tax-advantaged investments, commercial loan... -

Page 92

... value of its variable interests plus any related tax credits previously recognized. The Company also deconsolidated certain community development and tax-advantaged investment entities as a result of adopting the new accounting guidance, principally because the Company did not have power to direct... -

Page 93

...S The Company serviced $173.9 billion of residential mortgage loans for others at December 31, 2010, and $150.8 billion at December 31, 2009. The net impact included in mortgage banking revenue of assumption changes on the fair value of MSRs and fair value changes of derivatives used to economically... -

Page 94

... S S E T S Intangible assets consisted of the following: December 31 (Dollars in Millions) Estimated Life (a) Amortization Method (b) Balance 2010 2009 Goodwill...Merchant processing contracts . Core deposit benefits ...Mortgage servicing rights...Trust relationships ...Other identified intangibles... -

Page 95

...carrying value of goodwill for the years ended December 31, 2010 and 2009: (Dollars in Millions) Wholesale Banking and Commercial Real Estate Consumer and Small Business Banking Wealth Management and Securities Services Payment Services Treasury and Corporate Support Consolidated Company Balance at... -

Page 96

...the following: (Dollars in Millions) Rate Type Rate (a) Maturity Date 2010 2009 U.S. Bancorp (Parent Company) Subordinated notes ...Convertible senior debentures ... Medium-term notes ...Junior subordinated debentures ...Capitalized lease obligations, mortgage indebtedness and other (b) ...Subtotal... -

Page 97

... price specified in the indentures plus any accrued but unpaid interest to the redemption date. The Company used the proceeds from the sales of the Debentures for general corporate purposes. In connection with the formation of USB Capital IX, the trust issued redeemable ITS to third-party investors... -

Page 98

... Economic Stabilization Act of 2008 for proceeds of $6.6 billion. The Company allocated $172 million of the proceeds to the warrant, with the resulting discount on the Series E Preferred Stock being accreted over five years and reported as a reduction to income applicable to common equity over that... -

Page 99

... (the "Series D Preferred Stock"). The Series B Preferred Stock and Series D Preferred Stock have no stated maturity and will not be subject to any sinking fund or other obligation of the Company. Dividends, if declared, will accrue and be payable quarterly, in arrears, at a rate per annum equal to... -

Page 100

... their perceived credit risk and include certain off-balance sheet exposures, such as unfunded loan commitments, letters of credit, and derivative contracts. The Company is also subject to a leverage ratio requirement, a non risk-based asset ratio, which is defined as Tier 1 capital as a percentage... -

Page 101

... Rate Exchangeable Non-cumulative Perpetual Series A Preferred Stock with a liquidation preference of $100,000 per share ("Series A Preferred Securities") to third-party investors, and investing the proceeds in certain assets, consisting predominately of mortgage-backed securities from the Company... -

Page 102

... assumed discount rate and the long-term rate of return ("LTROR"). Annually, the Company's Compensation and Human Resources Committee (the "Committee"), assisted by outside consultants, evaluates plan objectives, funding policies and plan investment policies considering its long-term investment time... -

Page 103

... on plan assets ...Employer contributions ...Plan participants' contributions ...Benefit payments ... Fair value at end of measurement period ...Funded (Unfunded) Status ...Components Of The Consolidated Noncurrent benefit asset ...Current benefit liability ...Noncurrent benefit liability ...Balance... -

Page 104

... (loss) for the years ended December 31 for the retirement plans: Pension Plans (Dollars in Millions) 2010 2009 2008 Postretirement Welfare Plan 2010 2009 2008 Components Of Net Periodic Benefit Cost Service cost ...Interest cost ...Expected return on plan assets ...Prior service cost (credit) and... -

Page 105

... with U.S. Bancorp Asset Management, Inc., an affiliate of the Company, certain plan assets are lent to qualified borrowers on a short-term basis in exchange for investment fee income. These borrowers collateralize the loaned securities with either cash or noncash securities. Cash collateral held... -

Page 106

.... Stock incentive plans of acquired companies are generally terminated at the merger closing dates. Option holders under such plans receive the Company's common stock, or options to buy the Company's stock, based on the conversion terms of the various merger agreements. At December 31, 2010, there... -

Page 107

...the Company's expected dividend yield over the life of the options. The following summarizes certain stock option activity of the Company: (Dollars in Millions) 2010 2009 2008 Fair value of options vested ...Intrinsic value of options exercised ...Cash received from options exercised ...Tax benefit... -

Page 108

...36.06 $28.28 RESTRICTED STOCK AND UNIT AWARDS A summary of the status of the Company's restricted shares of stock is presented below: 2010 WeightedAverage GrantDate Fair Value 2009 WeightedAverage GrantDate Fair Value 2008 WeightedAverage GrantDate Fair Value Year Ended December 31 Shares Shares... -

Page 109

... $1,087 Applicable income taxes ... The tax effects of fair value adjustments on securities available-for-sale, derivative instruments in cash flow hedges and certain tax benefits related to stock options are recorded directly to shareholders' equity as part of other comprehensive income (loss). In... -

Page 110

...(Dollars in Millions) 2010 2009 Deferred Tax Assets Allowance for credit losses ...Securities available-for-sale and financial instruments ...Accrued expenses ...Stock compensation ...Pension and postretirement benefits ...Federal, state and foreign net operating loss carryforwards Partnerships and... -

Page 111

... forward commitments to buy residential mortgage loans to economically hedge the change in the fair value of the Company's residential MSRs. In addition, the Company acts as a seller and buyer of interest rate derivatives and foreign exchange contracts to accommodate its customers. To mitigate the... -

Page 112

... Buy ...Sell ...Options Purchased ...Written ...Receive fixed/pay floating swaps ...Foreign exchange forward contracts ...Equity contracts ...Credit contracts...December 31, 2009 Fair value hedges Interest rate contracts Receive fixed/pay floating swaps ...Foreign exchange cross-currency swaps Cash... -

Page 113

... the customer-related derivative positions of the Company: Asset Derivatives Weighted-Average Remaining Maturity In Years Liability Derivatives Weighted-Average Remaining Maturity In Years (Dollars in Millions) Notional Value Fair Value Notional Value Fair Value December 31, 2010 Interest rate... -

Page 114

... Interest rate contracts ...Foreign exchange cross-currency swaps...Other economic hedges Interest rate contracts Futures and forwards...Purchased and written options ...Foreign exchange forward contracts ...Equity contracts ...Credit contracts ...Customer-Related Positions Interest rate contracts... -

Page 115

... remeasurement of certain assets and liabilities, and disclosures. Derivatives, trading and available-for-sale investment securities, certain mortgage loans held for sale ("MLHFS") and MSRs are recorded at fair value on a recurring basis. Additionally, from time to time, the Company may be required... -

Page 116

... corporate debt securities and SIV-related securities. Beginning in the first quarter of 2009, due to the limited number of trades of non-agency mortgage-backed securities and lack of reliable evidence about transaction prices, the Company determines the fair value of these securities using a cash... -

Page 117

... market rates. Short-term Borrowings Federal funds purchased, securities sold under agreements to repurchase, commercial paper and other short-term funds borrowed have floating rates or short-term maturities. The fair value of short-term borrowings was determined by discounting contractual cash... -

Page 118

...political subdivisions...Obligations of foreign governments ...Corporate debt securities ...Perpetual preferred securities ...Other investments ...Total available-for-sale . Mortgage loans held for sale ...Mortgage servicing rights...Derivative assets ...Other assets ...$ 873 $ 1,664 $ - $ - $ 2,537... -

Page 119

... of Period Balance 2010 Available-for-sale securities Mortgage-backed securities Residential non-agency Prime ...Non-prime ...Commercial non-agency ...Asset-backed securities Collateralized debt obligations/Collateralized loan obligations ...Other ...Corporate debt securities ...Other investments... -

Page 120

... with disclosure guidance related to fair values of financial instruments, the Company did not include assets and liabilities that are not financial instruments, such as the value of goodwill, long-term relationships with deposit, credit card, merchant processing and trust customers, other purchased... -

Page 121

... of customers to ensure payment or collection in connection with trade transactions. In the event of a customer's nonperformance, the Company's credit loss exposure is the Commitments to extend credit Commercial and commercial real estate ...Corporate and purchasing cards (a) ...Retail credit cards... -

Page 122

... lending activities by acting as the customer's agent involving the loan of securities. The Company indemnifies customers for the difference between certain third-parties in connection with the sale or syndication of certain assets, primarily loan portfolios and low-income housing tax credits... -

Page 123

...future payments, if any, under the loan buy-back guarantees. Merchant Processing The Company, through its subsidiaries, provides merchant processing services. Under the rules of credit card associations, a merchant processor retains a contingent liability for credit card transactions processed. This... -

Page 124

... 31, 2010. OTHER CONTINGENT LIABILITIES Visa Restructuring and Card Association Litigation The Company's payment services business issues and acquires credit and debit card transactions through the Visa U.S.A. Inc. card association or its affiliates (collectively "Visa"). In 2007, Visa completed... -

Page 125

...' Equity Short-term funds borrowed ...Long-term debt ...Other liabilities ...Shareholders' equity ... Total liabilities and shareholders' equity ... CONDENSED STATEMENT OF INCOME Year Ended December 31 (Dollars in Millions) 2010 2009 2008 Income Dividends from bank subsidiaries ...Dividends from... -

Page 126

...12,082 ... Net cash used in investing activities ...Financing Activities Net increase (decrease) in short-term borrowings ...Proceeds from issuance of long-term debt ...Principal payments or redemption of long-term debt ...Fees paid on exchange of income trust securities for perpetual Proceeds from... -

Page 127

...Consolidated Balance Sheet - Five Year Summary (Unaudited) December 31 (Dollars in Millions) 2010 2009 2008 2007 2006 % Change 2010 v 2009 Assets Cash and due from banks ...Held-to-maturity securities ...Available-for-sale securities ...Loans held for sale ...Loans ...Less allowance for loan losses... -

Page 128

...credit losses ...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage... -

Page 129

...credit losses ...Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage... -

Page 130

...Year Ended December 31 Average Balances 2010 Yields and Rates Average Balances 2009 Yields and Rates (Dollars in Millions) Interest Interest Assets Investment securities ...Loans held for sale ...Loans (b) Commercial ...Commercial real estate Residential mortgages . Retail ... ... $ 47,763 5,616... -

Page 131

Related Yields And Rates (a) (Unaudited) 2008 Average Balances Yields and Rates Average Balances 2007 Yields and Rates Average Balances 2006 Yields and Rates 2010 v 2009 % Change Average Balances Interest Interest Interest $ 42,850 3,914 54,307 31,110 23,257 55,570 164,244 1,308 165,552 2,730 ... -

Page 132

...86 22.51 $.050 .050 .050 .050 The common stock of U.S. Bancorp is traded on the New York Stock Exchange, under the ticker symbol "USB." At January 31, 2011, there were 55,191 holders of record of the Company's common stock. STOCK PERFORMANCE CHART The following chart compares the cumulative total... -

Page 133

... the Bank Holding Company Act of 1956. U.S. Bancorp provides a full range of financial services, including lending and depository services, cash management, foreign exchange and trust and investment management services. It also engages in credit card services, merchant and ATM processing, mortgage... -

Page 134

... fees charged to merchants for debit card transactions, enhances the regulation of consumer mortgage banking, limits the pre-emption of local laws applicable to national banks, and excludes certain instruments currently included in determining the Tier 1 regulatory capital ratio. The capital... -

Page 135

... the ability of their borrowers to make debt service payments on loans. Should unemployment or real estate asset values fail to recover for an extended period of time, the Company could be adversely affected. Changes in consumer use of banks and changes in consumer spending and saving habits could... -

Page 136

... into direct investments. Direct investments, such as U.S. Government and corporate securities and other investment vehicles (including mutual funds) generally pay higher rates of return than financial institutions, because of the absence of federal insurance premiums and reserve requirements. Acts... -

Page 137

... of the Company, the execution of unauthorized transactions by employees, errors relating to transaction processing and technology, breaches of the internal control system and compliance requirements and business continuation and disaster recovery. This risk of loss also includes the potential legal... -

Page 138

... asset balances; or significantly increase its accrued taxes liability. For more information, refer to "Critical Accounting Policies" in this Annual Report. Changes in accounting standards could materially impact the Company's financial statements From time to time, the Financial Accounting... -

Page 139

... interference with communications, including the interruption or loss of the Company's websites, which could prevent the Company from obtaining deposits, originating loans and processing and controlling its flow of business, as well as through the destruction of facilities and the U.S. BANCORP 137 -

Page 140

... and stock price performance of other companies that investors deem comparable to the Company; new technology used or services offered by the Company's competitors; news reports relating to trends, concerns and other issues in the financial services industry; and changes in government regulations... -

Page 141

... From the time of the merger, Mr. Davis was responsible for Consumer Banking, including Retail Payment Solutions (card services), and he assumed additional responsibility for Commercial Banking in 2003. Mr. Davis has held management positions with the Company since joining Star Banc Corporation, one... -

Page 142

... as Chief Financial Officer of the Payment Services business from October 2006 until September 2007. From March 2001 until July 2005, he served as Senior Vice President and Director of Investor Relations at U.S. Bancorp. Mr. Payne is Vice Chairman, Wholesale Banking, of U.S. Bancorp. Mr. Payne, 63... -

Page 143

... Officer JW Levin Partners LLC (Private investment and advisory) New York, New York 1. Executive Committee 2. Compensation and Human Resources Committee 3. Audit Committee 4. Community Reinvestment and Public Policy Committee 5. Governance Committee 6. Risk Management Committee U.S. BANCORP... -

Page 144

... copies of our annual reports. Please contact: U.S. Bancorp Investor Relations 800 Nicollet Mall Minneapolis, MN 55402 [email protected] Phone: 866-775-9668 Media Requests U.S. Bancorp common stock is listed and traded on the New York Stock Exchange under the ticker symbol USB. Steven... -

Page 145

U.S. Bancorp 800 Nicollet Mall Minneapolis, MN 55402 usbank.com