US Bank 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2U.S. BANCORP

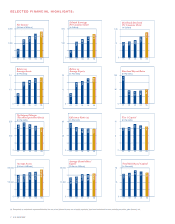

SELECTED FINANCIAL HIGHLIGHTS:

(a) Computed as noninterest expense divided by the sum of net interest income on a taxable-equivalent basis and noninterest income excluding securities gains (losses), net.

4,489

01

5,000

2,500

002 03 04 05

1,479

3,733

4,167

3,168

Net Income

(Dollars in Millions)

1.230

01

1.40

.70

002 03 04 05

.750

.780

.855

1.020

Dividends Declared

Per Common Share

(In Dollars)

2.42

01

3.00

1.50

002 03 04 05

.76

1.65

1.93

2.18

Diluted Earnings

Per Common Share

(In Dollars)

2.21

01

2.4

1.2

002 03 04 05

.89

1.84

1.99

2.17

Return on

Average Assets

(In Percents)

3.97

01

5.00

2.50

002 03 04 05

4.46

4.65

4.49

4.25

Net Interest Margin

(Taxable-Equivalent Basis)

(In Percents)

203,198

01

220,000

110,000

002 03 04 05

165,944

171,948

187,630

191,593

Average Assets

(Dollars in Millions)

22.5

01

24

12

002 03 04 05

9.0

18.3

19.2

21.4

Return on

Average Equity

(In Percents)

44.3

01

60

30

002 03 04 05

57.2

48.8

45.6

45.3

Efficiency Ratio (a)

(In Percents)

19,953

01

25,000

12,500

002 03 04 05

16,426

19,393

19,459

17,273

Average Shareholders’

Equity

(Dollars in Millions)

50.2

01

100

50

002 03 04 05

97.4

47.3

44.1

46.2

Dividend Payout Ratio

(In Percents)

8.2

01

10

5

002 03 04 05

7.8

8.0

9.1

8.6

Tier 1 Capital

(In Percents)

12.5

01

15

7.5

002 03 04 05

11.9

12.4

13.6

13.1

Total Risk-Based Capital

(In Percents)