US Bank 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PRIVATE CLIENT, TRUST AND ASSET MANAGEMENT:

Corporate trust and institutional

custody growth solidifies our leadership

u.s. bank is a recognized national leader

in the corporate trust and institutional

custody businesses — the largest trustee in the area of tax-exempt

debt, the second largest in the area of asset-backed and mortgage-backed securities,

the third largest in new corporate bond issuances, and the ninth-largest institutional

custody provider.

U.S. Bank recently solidified this top tier position with the acquisition of a major

corporate trust and institutional custody portfolio. As a result of the transaction,

which closed on December 30, 2005, U.S. Bank Corporate Trust Services acquired

approximately 14,100 new client issuances and $410 billion in assets under

administration, and U.S. Bank Institutional Trust & Custody acquired approximately

1,700 new clients and $570 billion in assets under administration.

This transaction strongly complements our existing corporate trust and

institutional custody businesses, making us more competitive by increasing our

scale and leveraging our existing capabilities and operational platforms. In addition

to serving the specialized needs of our corporate trust and institutional custody

customers, U.S. Bancorp continues to enhance our top-notch service delivery to

affluent individuals and families, professional service corporations and nonprofit

organizations through The Private Client Group. Acting as a bank within a bank,

The Private Client Group works to build, manage and preserve our customers’

wealth by providing expert planning, programs and advice.

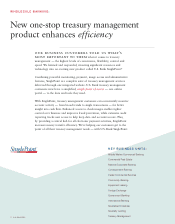

KEY BUSINESS UNITS:

The Private Client Group

Corporate Trust Services

Institutional Trust & Custody

U.S. Bancorp Asset Management, Inc.

U.S. Bancorp Fund Services, LLC

10 U.S. BANCORP