TiVo 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 TiVo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

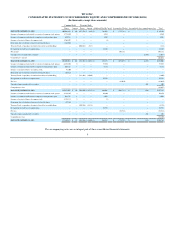

January 31, 2011 January 31, 2010

(in thousands)

Due within 1 year $ 123,631 $ 141,857

Due within 1 year through 5 years 14,585 31,834

Due within 5 years through 10 years — —

Due after 10 years 2,490 4,112

Total $ 140,706 $ 177,803

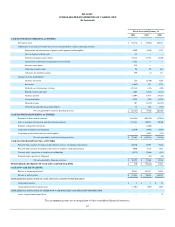

Unrealized Gains (Losses) on Marketable Investment Securities

The following table summarizes unrealized gains and losses related to the Company’s investments in marketable securities designated as available-for-

sale:

As of January 31, 2011

Adjusted

Cost Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

(in thousands)

Certificate of deposit $ 25,600 $ 7 $ — $ 25,607

Commercial paper 24,471 2 — 24,473

Corporate debt securities 42,847 50 — 42,897

US agency securities 23,074 11 (2) 23,083

US Treasury securities 5,009 14 — 5,023

Foreign government securities 12,030 5 — 12,035

Variable-rate demand notes 2,600 — — 2,600

Asset-backed securities 2,499 — (1) 2,498

Auction rate securities 3,000 — (510) 2,490

Total $ 141,130 $ 89 $ (513) $ 140,706

As of January 31, 2010

Adjusted

Cost Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

(in thousands)

Certificate of deposit $ 16,408 $ — $ (7) $ 16,401

Commercial paper 39,547 12 — 39,559

Corporate debt securities 49,743 134 (44) 49,833

US agency securities 26,958 40 — 26,998

US Treasury securities 15,065 48 — 15,113

Foreign government securities 25,708 79 — 25,787

Auction rate securities 5,000 — (888) 4,112

Total $ 178,429 $ 313 (939) $ 177,803

The available-for-sale investments that were in an unrealized loss position as of January 31, 2011 and January 31, 2010 , aggregated by length of time

that individual securities have been in a continuous loss position, were as follows:

19