TiVo 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 TiVo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

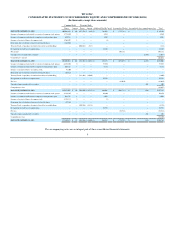

As of January 31,

2011 2010

(in thousands)

Cash and cash equivalents:

Cash $ 4,362 $ 4,111

Cash equivalents:

Commercial paper 40,189 14,994

Money market funds 26,670 51,786

Total cash and cash equivalents 71,221 70,891

Marketable securities:

Certificate of deposit 25,607 16,401

Commercial paper 24,473 39,559

Corporate debt securities 42,897 49,833

US agency securities 23,083 26,998

US Treasury securities 5,023 15,113

Foreign government securities 12,035 25,787

Variable-rate demand notes 2,600 —

Asset-backed securities 2,498 —

Current marketable securities 138,216 173,691

Auction rate securities (1) 2,490 4,112

Non-current marketable securities 2,490 4,112

Total marketable securities 140,706 177,803

Other investment securities:

Other investment securities - cost method 3,400 3,400

Total other investment securities (1) 3,400 3,400

Total cash, cash equivalents, marketable securities and other investment securities $ 215,327 $ 252,094

(1) Auction rate securities and other investment securities are included in “Long-term investments” on the Company’s consolidated balance sheets.

Marketable Securities

The Company’s investment securities portfolio consists of various debt instruments, including corporate and government bonds, asset-backed

securities, and foreign corporate and government securities, all of which are classified as available-for-sale.

Other Investment Securities

TiVo has an investment in a private company where the Company’s ownership is less than 20% and TiVo does not have significant influence. The

investment is accounted for under the cost method and is periodically assessed for other-than-temporary impairment. See Note 4, "Fair Value" for additional

information on the impairment assessment of the investment.

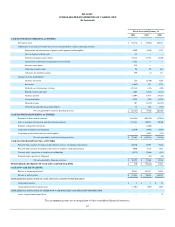

Contractual Maturity Date

The following table summarized the estimated fair value of the Company’s debt investments, designated as available-for-sale classified by the

contractual maturity date of the security:

18