TiVo 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 TiVo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

excess non-cancelable purchase commitments. As of January 31, 2011, the Company maintained a $365,000 inventory reserve as a result of inventory

impairment charges. Even if our current sales projections exceed our original projections, the inventory reserves are not reversed until the previously impaired

inventory is sold or scrapped.

Property and Equipment

Property and equipment are stated at cost less depreciation. Maintenance and repair expenditures are expensed as incurred.

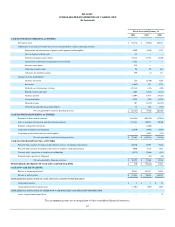

Depreciation is computed using the straight-line method over estimated useful lives as follows:

Furniture and fixture 3-5 years

Computer and office equipment 3-5 years

Lab equipment 3 years

Leasehold improvements The shorter of 7 years or the term of the lease

Capitalized software for internal use 1-5 years

Capitalized Software

Software development costs are capitalized when a product’s technological feasibility has been established by completion of a working model of the

product and amortization begins when a product is available for general release to customers. The period between the development of a working model and

the release of the final product to customers is short, and, therefore, the development costs incurred during this short period are immaterial and, as such, are

not capitalized.

Software development costs incurred as part of an approved project plan that result in additional functionality to internal use software are capitalized and

amortized on a straight-line basis over the estimated useful life of the software, between one and five years.

Intangible Assets

Purchased intangible assets include intellectual property such as patent rights which are carried at cost less accumulated amortization. Useful lives

generally range from five to seven years.

Sales Taxes

The Company accounts for sales taxes imposed on its goods and services on a net basis in the consolidated statement of operations.

Revenue Recognition and Deferred Revenue

The Company generates service revenues from fees for providing the TiVo service to consumers and through the sale of advertising and audience

research measurement services. The Company also generates technology revenues from licensing technology and by providing engineering professional

services. In addition, the Company generates hardware revenues from the sale of hardware products that enable the TiVo service.

Service Revenues. Included in service revenues are revenues from recurring and prepaid subscription plans to the TiVo service and fees received from

the sale of advertising and audience research measurement services. Monthly and prepaid fixed-length subscription revenues are recognized ratably over the

period the service is provided. Subscription revenues from product lifetime subscriptions are recognized ratably over the Company’s estimate of the useful life

of a TiVo-enabled DVR associated with the subscription. Effective November 1, 2008, the Company extended the period it uses to recognize product lifetime

subscription revenues from 54 months to 60 months for the product lifetime subscriptions acquired on or before October 31, 2007 and such change is being

recognized on a prospective basis with no adjustment to previously recognized revenues. The new estimates of expected lives are dependent on assumptions

with regard to future churn of the product lifetime subscriptions. The Company will continue to monitor the useful life of a TiVo-enabled DVR and the impact

of the differences between actual churn and forecasted churn rates. If subsequent actual experience is not in line with the Company’s current assumptions,

including higher churn of product lifetime subscriptions due to the incompatibility of its standard definition TiVo units with high definition programming and

increased competition, the Company may revise the estimated life which could result in the recognition of revenues from this source over a longer or shorter

period.

13