TiVo 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 TiVo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

hardware products. The Company’s warranty reserve liability is calculated as the total volume of unit sales over the warranty period, multiplied by the

expected rate of warranty returns (based on historical experience) multiplied by the estimated cost to replace or repair the customers’ product returns under

warranty.

Income Taxes

The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities are determined based on differences

between financial reporting and tax reporting bases of assets and liabilities and are measured using enacted tax rates and laws that are expected to be in effect

when the differences are expected to reverse. Realization of deferred tax assets is dependent upon future earnings, the timing and amount of which are

uncertain.

TiVo takes a two-step approach to recognizing and measuring uncertain tax positions. The first step is to evaluate the tax position for recognition by

determining if the weight of available evidence indicates that it is more likely than not that the position will be sustained upon tax authority examination,

including resolution of related appeals or litigation processes, if any. The second step is to measure the tax benefit as the largest amount that is more than 50%

likely of being realized upon ultimate settlement.

The Company’s policy is to include interest and penalties related to unrecognized tax benefits, if any, within the provision for taxes in the consolidated

statements of operations.

Business Concentrations and Credit Risk

The Company’s business is concentrated primarily in the United States and is dependent on discretionary consumer spending. Continued uncertainty or

adverse changes in the economy could lead to additional significant declines in discretionary consumer spending, which, in turn, could result in further

declines in the demand for the TiVo service and TiVo-enabled DVRs. As a result of the recent national and global economic downturn, overall consumer

spending has declined. Retailers in North America appear to be taking a more conservative stance in ordering electronics inventory and consumers as well

appear to be taking a more conservative stance in discretionary purchases, including TiVo DVRs and service subscriptions. Decreases in demand for the

Company’s products and services, particularly during the critical holiday selling season, could have an adverse impact on its operating results and financial

condition. Uncertainty and adverse changes in the economy could also increase the risk of losses on the Company’s investments, increase costs associated

with developing and producing its products, increase TiVo’s churn rate per month, increase the cost and decrease the availability of potential sources of

financing, and increase the Company’s exposure to losses from bad debts, any of which could have an adverse impact on the Company’s financial condition

and operating results.

Financial instruments that potentially subject the Company to a concentration of credit risk principally consist of cash, cash equivalents, short-term and

long-term investments, and trade receivables. The Company currently invests the majority of its cash in high-grade government and corporate debt and

maintains them with three financial institutions with high credit ratings. As part of its cash management process, the Company performs periodic evaluations

of the relative credit ratings of these financial institutions and issuers of the securities the Company owns. The Company has not experienced significant credit

losses on its cash, cash equivalents, or short-term and long-term investments.

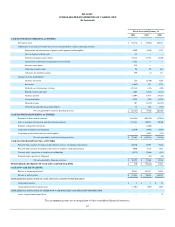

As of January 31, 2011, the Company held approximately $3.0 millionprincipal amount of investments with an auction reset feature (auction-rate

securities, or “ARS”), with a fair value of $2.5 millionthat are classified as long-term assets. The Company has recorded an unrealized loss on these auction

rate securities of $510,000, as the estimated fair value of these ARS was $510,000lower than their cost. The Company has no intent to sell and it is more-

likely-than not that the Company will not be required to sell these ARS prior to recovery. Further, the total unrealized loss is primarily due to a liquidity

discount resulting from the failed auctions. Therefore, the Company will continue to treat the decline in fair values as temporary and record the unrealized loss

in accumulated other comprehensive loss on the accompanying consolidated balance sheet as of January 31, 2011. The Company is exposed to credit risk on

its investments to the extent of the amount recorded on the consolidated balance sheets as of January 31, 2011.

The majority of the Company’s customers are concentrated in the United States. The Company is subject to a minimal amount of credit risk related to

service revenue contracts as these are primarily obtained through credit card sales. The Company sells its TiVo-enabled DVRs to retailers under customary

credit terms and generally requires no collateral. No customer generated 10% or more of net revenues for the fiscal years ended January 31, 2011, 2010, and

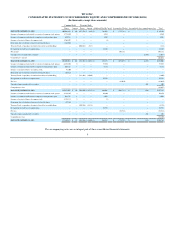

2009. The Company’s accounts receivable concentrations as of January 31, 2011, 2010 and 2009 were as follows:

16