TeleNav 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 TeleNav annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

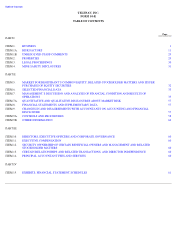

Table of Contents

We also enter into various types of licensing agreements to obtain access to technology or data that end users utilize in connection with our

navigation services. Our contracts with certain licensors include minimum guaranteed royalty payments, which are payable regardless of the

ultimate volume of revenue derived from the number of paying end users. Our most important agreements are with the providers of maps

pursuant to which we generally pay a monthly fee per end user, a per transaction fee or a revenue sharing percentage for data provided based in

each case upon a multi-tiered fee structure. We also obtain map data from HERE North America, LLC, a Nokia company, or HERE, pursuant to

an agreement dated December 1, 2002. Our agreement with HERE was automatically renewed under its existing terms through January 31,

2016, and automatically renews for successive one year periods unless either party provides notice of non-renewal at least 180 days prior to the

expiration of the applicable term. In addition, HERE is obligated to make available certain map data for our current automotive customers to

fulfill their requirements as follows: for Ford (through December 2017); and for GM (through December 2019), which can be extended for an

additional period of ten years and seven years, respectively. In August 2015, Audi AG, or Audi, BMW AG, or BMW, and Mercedes AG, or

Mercedes, announced their acquisition of Nokia’s HERE map business.

We also obtain map data pursuant to an agreement with TomTom North America, Inc., or TomTom, dated July 1, 2009, as amended. Our

agreement with TomTom automatically renews for each supported application for successive one year periods each July 1 (except for brought-

in

applications sold on Apple's App Store and selected vehicle navigation system applications), unless either party provides written notice of

termination at least 90 days prior to the expiration of the then-current term for each supported application. We most recently amended our

TomTom agreement effective January 30, 2014 to extend the license period for TomTom map data for voice-

guided turn by turn GPS navigation

service for mobile phones (except for Sprint’s bundled offering, automotive navigation products) through December 31, 2015.

Our agreements with HERE and TomTom also allow a party to terminate the agreement if the other party materially breaches its

obligations and fails to cure such breach. In addition, we obtain other data such as weather updates, gas prices, POI and traffic information from

additional providers.

Competition

The markets for development, distribution and sale of location services and advertising services are highly competitive. Many of our

competitors have greater name recognition, larger customer bases and significantly greater financial, technical, marketing, public relations, sales,

distribution and other resources than we do.

We compete in the location services market and our primary competitors include location service providers such as Apple, Google,

Microsoft, Nokia, TeleCommunication Systems, or TCS, and TomTom; PND providers such as Garmin Ltd., or Garmin, and TomTom;

integrated navigation mobile phone providers such as Garmin and Nokia; and providers of Internet and mobile based maps and directions such

as AOL Corporation, or AOL, Apple, Mapquest, Inc., or Mapquest, Google, Microsoft and Yahoo!, Inc., or Yahoo, Yelp Inc., or Yelp,

Foursquare Labs, Inc., or Foursquare, and Fullpower Technologies, Inc. (MotionX), or Fullpower.

We compete in the automotive navigation market with established automobile manufacturers and OEMs and providers of on-board

navigation services such as AISIN AW CO., Ltd, or AISIN, Robert Bosch GmbH, or Bosch, Elektrobit Corporation, or Elktrobit, Garmin,

TomTom and NNG LLC, or NNG, as well as other competitors such as Apple, Google, Microsoft and TCS.

We compete in the advertising network services business with mobile platform providers, including Google, Apple, and Millennial Media,

Inc., or Millennial Media, xAD, Inc., or xAD, Verve Wireless, Inc., or Verve Wireless, PlaceIQ, Inc., or PlaceIQ, and NinthDecimal, Inc., or

NinthDecimal, among others.

Competition in our markets is based primarily on product placement and performance including features, functions, reliability, flexibility,

scalability and interoperability; wireless carrier, automotive manufacturer and OEM and advertising agency relationships; technological

expertise, capabilities and innovation; price of services and products and total cost of ownership; brand recognition; and size and financial

stability of operations. We believe we compete favorably with respect to these factors based upon the performance, reliability and breadth of our

services and products and our technical experience.

Some of our competitors and potential competitors enjoy advantages over us, either globally or in particular geographic markets, including

with respect to the following:

9

•

significantly greater revenue and financial resources;

•

stronger brand and consumer recognition in a particular market segment, geographic region or worldwide;