TD Bank 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TD BANK GROUP ANNUAL REPORT 2012 MANAGEMENT’S DISCUSSION AND ANALYSIS16

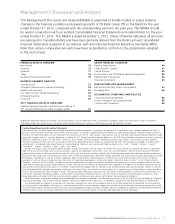

(millions of Canadian dollars) 2012 vs. 2011

2012 2011 % change

Investment and securities services

TD Waterhouse fees and commissions $ 384 $ 459 (16.3)%

Full-service brokerage and other securities services 562 631 (10.9)

Underwriting and advisory 437 378 15.6

Investment management fees 241 215 12.1

Mutual funds management 997 941 6.0

Total investment and securities services 2,621 2,624 (0.1)

Credit fees 745 671 11.0

Net gains (losses) from available-for-sale securities 373 393 (5.1)

Trading income (loss) (41) (127) 67.7

Service charges 1,775 1,602 10.8

Card services 1,039 959 8.3

Insurance revenue, net of claims and related expenses1 1,113 1,167 (4.6)

Trust fees 149 154 (3.2)

Other income (loss) 322 558 (42.3)

Total $ 8,096 $ 8,001 1.2%

(millions of Canadian dollars) 2012 2011

Net interest income $ 1,050 $ 818

Trading income (loss) (41) (127)

Financial assets and liabilities designated

at fair value through profit or loss1 10 4

Total trading-related income (loss) $ 1,019 $ 695

By product

Interest rate and credit portfolios $ 534 $ 212

Foreign exchange portfolios 374 428

Equity and other portfolios 101 51

Financial assets and liabilities designated

at fair value through profit or loss1 10 4

Total trading-related income (loss) $ 1,019 $ 695

1 Excludes amounts related to securities designated at fair value through profit or

loss that are not managed within a trading portfolio, but which have been

combined with derivatives to form economic hedging relationships.

NON-INTEREST INCOME

TABLE 9

TRADING-RELATED INCOME

TABLE 10

1 The results of the Bank’s Insurance business within Wealth and Insurance include

both insurance revenue, net of claims and related expenses and the income from

investments that fund policy liabilities which are designated at fair value through

profit or loss within the Bank’s property and casualty insurance subsidiaries.

TRADING-RELATED INCOME

Trading-related income is the total of net interest income on trading

positions, trading income which includes income from trading loans,

and income from loans designated at fair value through profit or loss

that are managed within a trading portfolio. Trading-related income

increased by $324 million, or 47% from 2011. The increase was primar-

ily in interest rate and credit portfolios and equity and other portfolios,

partially offset by a decrease in foreign exchange compared to the prior

year. The trading environment for interest rate and credit trading

improved on tighter spreads and increased client activity in 2012.

The mix of trading-related income between net interest income and

trading income is largely dependent upon the level of interest rates,

which drives the funding costs of the Bank’s trading portfolios.

Generally, as interest rates rise, net interest income declines and trad-

ing income reported in non-interest income increases. Management

believes that the total trading-related income is the appropriate

measure of trading performance.

NON-INTEREST INCOME

Non-interest income for the year on a reported basis was $8,096 million,

an increase of $95 million, or 1%, compared with last year. Adjusted

non-interest income for the year was $8,189 million, an increase of

$317 million, or 4%, compared with last year. The increase in adjusted

non-interest income was primarily driven by increases in the Canadian

Personal and Commercial Banking and U.S. Personal and Commercial

Banking segments, partially offset by a decline in Wealth and

Insurance. Canadian Personal and Commercial Banking non-interest

income increased primarily due to higher transaction volumes, the

contribution from MBNA and fee repricing. U.S. Personal and

Commercial Banking non-interest income increased due to higher

fee-based revenue and gains on sales of securities, partially offset by

the impact of the Durbin Amendment and the anticipated run-off in

legacy Chrysler Financial revenue. Wealth and Insurance non-interest

income decreased primarily due to unfavourable prior years claims

development in the Ontario auto market and weather-related events

in the Insurance business and lower trading revenue in the Wealth

business, partially offset by strong premium growth and the inclusion

of MBNA in the Insurance business and higher fee-based revenue from

higher client assets in the Wealth business.