TD Bank 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Built on strength.

Focused on the future.

2012 Annual Report

Table of contents

-

Page 1

Built on strength. Focused on the future. 2012 Annual Report -

Page 2

... Indicators Group President and CEO's Message Chairman of the Board's Message MANAGEMENT'S DISCUSSION AND ANALYSIS FINANCIAL RESULTS Consolidated Financial Statements Notes to Consolidated Financial Statements Principal Subsidiaries Ten-Year Statistical Review Glossary Shareholder and Investor... -

Page 3

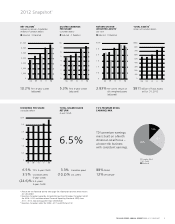

... of Total Assets at Oct. 31, 2012 DIVIDENDS PER SHARE (Canadian dollars) TOTAL SHAREHOLDER RETURN (5-year CAGR) TD'S PREMIUM RETAIL EARNINGS MIX $3.0 2.5 12% 2.0 1.5 1.0 6.5% 08 09 10 11 12 TD's premium earnings mix is built on a North American retail focus - a lower-risk business with... -

Page 4

...U.S. TD increased its target dividend payout range to 40 -50% from 35- 45% and raised dividends twice during ï¬scal 2012. TD continued to invest in its growth businesses announcing a deal to acquire Target's U.S. Credit Card portfolio and enjoying market share gains in domestic commercial banking... -

Page 5

... million from TD's community giving budget 7 was used to support environmental projects CEI is a measurement program that tracks TD customers' loyalty and advocacy. Scale for employee engagement score is from one to five. Calculated based on Canadian Cash Donations/five-year rolling average domestic... -

Page 6

... model, combined with the capacity of our management team and the dedication of our employees, will not only see TD through these challenging times, but help us sustain our leadership position in the future. Ed Clark Group President and Chief Executive Ofï¬cer 4 TD BANK GROUP ANNUAL REPORT 2012... -

Page 7

... economic growth, TD Bank Group achieved strong ï¬nancial results, increased its dividend twice and maintained a sound capital position. TD's performance is a reï¬,ection of the bank's proven business strategy and the leadership team's commitment to deliver value to all our stakeholders. CORPORATE... -

Page 8

...Board as part of the succession planning process for the position of CEO and periodically review TD's organization structure to ensure alignment with business objectives and succession planning; • Oversee the selection, evaluation, development and compensation of other members of senior management... -

Page 9

... and Insurance U.S. Personal and Commercial Banking Wholesale Banking Corporate 2011 FINANCIAL RESULTS OVERVIEW Selected Annual Information and Discussion relating to 2011 & 2010 Performance under Canadian GAAP GROUP FINANCIAL CONDITION Balance Sheet Review Credit Portfolio Quality Capital Position... -

Page 10

...TD Bank Group (TD or the Bank). TD is the sixth largest bank in North America by branches and serves approximately 22 million customers in four key businesses operating in a number of locations in key ï¬nancial centres around the globe: Canadian Personal and Commercial Banking, Wealth and Insurance... -

Page 11

...The first quarter 2012 was the last quarter U.S. Personal and Commercial Banking included any further FDIC-assisted and South Financial related integration charges or direct transaction costs as an item of note. The Bank purchases CDS to hedge the credit risk in Wholesale Banking's corporate lending... -

Page 12

... to measure shareholder value creation. Economic proï¬t is adjusted net income available to common shareholders less a charge for average common equity. The rate used in the charge for average common equity is the equity cost of capital calculated using the capital asset pricing model. The charge... -

Page 13

...ECONOMIC PROFIT AND RETURN ON COMMON EQUITY 2012 Return on common equity 2011 Return on invested capital (millions of Canadian dollars) Average common equity Average cumulative goodwill and intangible assets amortized, net of income taxes Average common equity/Average invested capital Rate charged... -

Page 14

... last year, as shown in the table below. TABLE 6 IMPACT OF FOREIGN EXCHANGE RATE ON U.S. PERSONAL AND COMMERCIAL BANKING AND TD AMERITRADE TRANSLATED EARNINGS 2012 vs. 2011 (millions of Canadian dollars) U.S. Personal and Commercial Banking Increased total revenue âˆ' reported Increased total... -

Page 15

... loan and deposit volume growth, partially offset by lower margin on average earning assets. Wholesale Banking net interest income increased largely due to higher trading-related revenue. NET INTEREST INCOME (millions of Canadian dollars) $16,000 12,000 8,000 4,000 0 11 12 Reported Adjusted... -

Page 16

... Average balance 1,2 (millions of Canadian dollars, except as noted) Interest3 2012 Average rate Average balance Interest3 2011 Average rate Interest-earning assets Interest-bearing deposits with Banks Canada U.S. Securities Trading Canada U.S. Non-trading Canada U.S. Securities purchased... -

Page 17

... INCOME 1,2 (millions of Canadian dollars) Average volume Average rate 2012 vs. 2011 Favourable (unfavourable) due to change in Net change Interest-earning assets Interest-bearing deposits with banks Canada U.S. Securities Trading Canada U.S. Non-trading Canada U.S. Securities purchased under... -

Page 18

... increases. Management believes that the total trading-related income is the appropriate measure of trading performance. TA B L E 10 TRADING-RELATED INCOME 2012 2011 (millions of Canadian dollars) Net interest income Trading income (loss) Financial assets and liabilities designated at fair value... -

Page 19

... the acquisition of MBNA Canada's credit card portfolio, higher employee-related costs, business initiatives and volume growth. U.S. Personal and Commercial Banking expenses increased due to investments in new stores and infrastructure, the Chrysler Financial acquisition and economic and regulatory... -

Page 20

... of intangibles Fair value of derivatives hedging the reclassiï¬ed available-for-sale securities portfolio Integration charges and direct transaction costs relating to U.S. Personal and Commercial Banking acquisitions Fair value of credit default swaps hedging the corporate loan book, net of... -

Page 21

...in 2012 elevated earnings above 2011 levels. The Bank's earnings have seasonal impacts, principally the second quarter being affected by fewer business days. The Bank's earnings are also impacted by market-driven events and changes in foreign exchange rates. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE... -

Page 22

... and Commercial Banking acquisitions Decrease (increase) in fair value of credit default swaps hedging the corporate loan book, net of provision for credit losses Integration charges, direct transaction costs, and changes in fair value of contingent consideration relating to the Chrysler Financial... -

Page 23

... costs, and changes in fair value of contingent consideration related to the Chrysler Financial acquisition are reported in the Corporate segment. Effective the ï¬rst quarter of 2012, executive responsibilities for the TD Insurance business were moved from Group Head, Canadian Banking, Auto Finance... -

Page 24

... These changes have been applied prospectively. Return on invested capital, which was used as the return measure in prior periods, has not been restated to return on common equity. Prior to Q1 2012, the amounts were calculated based on Canadian GAAP. 22 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT... -

Page 25

... manner. Business investment should improve going forward, supported by a continued low level of interest rates which we expect to persist over the medium term. The housing market has begun pulling back with home prices declining modestly over the last few months. We anticipate a price adjustment of... -

Page 26

... deposits Business banking Other1 Total 1 $ 3,594 1,901 2,809 2,170 178 $ 10,652 $ 2,627 1,946 2,753 2,060 146 $ 9,532 Other revenue includes internal commissions on sales of mutual funds and other Wealth and Insurance products, and other branch services. 24 TD BANK GROUP ANNUAL REPORT 2012... -

Page 27

... the new Investment Savings account. Average business deposit volumes increased $6.3 billion, or 10%. Reported margin on average earning assets increased 6 bps to 2.82%, while the adjusted margin on average earning assets increased 8 bps to 2.84%, compared TD BANK GROUP ANNUAL REPOR T 2012 MANAGE... -

Page 28

... sales force to serve customers. Customer and average balance growth led to healthy deposit volume growth. BUSINESS OUTLOOK AND FOCUS FOR 2013 We will continue to build on our industry-leading customer service and convenience position. We plan to open new branches and commercial banking centres... -

Page 29

..., grow and successfully transition their wealth. TD Insurance provides advice and insurance solutions to protect Canadians through a full suite of home, auto, creditor, travel, life and health products. $207 $1,367 NET INCOME (millions of Canadian dollars) Assets under Management $258 Assets under... -

Page 30

... in home and auto and #2 in personal lines position. • TD Insurance invested in customer experience through the addition of client-facing roles, increased training and streamlined processes resulting in doubling of customer satisfaction scores year over year. • Closed the MBNA Canada acquisition... -

Page 31

...Canada by assets under administration and trade volume. In Europe, TD Direct Investing provides multi-currency and multi-exchange online direct investing services for retail investors, and custody and clearing services for corporate clients. This business has a leading market share, is ranked number... -

Page 32

... Commercial Banking offers a full range of banking services to nearly 8 million customers including individuals, businesses, and governments. $1,128 Reported $1,422 Adjusted 67.3% Reported (percent) 60.2% Adjusted NET INCOME (millions of Canadian dollars) EFFICIENCY RATIO $1,600 80% 1,200... -

Page 33

.... Return on invested capital, which was used as the return measure in prior periods, has not been restated to return on common equity. Margin on average earning assets exclude the impact related to the TD Ameritrade insured deposit accounts (IDA). TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT... -

Page 34

... drive long-term competitiveness. • Broaden and deepen customer relationships through cross-selling initiatives. • Select asset purchases to optimize the balance sheet (i.e., announcement of agreement to acquire Target's U.S. credit card portfolio). 32 TD BANK GROUP ANNUAL REPORT 2012 MANAGE... -

Page 35

...0 11 12 0 11 12 0 11 12 TA B L E 22 REVENUE 2012 2011 (millions of Canadian dollars) Investment banking and capital markets Corporate banking Equity investments Total $ 1,987 448 219 $ 2,654 $ 1,724 453 319 $ 2,496 TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT'S DISCUSSION AN D ANALYSIS 33 -

Page 36

...now be return on common equity rather than return on invested capital. These changes have been applied prospectively. Return on invested capital, which was used as the return measure in prior periods, has not been restated to return on common equity. 34 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT... -

Page 37

...to the prior year. Partially offsetting these increases were lower foreign exchange revenue, decreased equity underwriting and decreased commission revenue. Corporate Banking • Corporate banking revenue which includes corporate lending, trade ï¬nance and cash management services was $448 million... -

Page 38

...ï¬ed available-for-sale securities portfolio Fair value of credit default swaps hedging the corporate loan book, net of provision for credit losses Integration charges, direct transaction costs, and changes in fair value of contingent consideration relating to the Chrysler Financial acquisition... -

Page 39

...) for insurance claims11 General allowance release (increase) in Canadian Personal and Commercial Banking and Wholesale Banking12 Agreement with Canada Revenue Agency13 Integration charges relating to the Chrysler Financial acquisition14 Total adjustments for items of note Net income available to... -

Page 40

... for credit losses Income taxes due to changes in statutory income tax rates Insurance claims General allowance increase (release) in Canadian Personal and Commercial Banking and Wholesale Banking Agreement with Canada Revenue Agency Integration charges relating to Chrysler Financial acquisition... -

Page 41

...) in U.S. Personal and Commercial Banking decreased by $2 billion due to the translation effect of a stronger Canadian dollar. Other assets increased by $7 billion primarily due to an increase in the market value of derivatives in Wholesale Banking. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT... -

Page 42

... earnings growth and higher common share capital due to additional common share issuances through the dividend reinvestment plan and the exercise of stock options. TA B L E 29 SELECTED CONSOLIDATED BALANCE SHEET ITEMS October 31 October 31 2012 2011 (millions of Canadian dollars) Trading loans... -

Page 43

...for loan losses increased by $330 million to $2,644 million in 2012. LOAN PORTFOLIO Overall in 2012, the Bank's credit quality remained stable despite uncertain economic conditions, due to established business and risk management strategies and a continuing low interest rate environment. During 2012... -

Page 44

... allowances Percentage change over previous year - loans and acceptances, net of allowance 1 2 Based on geographic location of unit responsible for recording revenue. Includes all FDIC covered loans and other acquired credit-impaired loans. TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT'S DISCUSSION... -

Page 45

...(millions of Canadian dollars, except as noted) 2011 Percentage of total 2012 2011 Gross loans Net loans Net loans Canada Atlantic provinces British Columbia2 Ontario2 Prairies2 Québec Total Canada United States Carolinas (North and South) Florida New England3 New Jersey New York Pennsylvania... -

Page 46

... Financial Statements. Excludes debt securities classified as loans. For additional information refer to the "Exposure to Non-agency Collateralized Mortgage Obligations" section of this document and Note 7 to the 2012 Consolidated Financial Statements. 44 TD BANK GROUP ANNUAL REPORT 2012 MANAGE... -

Page 47

... at October 31, 2012 (October 31, 2011 - $14 million) and amortized cost of nil at October 31, 2012 (October 31, 2011 - $5 million). No allowance is recorded for trading loans or loans designated at fair value through profit or loss. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT'S DISCUSSION AN... -

Page 48

... Net impaired loans (millions of Canadian dollars, except as noted) 2011 Net impaired loans 2012 2011 Canada Atlantic provinces British Columbia3 Ontario3 Prairies3 Québec Total Canada4 United States Carolinas (North and South) Florida New England5 New Jersey New York Pennsylvania Other... -

Page 49

... Jersey and New York, representing 6% and 5% of total counterparty-speciï¬c provisions, compared to 8% and 4% respectively in 2011. Table 36 provides a summary of provisions charged to the Consolidated Statement of Income. TA B L E 36 PROVISION FOR CREDIT LOSSES1 2012 2011 (millions of Canadian... -

Page 50

... - $14 million) and amortized cost of nil at October 31, 2012 (October 31, 2011 - $5 million). No allowance is recorded for trading loans or loans designated at fair value through profit or loss. Includes all FDIC covered loans and other ACI loans. 48 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT... -

Page 51

... FOR CREDIT LOSSES BY GEOGRAPHY 1 (millions of Canadian dollars, except as noted) 2012 2011 Percentage of total 2012 2011 Canada Atlantic provinces British Columbia2 Ontario2 Prairies2 Québec Total Canada3 United States Carolinas (North and South) Florida New England4 New Jersey New York... -

Page 52

...) of protection the Bank purchased via credit default swaps. Other European exposure is distributed across 11 countries, each of which has a net exposure below $1.0 billion as at October 31, 2012 and October 31, 2011. 50 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT'S DISCUSSION AN D ANALYSIS -

Page 53

... to a Special Purpose Vehicle that has been in run-off since 2008; and $20 million invested in European diversiï¬ed investment funds. As part of the Bank's usual credit risk and exposure monitoring processes, all exposures are reviewed on a regular basis. European exposures are reviewed monthly or... -

Page 54

... contractual amount owed net of charge-offs since inception of loan. Other includes the ACI loan portfolios of Chrysler Financial and MBNA Canada. During the year ended October 31, 2012, the Bank recorded $114 million of provision for credit losses on ACI loans. The following table provides key... -

Page 55

...no ï¬nancial statement impact. The Bank's assessment of impairment for these reclassiï¬ed securities is not impacted by a change in the credit ratings. TA B L E 43 NON-AGENCY ALT-A AND PRIME JUMBO CMO PORTFOLIO BY VINTAGE YEAR October 31, 2012 Alt-A Amortized cost Fair value Amortized cost Prime... -

Page 56

... CONDITION Capital Position TA B L E 44 CAPITAL STRUCTURE AND RATIOS 1 (millions of Canadian dollars, except as noted) 2012 Basel II 2011 Basel II Tier 1 capital Common shares Contributed surplus Retained earnings Fair value (gain) loss arising from changes in the institution's own credit... -

Page 57

... 2 capital. Tier 2 Capital Subsequent to year-end, on November 1, 2012, the Bank redeemed $2.5 billion of subordinated debentures, which qualiï¬ed as Tier 2 regulatory capital. See Note 17 to the Bank's Consolidated Financial Statements for more details. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE... -

Page 58

... reasons: the Basel 2.5 changes related to market risk amendment, closing of the MBNA acquisition in the ï¬rst quarter of 2012, and organic growth in the retail and commercial businesses in both Canada and the U.S. 56 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT'S DISCUSSION AN D ANALYSIS -

Page 59

...amount of TD Capital Trust IV Notes - Series 2 issued and outstanding. TD's expectation is subject to a number of risk factors and assumptions outlined in the Bank's February 7, 2011 press release, which is available on the Bank's website at www.td.com. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT... -

Page 60

... loans, automobile loans, credit card loans, and business and government loans to enhance its liquidity position, to diversify sources of funding and to optimize the management of the balance sheet. Certain automobile loans acquired by the Bank as part of the acquisition of Chrysler Financial... -

Page 61

... sold with recourse, credit enhancements, written options, and indemniï¬cation agreements. Certain guarantees remain offbalance sheet. See Note 30 to the Consolidated Financial Statements for further information regarding the accounting for guarantees. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT... -

Page 62

...CLOSE FAMILY MEMBERS AND THEIR RELATED ENTITIES October 31 October 31 2012 2011 (millions of Canadian dollars) Personal loans, including mortgages Business loans Total 6 201 $ 207 $ $ 12 195 $ 207 In addition, the Bank offers deferred share and other plans to non-employee directors, executives... -

Page 63

..., the Bank's earnings are signiï¬cantly affected by the general business and economic conditions in these regions. These conditions include short-term and long-term interest rates, inï¬,ation, ï¬,uctuations in the debt and capital markets, consumer debt levels, government spending, exchange rates... -

Page 64

... signiï¬cant systems changes, less ï¬,exible trading options, higher capital requirements, more stringent regulatory requirements along with some potential beneï¬ts as a result of reduced risk through central counterparty clearing. 62 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT'S DISCUSSION AN... -

Page 65

... and reduce access to capital markets. A lowering of credit ratings may also affect the Bank's ability to enter into normal course derivative or hedging transactions and impact the costs associated with such transactions. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT'S DISCUSSION AN D ANALYSIS 63 -

Page 66

... basis by management, and escalated to senior management and at the Board level, as required. TD measures management's performance against its risk appetite metrics; this is used as a key input into the compensation decision process. 64 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT'S DISCUSSION... -

Page 67

... Risk Committee (RRC) Governance, Risk and Control Groups Business Segments Internal Audit Canadian Banking, Auto Finance and Credit cards Wealth and Insurance U.S. Personal and Commercial Banking Wholesale Banking Internal Audit The Board The Board oversees TD's strategic direction and the... -

Page 68

...) group manages, directs and reports on TD's capital and investment positions, interest rate risk, and liquidity and funding risk and the market risks of TD's non-trading bank activities. The Risk Management function oversees TBSM's capital and investment activities. Three Lines of Defence In order... -

Page 69

... the Internal Capital Adequacy Assessment Process (ICAAP) and related economic capital practices. At TD, performance is measured based on the allocation of risk-based capital to businesses and the cost charged against that capital. Risk Monitoring and Reporting TD monitors and reports on risk levels... -

Page 70

...credit risk models are monitored on an ongoing basis. Unanticipated economic or political changes in a foreign country could affect cross-border payments for goods and services, loans, dividends, trade-related ï¬nance, as well as repatriation of TD's capital in that country. TD currently has credit... -

Page 71

... We use external credit ratings assigned by one or more of Moody's Investors Service, Standard & Poor's, and Fitch to determine the appropriate risk weight for our exposures to Sovereigns (governments, central banks and certain public sector entities) and Banks (regulated deposit-taking institutions... -

Page 72

... as collateral, seniority ranking of debt, and loan structure. Internal risk ratings are key to portfolio monitoring and management and are used to set exposure limits and loan pricing. Internal risk ratings are also used in the calculation of regulatory capital, economic capital, and incurred but... -

Page 73

... to conduct a review of the market risk proï¬le and trading results of our trading businesses, recommend changes to risk policies, review underwriting inventories, and review the usage of capital and assets in Wholesale Banking. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT'S DISCUSSION AN... -

Page 74

... changes in market rates and prices could have on the value of a portfolio over a speciï¬ed period of time. At the end of each day, risk positions are compared with risk limits, and any excesses are reported in accordance with established market risk policies and procedures. Calculating VaR TD... -

Page 75

... interest rate changes, and on the size and maturity of the mismatched positions. It is also affected by new business volumes, renewals of loans or deposits, and how actively customers exercise options, such as prepaying a loan before its maturity date. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT... -

Page 76

...non-rate sensitive deposits being invested in a shorter term maturity proï¬le. This is consistent with net interest income management strategies overseen by ALCO. Reported EaR remains consistent with the Bank's risk appetite and within established board limits. 74 TD BANK GROUP ANNUAL REPORT 2012... -

Page 77

... the Enterprise Investment Policy that sets out limits for TD's own portfolio. WHY MARGINS ON AVERAGE EARNING ASSETS FLUCTUATE OVER TIME As explained above, the objective of our approach to asset/liability management is to lock in margins on ï¬xed-rate loans and deposits as they are booked. It also... -

Page 78

... down" of available committed lines of credit to personal, commercial and corporate lending customers; • Increased collateral requirements associated with downgrades in TD's senior long-term debt credit rating and adverse movement in reference rates for all derivative contracts; • Coverage of... -

Page 79

... Management and Insurance subsidiaries are not included in the liquid-asset position of the Canadian Personal and Commercial Banking segment due to regulatory restrictions involving the investment of such funds with the Toronto-Dominion Bank (Parent). For the year ended October 31, 2012, our average... -

Page 80

... is responsible for meeting all TD long-term funding needs related to mortgage or loan asset growth, corporate investment needs or subsidiary capital requirements. TA B L E 59 LONG TERM FUNDING SOURCES 2012 2011 (billions of Canadian dollars) Assets securitized Covered bonds1 Senior unsecured... -

Page 81

...such as credit, market and liquidity risk. We must mitigate and manage operational risk so that we can create and sustain shareholder value, successfully execute our business strategies, operate efï¬ciently and provide reliable, secure and TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT'S DISCUSSION... -

Page 82

... structure to manage insurance risk and includes risk appetite, policies, processes as well as limits and governance. The Insurance Risk Management Framework is maintained by Risk Management and supports alignment with TD's risk appetite for insurance risk. 80 TD BANK GROUP ANNUAL REPORT 2012... -

Page 83

... for effective and prudent management of the Bank's capital position and supports maintenance of adequate capital. It oversees the allocation of capital limits for business segments and reviews adherence to capital limits and targets. TD BANK GROUP ANNUAL REPOR T 2012 MANAGE MENT'S DISCUSSION AN... -

Page 84

... that new and existing business activities, transactions, products or sales practices that are referred to it are reviewed at a sufï¬ciently broad and senior level so that the associated reputational risk issues are fully considered. 82 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT'S DISCUSSION... -

Page 85

... tonne/employee by 2015. In 2012, TD made a voluntary commitment to reduce our North American paper usage by 20% by 2015 (relative to a 2010 baseline). During 2012, TD applied our Environmental and Social Credit Risk Management Procedures to credit and lending in the wholesale, commercial and retail... -

Page 86

... and intangibles). Any unallocated capital not directly attributable to the CGUs is held within the Corporate segment. TD's capital oversight committees provide oversight to the Bank's capital allocation methodologies. 84 TD BANK GROUP ANNUAL REPORT 2012 MANAGE MENT'S DISCUSSION AN D ANALYSIS -

Page 87

... long-term return on plan assets, compensation increases, health care cost trend rate, and discount rate are management's best estimates and are reviewed annually with the Bank's actuaries. The Bank develops each assumption using relevant historical experience of the Bank in conjunction with market... -

Page 88

...has also audited the Consolidated Financial Statements of the Bank as of and for the year ended October 31, 2012. Their Report on Internal Controls under Standards of the Public Company Accounting Oversight Board (United States), included in the Consolidated Financial Statements expresses an unquali... -

Page 89

...and our report dated December 5, 2012 expressed an unqualiï¬ed opinion on The Toronto-Dominion Bank's internal control over ï¬nancial reporting. Ernst & Young LLP Chartered Accountants Licensed Public Accountants Toronto, Canada December 5, 2012 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS... -

Page 90

... two-year period ended October 31, 2012 of The Toronto-Dominion Bank and our report dated December 5, 2012 expressed an unqualiï¬ed opinion thereon. Ernst & Young LLP Chartered Accountants Licensed Public Accountants Toronto, Canada December 5, 2012 88 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL... -

Page 91

... October 31 2012 October 31 2011 As at November 1 2010 ASSETS Cash and due from banks Interest-bearing deposits with banks Trading loans, securities, and other (Note 5) Derivatives (Notes 5, 10) Financial assets designated at fair value through proï¬t or loss (Note 5) Available-for-sale securities... -

Page 92

... Statement of Income For the years ended October 31 (millions of Canadian dollars, except as noted) 2012 2011 Interest income Loans Securities Interest Dividends Deposits with banks ` Interest expense Deposits Securitization liabilities Subordinated notes and debentures Preferred shares and capital... -

Page 93

Consolidated Statement of Changes in Equity For the years ended October 31 (millions of Canadian dollars) 2012 2011 Common shares (Note 21) Balance at beginning of year Proceeds from shares issued on exercise of stock options Shares issued as a result of dividend reinvestment plan Proceeds from ... -

Page 94

...- income tax provision of $304 million). All items presented in other comprehensive income will be reclassified to the Consolidated Statement of Income in subsequent periods. The accompanying Notes are an integral part of these Consolidated Financial Statements. 92 TD BANK GROUP ANNUAL REPORT 2012... -

Page 95

...) from available-for-sale securities (Note 6) Equity in net income of an investment in associate (Note 35) Deferred taxes (Note 26) Changes in operating assets and liabilities Interest receivable and payable (Notes 14, 16) Securities sold short Trading loans and securities Loans Deposits Derivatives... -

Page 96

... Judgments, Estimates and Assumptions Current and Future Changes in Accounting Policies Fair Value of Financial Instruments Securities Loans, Impaired Loans and Allowance for Credit Losses Transfers of Financial Assets Special Purpose Entities Derivatives Acquisitions Goodwill and Other Intangibles... -

Page 97

... the current year. The Consolidated Financial Statements were prepared under a historical cost basis, except for certain items carried at fair value as discussed below. NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES •฀ T ฀ he activities of the SPE are being conducted on the Bank's behalf... -

Page 98

... at fair value, obligations related to securities sold short, and physical commodities, as well as certain ï¬nancing-type commodities transactions that are recorded on 96 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS the Consolidated Balance Sheet as securities purchased under reverse... -

Page 99

... of an active market for that ï¬nancial asset. Acquired credit-impaired (ACI) loans are reported separately from impaired loans as they exhibited indications of impairment at the date of acquisition and are accounted for based on present value of expected cash ï¬,ows on the date of acquisition and... -

Page 100

... at fair value. Guarantees that are considered derivatives are a type of credit derivative which are over-the-counter (OTC) contracts designed to transfer the credit risk in an underlying ï¬nancial instrument from one counterparty to another. 98 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 101

... interest rate, foreign exchange, equity, commodity and credit derivative contracts. The Bank uses these instruments for trading and non-trading purposes to manage the risks associated with its funding and investment strategies. Derivatives are carried at their fair value on the Consolidated Balance... -

Page 102

... expected cash ï¬,ows using management's best estimates of key assumptions that market participants would use in determining fair value. Refer to Note 3 for assumptions used by management in determining the fair value of retained interests. 100 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 103

... increase to the carrying amount of the asset. The asset is depreciated on a straight-line basis over its remaining useful life while the liability is accreted to reï¬,ect the passage of time until the eventual settlement of the obligation. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS... -

Page 104

... management's best estimates of expected long-term return on plan assets, compensation increases, health care cost trend rate, and discount rate, which are reviewed annually with the Bank's actuaries. The expense recognized includes the cost of beneï¬ts for employee service provided in the current... -

Page 105

... exchange rates, and option volatilities. Valuation techniques include comparisons with similar instruments where observable market prices exist, discounted cash ï¬,ow analysis, option pricing models, and other valuation techniques commonly used by market participants. TD BANK GROUP ANNUAL REPORT... -

Page 106

... long-term return on plan assets, compensation increases, health care cost trend rate, and discount rate are management's best estimates and are reviewed annually with the Bank's actuaries. The Bank develops each assumption using relevant historical experience of the Bank in conjunction with market... -

Page 107

... the Bank as at October 31, 2012 on a prospective basis. FUTURE CHANGES IN ACCOUNTING POLICIES The following standards have been issued, but are not yet effective on the date of issuance of the Bank's Consolidated Financial Statements. The Bank is currently assessing the impact of the application of... -

Page 108

... evidence or by using a valuation technique that maximizes the use of observable market inputs. If quoted prices in active markets subsequently become available, these are used to determine fair value for debt securities classiï¬ed as loans. 106 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 109

... to the amount payable on the balance sheet date. For trading deposits, fair value is determined using discounted cash ï¬,ow valuation techniques which maximize the use of observable market inputs such as benchmark yield curves and foreign exchange rates. The Bank considers the impact of its own... -

Page 110

... Financial Assets and Liabilities (millions of Canadian dollars) October 31, 2012 Carrying value Fair value Carrying value October 31, 2011 Fair value FINANCIAL ASSETS Cash and due from banks Interest-bearing deposits with banks Trading loans, securities, and other Government and government-related... -

Page 111

... value of Level 3 assets and liabilities is determined using valuation models, discounted cash ï¬,ow methodologies, or similar techniques. This category generally includes retained interests in certain loan securitizations and certain derivative contracts. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL... -

Page 112

... shares Trading loans Commodities Retained interests Derivatives Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts Commodity contracts Financial assets designated at fair value through proï¬t or loss Securities Loans Available-for-sale securities1 Government... -

Page 113

... shares Trading loans Commodities Retained interests Derivatives Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts Commodity contracts Financial assets designated at fair value through proï¬t or loss Securities Loans Available-for-sale securities1 Government... -

Page 114

...Included in OCI Purchases Issuances Other2 Into Level 3 Out of Level 3 FINANCIAL LIABILITIES Trading deposits Derivatives4 Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts Commodity contracts Other ï¬nancial liabilities designated at fair value through pro... -

Page 115

... in OCI Purchases Issuances Other2 Into Level 3 Out of Level 3 Change in unrealized Fair value (gains) as at losses on Oct. 31, instruments 2011 still held3 FINANCIAL LIABILITIES Trading deposits Derivatives4 Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts... -

Page 116

... initial recognition. (millions of Canadian dollars) 2012 2011 Balance as at beginning of year New transactions Recognized in the Consolidated Statement of Income during the year Balance as at end of year $ 35 34 (21) $ 48 $ 15 26 (6) $ 35 114 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 117

...ed debt securities with a fair value of $789 million (October 31, 2011 - $2,162 million) were sold or matured, and $23 million after tax (October 31, 2011 - $69 million after tax) was recorded in net gains from available-for-sale securities. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 115 -

Page 118

... agencies debt Other OECD government-guaranteed debt Mortgage-backed securities Other debt securities Canadian issuers Other issuers Equity securities Common shares Preferred shares Retained interests Total trading securities Available-for-sale securities Government and government-related securities... -

Page 119

... agencies debt Other OECD government-guaranteed debt Mortgage-backed securities Other debt securities Canadian issuers Other issuers Equity securities Common shares Preferred shares Retained interests Total trading securities Available-for-sale securities Government and government-related securities... -

Page 120

... value of government and government-insured TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 3 securities, as at October 31, 2012, of nil (October 31, 2011 - nil and November 1, 2010 - $18 million). As at October 31, 2012, certain available-for-sale securities with a carrying value of $5 million... -

Page 121

...(23) $ 393 None of the write-downs for the year ended October 31, 2012, (2011 - nil) related to debt securities in the reclassified portfolio as described in "Reclassification of Certain Debt Securities - Trading to Available-for-Sale" above. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 119 -

Page 122

... realizable value of the collateral exceeded the loan amount. Includes Canadian government-insured real estate personal loans of $30,241 million as at October 31, 2012 (October 31, 2011 - $32,767 million; November 1, 2010 - $33,583 million). 120 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 123

... Bank's impaired loans. Impaired Loans1 (millions of Canadian dollars) Unpaid principal balance2 October 31, 2012 Related allowance for credit losses Average gross impaired loans Carrying value Residential mortgages Consumer instalment and other personal Credit card Business and government Total... -

Page 124

...of the accounting for FDIC covered loans. For additional information, see "FDIC Covered Loans" section in this Note. The allowance for credit losses for off-balance sheet instruments is recorded in provisions on the Consolidated Balance Sheet. 122 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 125

...of the accounting for FDIC covered loans. For additional information, see "FDIC Covered Loans" section in this Note. The allowance for credit losses for off-balance sheet instruments is recorded in provisions on the Consolidated Balance Sheet. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 123 -

Page 126

... classiï¬ed as loans as subsequent to any recorded impairment, interest income continues to be recognized using the effective interest rate which was used to discount the future cash ï¬,ows for the purpose of measuring the credit loss. 124 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 127

... transaction costs incurred are also capitalized and amortized using the effective interest rate method. In addition, the Bank transfers ï¬nancial assets to certain consolidated special purposes entities. Further details are provided in Note 9. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS... -

Page 128

...classiï¬ed as trading securities and are subsequently carried at fair value with the changes in fair value recorded in trading income. For the year ended October 31, 2012, the trading income recognized on the retained interest was $2 million. 126 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 129

...1, 2010 - $1.8 billion) in liquidity facilities for ABCP that could potentially be issued by the conduits. As at October 31, 2012, the Bank also provided no deal-speciï¬c credit enhancement (October 31, 2011 - $17 million; November 1, 2010 - $73 million). TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL... -

Page 130

... standard currency amounts with standard settlement dates and are transacted on an exchange. Credit Derivatives The Bank uses credit derivatives such as credit default swaps (CDS) and total return swaps in managing risks of the Bank's corporate loan portfolio and other cash instruments. Credit risk... -

Page 131

...1,164 1,164 $ 10,267 $ 51,470 871 871 $ 7,233 $ 52,552 The average fair value of trading derivatives for the year ended October 31, 2011 was: positive $49,699 million and negative $52,168 million. Averages are calculated on a monthly basis. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 129 -

Page 132

... rate contracts Foreign exchange contracts Forward contracts Cross-currency interest rate swaps Total foreign exchange contracts Credit derivatives Credit default swaps - protection purchased Total credit derivatives Other contracts Equity contracts Total other contracts Fair value - non-trading... -

Page 133

... of derivatives designated in hedge accounting relationships and the related hedged items, where appropriate, in the Consolidated Statement of Income and in other comprehensive income for the years ended October 31, 2012 and October 31, 2011. Fair Value Hedges (millions of Canadian dollars) Amounts... -

Page 134

... the Consolidated Statement of Other Comprehensive Income on related non-derivative instruments. Gains (Losses) on Non-Trading Derivatives not Designated in Qualifying Hedge Accounting Relationships1 (millions of Canadian dollars) 2012 2011 Interest rate contracts Foreign exchange contracts Credit... -

Page 135

... DERIVATIVE-RELATED RISKS Market Risk Derivatives, in the absence of any compensating upfront cash payments, generally have no market value at inception. They obtain value, positive or negative, as relevant interest rates, foreign exchange rates, equity, commodity or credit prices or indices change... -

Page 136

... derivative contracts are governed by master derivative agreements having credit support provisions that permit the Bank's counterparties to call for collateral depending on the net mark-to-market exposure position of all derivative contracts governed 134 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL... -

Page 137

...the Bank its South Financial preferred stock and the associated warrant acquired under the Treasury's Capital Purchase Program and discharged all accrued but unpaid dividends on that stock for total cash consideration of approximately $134 million. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS... -

Page 138

... of Chrysler Financial, Riverside, First Federal, AmericanFirst and South Financial. Primarily relates to goodwill arising from the acquisition of MBNA Canada of $93 million. See Note 11 for further details. Relates to the divestiture of our U.S. insurance business. 136 TD BANK GROUP ANNUAL REPORT... -

Page 139

... Group of CGUs (millions of Canadian dollars) October 31 2012 Carrying amount 2012 Discount rate1 October 31 2011 Carrying amount 2011 Discount rate1 November 1 2010 Carrying amount Canadian Personal and Commercial Banking Canadian Banking Wealth and Insurance2 Wealth3 Global Insurance Wholesale TD... -

Page 140

... 1, 2010 - $98 billion). Certain deposit liabilities are classiï¬ed as "Trading deposits" within the Consolidated Balance Sheet and accounted for at fair value with the change in fair value recognized in the Consolidated Statement of Income. 138 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 141

... (millions of Canadian dollars) October 31 2012 October 31 2011 November 1 2010 Amounts payable to brokers, dealers and clients Accounts payable, accrued expenses and other items Special purpose entity liabilities Insurance-related liabilities Accrued interest Accrued salaries and employee bene... -

Page 142

.... Preferred shares that are not mandatorily redeemable or that are not convertible into a variable number of the Bank's common shares at the holder's option, are not classiï¬ed as liabilities and are presented in Note 21, Share Capital. 140 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 143

... A real estate investment trust, Carolina First Mortgage Loan Trust (Carolina First REIT), a subsidiary of TD Bank, N.A., issued the Series 2000A Cumulative Fixed Rate Preferred Shares (Series 2000A shares). The Series 2000A shares are entitled to quarterly cumulative cash dividends, if declared... -

Page 144

... 1 2010 REIT preferred stock, Series A TD Capital Trust III Securities - Series 20081 Other Total 1 491 981 5 $ 1,477 $ 490 987 6 $ 1,483 $ 501 986 6 $ 1,493 $ Refer to Note 19 for a description of the TD Capital Trust III securities. 142 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 145

... Preferred Capital Corporation (Northgroup REIT), a subsidiary of TD Bank, N.A., issued 500,000 shares of Fixed-to-Floating Rate Exchangeable Non-Cumulative Perpetual Preferred Stock, Series A (Series A shares). Each Series A share is entitled to semi-annual non-cumulative cash dividends, if... -

Page 146

... 31, 2014, and on July 31 every ï¬ve years thereafter and vice versa. The Series AI shares are redeemable by the Bank for cash, subject to regulatory consent, at $25.00 per share on July 31, 2014 and on July 31 every ï¬ve years thereafter. 144 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 147

... of the plan, cash dividends on common shares are used to purchase additional common shares. At the option of the Bank, the common shares may be issued from the Bank's treasury at an average market price based on the last ï¬ve trading days before the date of the dividend payment, with a discount of... -

Page 148

.... Claims liabilities are calculated in accordance with the Bank's insurance Insurance Revenue, Net of Claims and Related Expenses (millions of Canadian dollars) accounting policy. See Note 2 to the Bank's Consolidated Financial Statements for further details. Sound product design is an essential... -

Page 149

... including claims handling costs, average claims by accident year, and trends in claims severity and frequency and other factors such as inï¬,ation, expected or in force government pricing and coverage reforms and the level of insurance fraud. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 147 -

Page 150

... 31, 2011 - 2.3 million; November 1, 2010 - 4.0 million). The outstanding options expire on various dates to December 12, 2021. A summary of the Bank's stock option activity and related information for the years ended October 31 is as follows: 148 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 151

...million). Compensation expense for these plans is recorded in the year the incentive award is earned by the plan participant. Changes in the value of these plans are recorded, net of the effects of related hedges, in the Consolidated Statement of Income. For the year ended October 31, 2012, the Bank... -

Page 152

... service and management's best estimates of expected long-term return on plan assets, compensation increases, health care cost trend rate and discount rate, which are reviewed annually by the Bank's actuaries. The discount rate used to value liabilities is based on long-term corporate AA bond yields... -

Page 153

... coverage and life insurance beneï¬ts to certain employees who meet minimum age and service requirements. Supplemental Employee Retirement Plans Supplemental employee retirement plans are partially funded by the Bank for eligible employees. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 151 -

Page 154

... and no service credits can be earned after March 31, 2012. 3 Primarily relates to the change in discount rate from 2011 to 2012. 4 Certain TD Auto Finance retirement plans were curtailed during the period. 5 The actual return on plan assets for the principal pension plans was $273 million for the... -

Page 155

...plans to the discount rate, the expected long-term return on plan assets and the rates of compensation, as well as the sensitivity of Sensitivity of Key Assumptions (millions of Canadian dollars, except as noted) the Bank's principal non-pension post-retirement beneï¬t plan to the health care cost... -

Page 156

... Provincial tax rate changes Other - net Provision for income taxes and effective income tax rate $ 1,938 (262) (481) (18) (85) $ 1,092 26.4% (3.6) (6.6) (0.2) (1.1) 14.9% $ 2,005 (214) (468) - 3 $ 1,326 28.1% (3.0) (6.6) - 0.1 18.6% 154 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 157

... 31, 2012 (October 31, 2011 - $12 million; November 1, 2010 - $192 million). The movement in the net deferred tax asset for the years ended October 31, 2012 and October 31, 2011 was as follows: Deferred Income Tax Expense (Recovery) (millions of Canadian dollars) Consolidated Statement of Income... -

Page 158

... charges and direct transaction costs relating to the acquisition of the MBNA Canada credit card portfolio are reported in the CAD P&C segment. Executive responsibilities for the TD Insurance business were moved from Group Head, Canadian Banking, Auto Finance, and Credit Cards, to the Group... -

Page 159

... operational decisions. The Bank's related parties include key management personnel, their close family members and their related entities, subsidiaries, associates, joint ventures, and post-employment beneï¬t plans for the Bank's employees. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 157 -

Page 160

..., which are subject to approved policy guidelines that govern all employees. Loans to Key Management Personnel, their Close Family Members and their Related Entities (millions of Canadian dollars) October 31 October 31 2012 2011 Transactions between the Bank, TD Ameritrade and Symcor also qualify... -

Page 161

... for March 7, 2013. A pro se class action complaint was ï¬led by plaintiff Hackney in federal court in PA against the Bank on October 23, 2012 relating to overdraft fees and deceptive advertising allegations. The Bank has not yet responded. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 159 -

Page 162

... make funds available for the ï¬nancing needs of customers. The Bank's policy for requiring collateral security with Credit Instruments (millions of Canadian dollars) respect to these contracts and the types of collateral security held is generally the same as for loans made by the Bank. Financial... -

Page 163

... hedge foreign exchange, equity, credit, commodity and interest rate risks. The Bank does not track, for accounting purposes, whether its clients enter into these derivative contracts for trading or hedging purposes and has not determined if the guaranteed party has the asset or liability related to... -

Page 164

...oating rate category. The Bank's risk management policies and procedures relating to credit, market, and liquidity risks as required under IFRS 7 are outlined in the shaded sections of the "Managing Risk" section of the MD&A in this report. October 31, 2012 Within 3 months 3 months to 1 year Total... -

Page 165

...of Canadian dollars, except as noted) Floating rate Within 3 months 3 months to 1 year Total within 1 year Over 1 year to 5 years Over 5 years October 31, 2011 Noninterest sensitive Total Assets Cash resources and other Effective yield Trading loans, securities, and other Effective yield Financial... -

Page 166

... Credit Risk (millions of Canadian dollars, except as noted) Loans and customers' liability under acceptances1 October 31 2012 October 31 2011 November 1 2010 October 31 2012 affected by changing economic, political or other conditions. The Bank's portfolio could be sensitive to changing conditions... -

Page 167

... Credit Risk Exposure (millions of Canadian dollars) October 31 2012 October 31 2011 November 1 2010 Cash and due from banks Interest-bearing deposits with banks Securities1 Trading Government and government-insured securities Other debt securities Retained interest Available-for-sale Government... -

Page 168

Financial Assets Subject to the Standardized Approach by Risk-Weights (millions of Canadian dollars) October 31, 2012 0% Loans Residential mortgages Consumer instalment and other personal Credit card Business and government Debt securities classiï¬ed as loans Total loans Securities purchased under... -

Page 169

... Housing Corporation (CMHC) insured exposures classified as sovereign exposure under Basel II and therefore included in the non-retail category under the AIRB approach. Other assets include amounts due from banks and interest-bearing deposits with banks. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL... -

Page 170

... portfolio include small business loans. N O T E 33 REGULATORY CAPITAL The Bank manages its capital under guidelines established by OSFI. The regulatory capital guidelines measure capital in relation to credit, market and operational risks. The Bank has various capital policies, procedures and... -

Page 171

... contingent liabilities to which the Bank is exposed. During the year ended October 31, 2012, TD Ameritrade did not experience any signiï¬cant restrictions to transfer funds in the form of cash dividends, or repayment of loans or advances. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 169 -

Page 172

... value of the Bank's investment in TD Ameritrade and the Bank's share of TD Ameritrade's stockholders' equity is comprised of goodwill, intangibles and the cumulative translation adjustment. Condensed Consolidated Statement of Income (millions of Canadian dollars) September 30 2012 September... -

Page 173

...Dealer Investment Counselling and Portfolio Management Holding Company Holding Company Securities Dealer Financial Services Entity Financial Services Entity Small Business Investment Company International Online Brokerage Services Dutch Bank Holding Company Securities Dealer Holding Company Discount... -

Page 174

..., commercial real estate leasing and closed-end funds. The Bank's involvement includes transferring assets to the entities, entering into derivative contracts with them, providing credit enhancement and liquidity facilities, providing investment management and administrative services, and holding... -

Page 175

... Bank manages it's exposure to liquidity Current and Non-Current Assets and Liabilities (millions of Canadian dollars) risk. Differences include (but are not limited to) such items as new business volumes, renewals of loans or deposits, and how actively customers exercise options. October 31, 2012... -

Page 176

... dollars) Maturity Within 1 year After 1 Year No Speciï¬c Maturity October 31, 2011 Total Assets Cash and due from banks Interest-bearing deposits with banks Trading loans, securities, and other Derivatives Financial assets designated at fair value through proï¬t or loss Available-for-sale... -

Page 177

.... The Bank prepared its opening IFRS Consolidated Balance Sheet as at November 1, 2010, the date of transition to IFRS which forms the starting point for the Bank's ï¬nancial reporting under IFRS. These Consolidated Financial Statements have been prepared in accordance with the accounting policies... -

Page 178

...Consolidated Balance Sheet for a description of significant measurement and presentation differences between Canadian GAAP and IFRS. Certain comparative amounts have been reclassified to conform to the new IFRS presentation adopted on transition date. 176 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL... -

Page 179

... differences of $2,947 million. As discussed in Note 38.3(f), this adjustment has no resulting net impact on equity. Certain comparative amounts have been reclassified to conform to the new IFRS presentation adopted on transition date. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 177 -

Page 180

...Business combinations Loan origination costs Share-based payments Other Presentation differences: Non-controlling interests in subsidiaries Total effect of transition to IFRS Net income under IFRS $ 5,889 38 70 (19) 16 (13) (40) 52 104 $ 156 $ 6,045 178 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL... -

Page 181

... the practical ability to sell the transferred ï¬nancial asset. Where the Bank has retained control of the ï¬nancial asset, it continues to recognize the ï¬nancial asset to the extent of its continuing involvement in the ï¬nancial asset. TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS 179 -

Page 182

...hedging relationship. The impact to the Bank's IFRS opening Consolidated Balance Sheet as at November 1, 2010 was an increase to accumulated other comprehensive income of $73 million, and a decrease in opening retained earnings of $73 million. 180 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL RESULTS -

Page 183

... to opening retained earnings of $820 million. (ii) Employee Benefits: Other Differences between Canadian GAAP and IFRS Measurement Date Under Canadian GAAP, the deï¬ned beneï¬t obligation and plan assets may be measured up to three months prior to the date of the ï¬nancial statements as long as... -

Page 184

... between Canadian GAAP and IFRS Income tax related adjustments result from differences in accounting for income taxes between Canadian GAAP and IFRS income tax accounting standards as well as the tax impact of all other transitional adjustments. 182 TD BANK GROUP ANNUAL REPORT 2012 FINANCIAL... -

Page 185

... Canadian GAAP and IFRS Other IFRS differences relate primarily to the accounting of foreign exchange for equity method investments and for available-for-sale securities. The total impact to the Bank's opening IFRS equity was a decrease of $34 million, comprised of an increase to retained earnings... -

Page 186

...TD Asset Management Inc. TD Waterhouse Private Investment Counsel Inc. TD Auto Finance (Canada) Inc. TD Auto Finance Services Inc. TD Equipment Finance Canada Inc. TD Financing Services Home Inc. TD Financing Services Inc. TD Investment Services Inc. TD Life Insurance Company TD Mortgage Corporation... -

Page 187

... Bank S.A.3 NatWest Personal Financial Management Limited (50%) NatWest Stockbrokers Limited (50%) TD Bank N.V. TD Ireland TD Global Finance TD Luxembourg International Holdings TD Ameritrade Holding Corporation (45.37%)4 TD Wealth Holdings (UK) Limited TD Direct Investing (Europe) Limited TD... -

Page 188

... terms used by other issuers. For further explanation, see "How the Bank Reports" in the accompanying Management's Discussion and Analysis (MD&A). Includes available-for-sale securities and financial assets designated at fair value through profit or loss. 186 TD BANK GROUP ANNUAL REPORT 2012... -

Page 189

... of income taxes Amortization of intangibles Fair value of derivatives hedging the reclassiï¬ed available-for-sale securities portfolio Integration charges and direct transaction costs relating to U.S. P&C Banking acquisitions Fair value of credit default swaps hedging the corporate loan book, net... -

Page 190

... of income taxes Net income Preferred dividends Net income available to common shareholders $ $ 2011 12,831 8,587 21,418 - 1,465 12,395 7,558 1,508 104 305 6,251 180 6,071 $ $ 2010 11,543 8,020 19,563 - 1,685 11,464 6,414 1,387 106 307 5,228 194 5,034 188 TD BANK GROUP ANNUAL REPORT 2012 TEN-YEAR... -

Page 191

...a reconciliation with reported results. Effective 2008, treasury shares have been reclassified from common and preferred shares and are shown separately. Prior to 2008, the amounts for treasury shares were not resonably determinable. TD BANK GROUP ANNUAL REPORT 2012 TEN-YEAR STATISTICAL REVIEW 189 -

Page 192

... charges relating to U.S. P&C Banking acquisitions Decrease/(Increase) in fair value of credit default swaps hedging the corporate loan book Other tax items2 Provision for (release of) insurance claims General allowance increase (release) in Canadian Personal and Commercial Banking and Wholesale... -

Page 193

... the "Credit Portfolio Quality" section of the 2012 MD&A. 9 Reflects the number of employees on an average full-time equivalent basis. 10 Includes retail bank outlets, private client centre branches, and estate and trust branches. 1 TD BANK GROUP ANNUAL REPORT 2012 TEN-YEAR STATISTICAL REVIEW 191 -

Page 194

... equity cost of capital calculated using the capital asset pricing model. Average Earning Assets: The average carrying value of deposits with banks, loans and securities based on daily balances for the period ending October 31 in each ï¬scal year. Average Invested Capital: Average invested capital... -

Page 195

... funds by contacting the Bank's transfer agent. Dividends will be exchanged into U.S. funds at the Bank of Canada noon rate on the ï¬fth business day after the record date, or as otherwise advised by the Bank. Dividend information for 2012 is available at www.td.com under Investor Relations/Share... -

Page 196

FSC Logo ® The TD logo and other trade-marks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries.