Stein Mart 2015 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2015 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

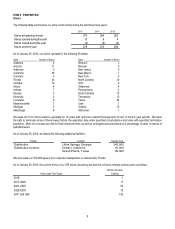

The following table presents cash flows data for fiscal 2015, fiscal 2014 and fiscal 2013 (dollar amounts in thousands):

Cash provided by (used in):

2015 2014 2013

Operating activities 38,412$ 52,431$ 40,066$

Investing activities (44,365)$ (40,342)$ (36,266)$

Financing activities (47,531)$ (13,629)$ (4,179)$

Cash provided by operating activities

Net cash provided by operating activities was $38.4 million for fiscal 2015 compared to net cash provided by operating activities of $52.4

million for fiscal 2014. The decrease in cash provided by operating activities for 2015 as compared to 2014 was primarily due to lower net

income adjusted for other non-cash charges and additional investments in inventory and changes in accounts payable. These decreases

were partially offset by changes in prepaid and accrued expenses, with the latter driven by higher accruals for income taxes.

Cash used in investing activities

Net cash used in investing activities included $44.4 million for capital expenditures. Capital expenditures in 2015 include approximately $22

million for opening and remodeling stores, including upgrades to fitting rooms, lighting, flooring and fixtures. The remaining capital

amounts are primarily for systems improvements. Capital expenditures in 2014 and 2013 include approximately $14 million and $13

million, respectively, for systems improvements, with the largest portion for our new merchandise information system. The remaining

capital amounts in 2014 and 2013 are for opening and remodeling stores.

We expect to invest approximately $43 million in capital expenditures in 2016 with $10 million for continuing information systems upgrades,

$11.8 million for store remodels and $17.4 million for new and relocated stores. Each new store requires capital expenditures of

approximately $0.5 million for fixtures and equipment, $0.7 million for leasehold improvements, $0.2 million for pre-opening expenses

(excluding rent during the pre-opening term) and average $1 million for initial inventory investment (or $0.4 million net of accounts

payable). Leasehold improvements generally are either paid for by the landlord or are reimbursed by the landlord through tenant

improvement allowances and recognized as a reduction of rent on a straight-line basis over the lease term. Rent during the pre-opening

term generally ranges from insignificant to $0.2 million with higher amounts attributable to situations where we have property access during

the period we are managing construction.

Cash used in financing activities

Net cash used in financing activities was $47.5 million for fiscal 2015 compared to cash used in financing activities of $13.6 million for fiscal

2014. During 2015, we had proceeds from borrowings of $673.3 million and repayments of debt for $483.1 million. Borrowings under the

Credit Facilities were initially used to pay a $5 per share special dividend. We paid cash dividends of $239.1 million during 2015. See

Note 8 of the Notes to the Consolidated Financial Statements for further discussion. In addition, we repurchased shares of common stock

for $3.6 million, received proceeds from the exercise of stock options of $1.3 million and received excess tax benefits from share-based

compensation of $3.9 million. During 2014, we paid cash dividends of $12.3 million, repurchased shares of common stock for $4.1 million,

received proceeds from the exercise of stock options of $0.9 million and received excess tax benefits from share-based compensation of

$1.9 million.

We had no capital leases in 2015 or 2014. Capital lease payments were $2.2 million for 2013.

Impact of Inflation

Although we expect that our operations will be influenced by general economic conditions, we do not believe that inflation has had a

material effect on our results of operations. However, there can be no assurance that our business will not be affected by inflation in the

future.

Contractual Obligations

The following table sets forth our contractual obligations at January 30, 2016 (dollar amounts in thousands):

Less than 1 – 2 3 – 5 After 5

Total 1 Year Years Years Years

Operating leases 492,502$ 93,094$ 82,385$ 177,724$ 139,299$

Debt 190,233 10,000 10,833 - 169,400

Total 682,735$ 103,094$ 93,218$ 177,724$ 308,699$

Other long-term liabilities on the balance sheet include the liability for deferred compensation, deferred taxes, postretirement benefit liability

and other long-term liabilities. These items do not have specific due dates, so they are excluded from the preceding table. Our

merchandise purchase orders are cancelable, and are therefore not included in the preceding table.