Stein Mart 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14

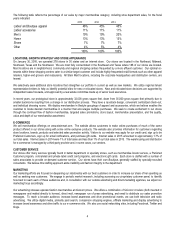

2015 Compared to 2014

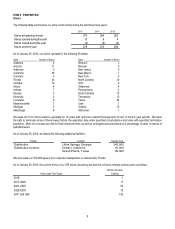

Net Sales. The following table provides net sales for fiscal 2015 compared to fiscal 2014 (dollar amounts in thousands):

2015 2014 Increase

Net sales 1,359,901$ 1,317,677$ 42,224$

Sales percent increase:

Total net sales 3.2%

Comparable store sales 1.0%

The increase in comparable store sales was driven by increases in average units per transaction and average unit retail prices, partially

offset by a decrease in the number of transactions. Comparable store sales reflects stores open throughout the period and prior fiscal year

and includes internet sales. Internet sales contributed approximately 0.7% to the comparable store sales. Comparable store sales does

not include leased department commissions.

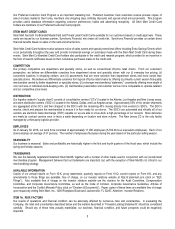

Gross Profit. The following table compares gross profit for fiscal 2015 to fiscal 2014 (dollar amounts in thousands):

2015 2014 Decrease

Gross profit 385,287$ 386,736$ (1,449)$

Percentage of net sales 28.3% 29.3% (1.0)%

The gross profit rate decreased primarily due to higher markdowns incurred during the fourth quarter, which included markdowns on

remaining fall seasonal inventories which were at higher levels at the end of this year compared to last year, due to lower than planned

sales.

Selling, General and Administrative Expenses. The following table compares SG&A for fiscal 2015 to fiscal 2014 (dollar amounts in

thousands):

2015 2014

Increase/

(Decrease)

Selling, general and administrative expenses 343,724$ 342,027$ 1,697$

Percentage of net sales 25.3% 26.0% (0.7)%

SG&A increased $1.7 million primarily as the result of higher store selling expenses of $4.2 million due to new stores and planned payroll

increases, $2.0 million of lower costs capitalized to inventory, $1.2 million of higher advertising expenses, and $1.1 million of higher

ecommerce related expenses. These increases were offset by $4.4 million of lower corporate compensation and benefits, $4.0 million of

lower expenses associated with the SEC investigation as well as higher credit card program income.

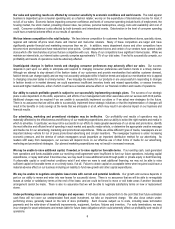

Interest Expense. The following table compares interest expense for fiscal 2015 to fiscal 2014 (dollar amounts in thousands):

2015 2014 Increase

Interest expense 3,283$ 266$ 3,017$

Percentage of net sales 0.2% 0.0% 0.2%

Interest expense increased due to borrowings in 2015 on our Credit Facilities. Borrowings under the Credit Facilities were initially used to

fund part of the $5 per share special dividend.

Income Taxes. The following table compares income tax expense for fiscal 2015 to fiscal 2014 (dollar amounts in thousands):

2015 2014 Decrease

Income tax expense 14,569$ 17,537$ (2,968)$

Effective tax rate ("ETR") 38.1% 39.5% (1.4)%

Our effective tax rate represents the applicable combined federal and state statutory rates reduced by the federal benefit of state taxes

deductible on federal returns, adjusted for the impact of permanent differences. The effective rate is impacted by changes in law, location

of new stores, level of earnings, and the resolution of tax positions with various taxing authorities.