Stein Mart 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Stein Mart annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

four quarterly dividends at $0.075 per share totaling $239.1 million during 2015.

On February 3, 2015, we entered into a $250 million second amended and restated credit agreement with Wells Fargo Bank (the “New

Credit Agreement”) and a $25 million master loan agreement with Wells Fargo Equipment Finance, Inc. (the “Equipment Term Loan” and,

together with the New Credit Agreement, the “Credit Facilities”). The Credit Facilities replaced the Company’s former $100 million senior

secured revolving credit facility.

On February 27, 2015 the Company paid a special cash dividend of $5.00 per common share. The payment made in connection with this

dividend was approximately $226 million, and was funded by existing cash and initial borrowings of $185 million on our $275 million Credit

Facilities.

Direct borrowings on our Credit Facilities were $190.2 million at year end 2015. We had no direct borrowings on our revolving credit

agreement as of January 31, 2015.

2016 Outlook

For 2016, we expect sales increases to leverage against our efficient expense structure to continue driving earnings, particularly as we add

stores.

We expect the following factors to influence our business in 2016:

x Current 2016 plans are to open at least 12 new stores, relocate two stores and close one store, for an increase of at least 11 net

new stores.

x New stores should increase sales an estimated 4% above our comparable store sales increases for the year.

x The gross profit rate is expected to be 50 basis points higher than 2015.

x Selling, general and administrative expenses (“SG&A”) are expected to be approximately $370 million with the increase primarily

due to new stores, higher incentive compensation and planned payroll increases.

x Interest expense is estimated to be about the same as in 2015.

x The effective tax rate for the year is estimated to be approximately 38.5%.

x Capital expenditures for 2016 are expected to be approximately $43 million, or $33 million net of tenant improvement

allowances.

2013 Change in Accounting Estimate

During the fourth quarter of 2013, we refined our estimation of the buying and distribution costs allocated to inventories. This change

lowered the percentage of expenses allocated to inventory purchases. The decrease in the allocation of costs to inventories resulted in a

$5.0 million pretax non-cash charge ($3.1 million after-tax or $0.07 per diluted share), comprised of a $15.0 million increase in SG&A and a

$10.0 million increase in gross profit.

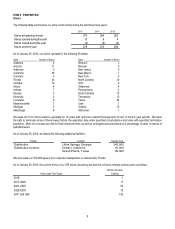

Results of Operations

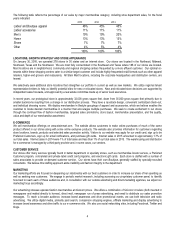

The following table sets forth each line item of the Consolidated Statements of Income expressed as a percentage of net sales:

2015 2014 2013

Net sales 100.0% 100.0% 100.0%

Cost of merchandise sold 71.7% 70.7% 70.9%

Gross profit 28.3% 29.3% 29.1%

Selling, general and administrative expenses 25.3% 26.0% 25.9%

Operating income 3.0% 3.3% 3.2%

Interest expense, net 0.2% 0.0% 0.0%

Income before income taxes 2.8% 3.3% 3.2%

Income tax expense 1.1% 1.3% 1.2%

Net income 1.7% 2.0% 2.0%