Southwest Airlines 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S O U T H W E S T A I RL I N E S C O . A N N U A L R E P O R T 2 0 0 6

To Our Shareholders:

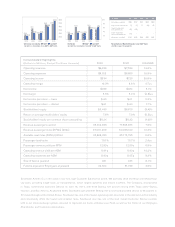

In 2006, Southwest Airlines recorded its 34th consecutive year of profitability, a record unmatched in commercial

airline history.

Our 2006 GAAP profit was $499 million, or $.61 per diluted share, compared to $484 million, or $.60 per

diluted share, for 2005.

Each year includes unrealized gains or losses and other items as required by Statement of Financial Accounting

Standard 133, related to our successful fuel hedging activities. Excluding these items ($88 million in losses in

2006 and $59 million in gains in 2005) produces a year-over-year profit increase of 38.1 percent and per diluted

share increase of 34.0 percent.

Driving these increases was strong revenue growth coupled with excellent cost controls. The earnings growth

was achieved despite an almost 50 percent increase in hedged jet fuel prices per gallon in 2006 versus 2005.

Operating revenues grew 19.8 percent on capacity growth of 8.8 percent (as measured by Available Seat Miles).

Revenue growth was driven by strong, record load factors (73.1 percent in 2006 versus 70.7 percent in 2005) and

higher yield per passenger, up 6.9 percent year-over-year. The result was a 10.2 percent increase in unit revenue

year-over-year, the strongest annual growth rate realized since 1992. An improving economy, driving stronger travel

demand, coupled with stable airline industry seat capacity combined to support strong revenue growth.

While revenue trends were softened by the August London terrorist threat and related carryon baggage

restrictions, such trends stabilized in fourth quarter 2006, resulting in a steady unit revenue growth rate of

4.2 percent. Based upon our January 2007 traffic and bookings to date, we expect 2007 first quarter year-over-year

unit revenue growth to exceed the prior year performance.

Our Employees did an excellent job providing outstanding Customer Service. Once again, Southwest placed

first in Customer Satisfaction, as measured by fewest Customer complaints reported to the Department of

Transportation (DOT) per passenger carried. It is, in large part, our People’s devotion to quality Customer Service

that has enabled Southwest to reach the point where it carries more passengers than any other U.S. airline, based

on the most recent DOT monthly statistics.

Our near-record 2006 unit revenue growth was achieved utilizing modest fare increases while maintaining our

Low-Fare Brand. As the Low-Fare Leader, we cherish our position in the U.S. industry as the Low-Cost Producer.

This position is a major element of our preparedness for bad times in the airline business and a major reason we

have remained the lone profitable airline throughout the entirety of the worst five-year period in airline history. In

addition, we have a strong “A Rated” balance sheet with only modest debt levels; substantial liquidity in the form

of cash on hand plus a $600 million fully available bank line of credit; and the best jet fuel price protection in

the airline industry. Coming into 2006, we had fuel derivative contracts in place for over 70 percent of our 2006

expected jet fuel needs at $36 per barrel, which saved us $675 million from cash settlements of these contracts.

We also have substantial hedging positions over the next three years at roughly $50 per barrel, providing us ample

protection against jet fuel price spikes, albeit at higher prices than during the last several years. These positions

also allow us to benefit from energy price decreases.

Our Employees have worked extremely hard to mitigate our fuel cost increases: first, by providing the best

airline Customer Service in the business; and second, by controlling the rest of our operating cost structure. For

the fourth year in a row, our People further improved their productivity and the overall efficiency of Southwest

Airlines, achieving constant unit costs with 2005 (excluding fuel). On the heels of 2004 and 2005, where we

Pe rf or mi ng A b o v e & B e y o n d .

2