Southwest Airlines 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S O U T H W E S T A I RL I N E S C O . A N N U A L R E P O R T 2 0 0 6

Southwest Airlines returned

significant service in 2006 to

hurricane-ravaged New Orleans.

Our commitment to help rebuild

and renew this great American

city is unwavering. We were the

last airline to leave New Orleans

during the natural disaster and

the first airline to return full-

time service. We will continue

to add flights as more and more

Americans return to laissez les

bon temps rouler!

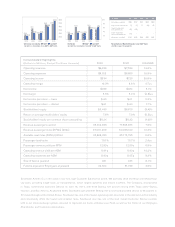

has been able to duplicate our success. At the end of 2006, our fulltime equivalent Employees per aircraft of 68 represented

the lowest level since 1972.

In addition to being the most productive airline of any Major U.S. carrier, Southwest has the best fuel hedge program in

the airline industry. Since 2000, the Company has saved more than $2 billion in fuel costs through our fuel hedge program.

Although we currently expect fuel headwinds in 2007 of more than $400 million, we have insured ourselves against further

Passenger tries to open

overhead bin then notices coin slot,

puts in money to open it.

Passenger wants to recline seat. Sees

coin slot on armrest, deposits money.

Passenger tries to lower window shade,

sees another coin slot.

VO: Tired of being nickeled and dimed

by other airlines?

catastrophic energy price increases by putting fuel derivative contracts in place for about 95 percent of our 2007 expected

jet fuel needs at $50 per barrel of crude oil. We also have protection in 2008 with fuel derivative contracts for 65 percent of

our anticipated fuel needs at $49 per barrel. We continue to opportunistically build positions for future years and currently

have fuel derivative contracts in place for 50 percent of expected fuel needs at $51 per barrel in 2009; more than

25 percent at $63 per barrel in 2010; 15 percent at $64 per barrel in 2011; and 15 percent at $63 per barrel in 2012.

In addition to fuel price protection, Southwest is working hard to reduce fuel consumption. We have installed blended

winglets on our entire 737-700 fleet and plan to install winglets on a significant portion of our 737-300 fleet, beginning in

first quarter 2007.

As a result of prudent risk management, conservative planning, and discipline, our balance sheet has never been stronger.

After the five most difficult years in the airline industry, we continue to retain an investment-grade credit rating and have

ample liquidity and access to capital. We ended 2006 with $1.8 billion in cash, including shortterm investments, and have a

fully available unsecured revolving credit line of $600 million. We also had approximately $600 million in cash deposits at

Boeing for future aircraft deliveries. Our unmortgaged assets have a value of more than $9 billion, and our debt to total

capital is under 35 percent, including aircraft leases as debt.

10