Southwest Airlines 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S O U T H W E S T A I RL I N E S C O . A N N U A L R E P O R T 2 0 0 6 15

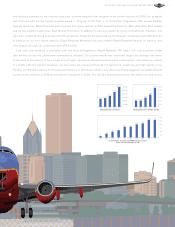

Note: The schedule inside the front cover reconciles the non-GAAP financial measures included in this report to the most comparable GAAP financial

measures. The special items, which are net of profitsharing and income taxes as appropriate, consist primarily of certain passenger revenue adjustments

(2002); government grants received under the Air Transportation Safety and System Stabilization Act as a result of the 2001 terrorist attacks (2002);

government grants received under the Emergency Wartime Supplemental Appropriations Act as a result of the U.S. war with Iraq (2003); and certain

unrealized gains or losses and other items related to derivative instruments associated with the Company’s fuel hedging program, recorded as a result of

SFAS 133, “Accounting for Derivative Instruments and Hedging Activities,” as amended (2002, 2003, 2004, 2005, 2006) . In management’s view,

comparative analysis of results can be enhanced by excluding the impact of these items as the amounts are not indicative of the Company’s operating

performance for the applicable period, nor should they be considered in developing trend analysis for future periods.

1997

$ 3,670

95

52

3,817

3,316

501

7

494

190

$ 304

$ .41

$ .39

$ .0098

$ 4,153

$ 628

$ 1,969

7.8 %

17.0 %

13.1 %

8.0 %

50,399,960

55,943,540

28,355,169

44,487,496

63.7 %

563

425

786,288

$72.81

12.94 ¢

8.58 ¢

7.45 ¢

6.34 ¢

62.5 ¢

788

23,974

261

1998

$ 4,010

99

55

4,164

3,518

646

(21)

667

256

$ 411

$ .55

$ .52

$ .0126

$ 4,605

$ 623

$ 2,352

9.4 %

19.0 %

15.5 %

9.9 %

52,586,400

59,053,217

31,419,110

47,543,515

66.1 %

597

441

806,822

$76.26

12.76 ¢

8.76 ¢

7.40 ¢

6.58 ¢

45.7 ¢

843

25,844

280

1999

$ 4,563

103

70

4,736

4,001

735

8

727

283

$ 444

$ .59

$ .56

$ .0143

$ 5,519

$ 872

$ 2,780

8.8 %

17.3 %

15.5 %

9.4 %

57,500,213

65,287,540

36,479,322

52,855,467

69.0 %

634

465

846,823

$79.35

12.51 ¢

8.96 ¢

7.57 ¢

6.64 ¢

52.7 ¢

924

27,653

312

2000

$ 5,468

111

71

5,650

4,702

948

4

944

367

$ 555

(5)

$ .74

(5)

$ .70

(5)

$ .0148

$ 6,500

$ 761

$ 3,376

9.2 %

18.0 %

16.8 %

9.8 %

63,678,261

72,566,817

42,215,162

59,909,965

70.5 %

663

492

903,754

$85.87

12.95 ¢

9.43 ¢

7.85 ¢

6.50 ¢

78.7 ¢

1,013

29,274

344

2001(3)

$ 5,379

91

85

5,555

5,016

539

(197)

736

285

$ 451

$ .59

$ .56

$ .0180

$ 8,779

$ 1,327

$ 3,921

5.9 %

12.4 %

9.7 %

8.1 %

64,446,773

73,628,723

44,493,916

65,295,290

68.1 %

690

514

940,426

$83.46

12.09 ¢

8.51 ¢

7.68 ¢

6.50 ¢

70.9 ¢

1,086

31,580

355

2002(3)

$ 5,341

85

96

5,522

5,181

341

24

317

129

$ 188

$ .24

$ .23

$ .0180

$ 8,766

$ 1,553

$ 4,374

2.1 %

4.5 %

6.2 %

3.4 %

63,045,988

72,462,123

45,391,903

68,886,546

65.9 %

720

537

947,331

$84.72

11.77 ¢

8.02 ¢

7.52 ¢

6.41 ¢

68.0 ¢

1,117

33,705

375