Southwest Airlines 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

Southwest Airlines Co. 2003 Annual Report

2003 proved to be another perilous year for the airline industry.

With the Iraq war, severe acute respiratory syndrome (SARS), a

weak economy, high energy costs, and terrorism-related concerns,

the major airlines continue to report billions in losses and struggle

for survival. Since September 11, 2001, major airlines have cut

capacity, slashed jobs, and scrambled to reduce their costs to

avoid bankruptcy and compete in an industry that is forever

changed. Two major airlines have already filed bankruptcy, and

other smaller carriers have ceased operations entirely.

As a result of the dire financial condition of our major

airline competitors, exacerbated by the war in Iraq, the government

provided substantial cash payments to the airline industry

under the Emergency Wartime Supplemental Appropriations

Act. The government also waived the requirement that security

fees be collected on airline tickets issued from June 1 to

September 30, 2003.

Despite these difficult challenges, we reported our 31st

consecutive annual profit in 2003 because of our low operating

costs and superb People. Southwest’s long profitability record is

unmatched in the airline industry, and we are also the only major

airline to post a profit in every quarter following the September 11

terrorist attacks. While the airline industry, as a whole, reported

losses for the third straight year in 2003, our profits were up

significantly from 2002, even excluding the favorable impact from

the $271 million federal grant.

Because we were financially prepared, we were able to

persevere through these difficult times and build a stronger

Southwest. Instead of significant capacity reductions, Southwest

invested in our future. We took care of our People, providing pay

rate increases and Profitsharing rather than furloughs and wage

concessions. We added airplanes, expanded airports, and invested

in facilities, equipment, and automation to enhance our Customers’

experience and prepare us for future growth.

Although we cannot predict what external, uncontrollable

events could impact us in 2004, it seems that the worst could finally

be behind us. The downward revenue trends prior to and shortly

following the Iraq war have improved, albeit gradually. Although

the industry has planned for significant capacity increases in 2004,

we are confident in our future and believe we are uniquely

positioned for growth.

Low Costs

Historically, Southwest has enjoyed a significant cost advantage

compared to the “legacy” carriers. That advantage has been somewhat

diminished as those carriers have reduced their labor costs and

improved their work rules through either voluntary concessions or

the bankruptcy process. In addition, there are now a number of

new, rapidly growing carriers with costs roughly comparable to

those of Southwest Airlines.

The Employees of Southwest have always understood that we

are profitable, growing, and successful because of our competitive

cost advantage. Although our costs remain low, we are not satisfied

with the inflation we began to experience in our cost structure

during second half 2003 and are aggressively implementing various

measures to improve our productivity. Effective December 15, 2003,

Southwest no longer pays a commission on flights booked by

traditional travel agencies, which will reduce operating costs by

approximately $40 million annually. In February 2004, we will

consolidate our reservations operations from nine into six

Reservations Centers. We will incur restructuring charges of an

estimated $20 million in first quarter 2004 and expect ongoing cost

savings to exceed that amount each year. As a result of these and

many other measures, cost pressures should ease in second half

2004. Our Employees are motivated and innovative, and we are

confident that our People will continue to find and embrace faster

and better ways of running our business.

While a lot of factors contribute to Southwest’s historic low

cost advantage, the primary driver is the productivity and Southwest

Spirit of our People. We are devoted to the low-fare, point-to-point

market niche and have a highly efficient route structure. This

market focus allows us to operate a single aircraft type, the Boeing 737.

Commonality of fleet significantly simplifies our scheduling,

operations, and maintenance and, therefore, lowers cost. We

consistently run an ontime operation, with few mishandled bags

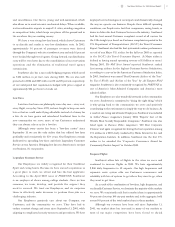

8.96¢

9.43¢

8.51¢

9.5¢

9.0¢

8.5¢

8.0¢

7.5¢

7.0¢

1999 2000 2001 2002

Operating Revenues Per Available Seat Mile

8.02¢

2003

8.27¢

1999 2000 2001 2002

Operating Expenses Per Available Seat Mile

7.48¢

7.73¢

7.54¢

7.41¢

2003

7.60¢

7.8¢

7.6¢

7.4¢

7.2¢

7.0¢

70

60

50

40

30

1999 2000 2001 2002

52,855

59,910

65,295 68,887

2003

71,790

Available Seat Miles (in millions)