Southwest Airlines 1998 Annual Report Download

Download and view the complete annual report

Please find the complete 1998 Southwest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

SOUTHWEST AIRLINES CO. ¤ SIX STORIES OF FREEDOM

Table Of Contents

Consolidated Highlights .............................................................................................................. 1

Preamble.................................................................................................................................... 3

Letter to Shareholders ................................................................................................................ 4

First Story of Freedom................................................................................................................ 6

Second Story of Freedom........................................................................................................... 9

Third Story of Freedom............................................................................................................. 12

Fourth Story of Freedom........................................................................................................... 15

Fifth Story of Freedom.............................................................................................................. 18

Sixth Story of Freedom............................................................................................................. 21

System Map ............................................................................................................................. 24

Financial Review ...................................................................................................................... 25

Management’s Discussion and Analysis.................................................................................... 25

Consolidated Financial Statements........................................................................................... 41

Notes to Consolidated Financial Statements............................................................................. 45

Report of Independent Auditors ................................................................................................ 62

Quarterly Financial Data ........................................................................................................... 63

Common Stock Price Ranges and Dividends............................................................................ 63

Ten-Year Summary .................................................................................................................. 64

Corporate Data ......................................................................................................................... 66

Directors and Officers............................................................................................................... 67

Consolidated Highlights

(DOLLARS IN THOUSANDS EXCEPT PER SHARE AMOUNTS) 1998 1997 CHANGE

Operating revenues $4,163,980 $3,816,821 9.1%

Operating expenses $3,480,369 $3,292,585 5.7%

Operating income $683,611 $524,236 30.4%

Operating margin 16.4% 13.7% 2.7 pts.

Net income $433,431 $317,772 36.4%

Net margin 10.4% 8.3% 2.1 pts.

Net income per share – basic $1.30 $.97 34.0%

Net income per share – diluted $1.23 $.93 32.3%

Stockholders’ equity $2,397,918 $2,009,018 19.4%

Return on average stockholders’ equity 19.7% 17.4% 2.3 pts.

Stockholders’ equity per common share outstanding $7.14 $6.05 18.0%

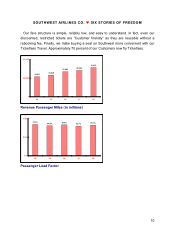

Revenue passengers carried 52,586,400 50,399,960 4.3%

Revenue passenger miles (RPMs) (000s) 31,419,110 28,355,169 10.8%

Available seat miles (ASMs) (000s) 47,543,515 44,487,496 6.9%

Passenger load factor 66.1% 63.7% 2.4 pts.

Passenger revenue yield per RPM 12.62 12.84¢ (1.7)%

Operating revenue yield per ASM 8.76¢ 8.58¢ 2.1%

Operating expenses per ASM 7.32¢ 7.40¢ (1.1)%

Number of Employees at yearend 25,844 23,974 7.8%

Table of contents

-

Page 1

... Stock Price Ranges and Dividends...63 Ten-Year Summary ...64 Corporate Data ...66 Directors and Officers...67 Consolidated Highlights (DOLLARS IN THOUSANDS EXCEPT PER SHARE AMOUNTS) 1998 1997 CHANGE Operating revenues Operating expenses Operating income Operating margin Net income Net margin... -

Page 2

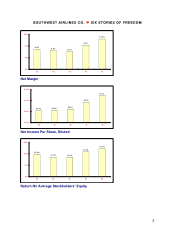

... AIRLINES CO. ¤ SIX ST ORIES OF FREEDOM 12% 10.4% 8.3% 8% 6.9% 6.4% 6.1% 4% 0% 94 95 96 97 98 Net Margin $1.50 $1.23 $1.00 $0.93 $0.54 $0.50 $0.55 $0.61 $0.00 94 95 96 97 98 Net Income Per Share, Diluted 24% 19.7% 17.4% 16% 15.6% 13.7% 13.5% 8% 0% 94 95 96 97 98 Return On Average... -

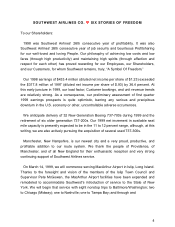

Page 3

... as leisure travelers. The Company, incorporated in Texas, commenced Customer Service on June 18, 1971, with three Boeing 737 aircraft serving three Texas cities - Dallas, Houston, and San Antonio. At yearend 1998, Southwest operated 280 Boeing 737 aircraft and provided service to 53 airports in 26... -

Page 4

...and profitable addition to our route system. We thank the people of Providence, of Manchester, and of all New England for their enthusiastic reception and very strong continuing support of Southwest Airlines service. On March 14, 1999, we will commence serving MacArthur Airport in Islip, Long Island... -

Page 5

... CO. ¤ SIX ST ORIES OF FREEDOM connecting service beyond those cities to numerous other Southwest Airlines destinations. We also plan to begin serving at least one other new city in 1999. Over a span approaching three decades, our People have overcome the potentially devastating effects of fierce... -

Page 6

... Southwest. We are a lowfare, high-frequency, point-to-point, shorthaul air carrier. Our operation is efficiently designed to maximize productivity, which reduces costs and maintains our high quality service. We are the low-cost producer in the U.S. airline industry, and that allows us to profitably... -

Page 7

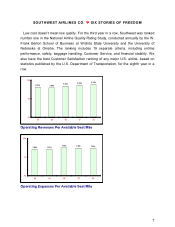

...ORIES OF FREEDOM Low cost doesn't mean low quality. For the third year in a row, Southwest was ranked number one in the National Airline Quality Rating Study, conducted annually by the W. Frank Barton School of Business at Wichita State University and the University of Nebraska at Omaha. The ranking... -

Page 8

... he and his mom first started flying with us. Now anytime Caleb competes, they fly to the nearest Southwest destination, rent a car for the rest of the way, and still save a lot of money. It' s worked out really well. And Caleb' s mom tells us he loves flying with us. He particularly enjoys buckling... -

Page 9

... the knowledge of what low fares and high quality service can produce. When Southwest Airlines enters a market and slashes fares, the number of travelers increases significantly, often three- and four-fold. The U.S. Department of Transportation refers to this surge in air traffic and its favorable... -

Page 10

... OF FREEDOM Our fare structure is simple, reliably low, and easy to understand. In fact, even our discounted, restricted tickets are "Customer friendly" as they are reusable without a rebooking fee. Finally, we make buying a seat on Southwest more convenient with our Ticketless Travel. Approximately... -

Page 11

.... And where Steve wants to go is just about everywhere Southwest Airlines flies. See, Steve' s trying to run one marathon in as many different states as he can. Maybe even all 50 by his 50th birthday. He says that with our low fares and frequent flights, he' s able to meet his goals. And he says... -

Page 12

... operating costs. In a service business such as ours, safe, high quality Customer Service is required. According to U.S. Department of Transportation statistics, we consistently rank first of all the major U.S. airlines in overall Customer Satisfaction. And Money magazine ranked Southwest number... -

Page 13

... receive a roundtrip ticket, good for travel anywhere on Southwest's system for up to a year. That's why we call our program Rapid Rewards. Rapid Rewards Customers can also receive flight credits through purchases with our travel partners (Alamo, Hertz, Budget, American Express, Diners Club, and MCI... -

Page 14

... wedding. " Some day." But when that day finally came, it looked like the trip might be a little out of her price range. Until she called us. And soon met her very best friend for the very first time. Now Thanh promises to stay loyal to Southwest. With her track record, we don' t doubt it. 14 -

Page 15

... many passengers connect. Southwest's point-to-point route system, as compared to hub-and-spoke, provides our Customers with extensive nonstop routings that minimize connections, delays, and travel time. Because of our high frequencies and high productivity, our airport turnaround time is minimal... -

Page 16

...lots of convenient flights from the cities we serve. To further increase our operating efficiency, we try to avoid congested airports, especially our competitors' hubs. We seek convenient satellite or downtown airports such as Dallas Love Field, Houston Hobby, Chicago Midway, Oakland, Providence, Ft... -

Page 17

.... Like shooting snow in Texas. So when he got the call that there was an inch or two in the Guadalupe Mountains, he called Southwest. Good thing, too. If he had to wait for some of the other airlines, he just might have ended up with nothing but a really well-lit picture of slush. 17 -

Page 18

..., we served 29 airports with 850 daily flights and earned a profit of $58 million. Since then, we have added 24 new destinations and 1,520 more daily flights and increased our profits 650 percent to $433.4 million in 1998. From our beginnings as an intra-Texas airline in the 1970s, we expanded our... -

Page 19

...FREEDOM While our focus has been shorthaul, we have lately augmented our service with longhaul flights (over 750 miles). We have added more longhaul flights over the last three years to mitigate the effects of new ticket taxes, which penalize shorthaul fares, and to take advantage of excellent route... -

Page 20

.... Or you may have seen her on your last Southwest Airlines flight. LaFaye tries to fly Southwest because she can go just about anywhere at a moment' s notice. Which means she can concentrate on the more important stuff. Like coming up with a few ad-libs for her films. Usually something like " Ouch... -

Page 21

...carry only seven percent of domestic traffic and have opportunities to significantly expand our route system in both new and existing cities. Our aircraft fleet is young, well maintained, and strategically matched with our market niche. Yet it is flexible enough to meet our needs on longhaul flights... -

Page 22

...to add at least two new cities. In December 1998, we announced the opening of service to MacArthur Airport in Islip, New York, on Long Island, in March 1999. A second new destination will be announced later this year. 737 Type -200 -300 -500 -700 Total Seats 122 137 122 137 134 Average Age (Yrs.) 17... -

Page 23

... car parts and serving up plates of burritos as big as your face. So when it came time to expand the funky dining experience to folks who' d never experienced it, he and his partner came up with a pretty simple business plan. Only expand to cities that Southwest flies to. That way, managers are free... -

Page 24

... freedom to fly - from the Atlantic Ocean to the Pacific Ocean, and from the Canadian border to the border of Mexico. To all our Customers, we are proud to say, 'You are now free to move about the country.'" California 22% Remaining West 27% East 19% Heartland 16% Midwest 16% Southwest's Capacity... -

Page 25

...percent; and the highest operating profit margin since 1981 of 16.4 percent. The Company experienced strong revenue growth, low unit costs, and continued strong demand for our product. At the end of 1998, Southwest served 52 cities in 26 states. We added service to Manchester, New Hampshire, in June... -

Page 26

... SIX ST ORIES OF FREEDOM Also during 1998, the Company's Customer Service and Reservations Sales Agents, represented by the International Association of Machinists and Aerospace Workers, AFL-CIO, and Flight Dispatchers, represented by the Southwest Airlines Employees Association, ratified collective... -

Page 27

... increase is primarily due to increased revenues from the sale of frequent flyer segment credits to participating partners in the Company's Rapid Rewards frequent flyer program. OPERATING EXPENSES Consolidated operating expenses for 1998 were $3,480.4 million, compared to $3,292.6 million in 1997... -

Page 28

... jet fuel costs, operating expenses per ASM are expected to increase in first quarter 1999 compared to first quarter 1998 primarily due to higher Profitsharing and Employee savings plan contributions and increased advertising primarily related to the opening of Islip, New York, on Long Island on... -

Page 29

... Employee. The increase in average salary and benefits cost per Employee primarily is due to higher effective wage rates, lower productivity in 1998 caused by Boeing aircraft delivery delays, and increased health care and workers' compensation costs. Profitsharing and Employee savings plans expense... -

Page 30

... change in accounting estimate will decrease aircraft depreciation by approximately $25 million in 1999. Other operating expenses per ASM increased 2.1 percent in 1998, compared to 1997, primarily due to increased costs resulting from the Year 2000 remediation program and increased revenue related... -

Page 31

... Parcel Service labor strike during third quarter 1997. Other revenues increased by 45.6 percent in 1997 to $82.9 million, compared to $56.9 million in 1996. This increase is primarily due to the sale of frequent flyer segment credits to participating partners in the Company's Rapid Rewards frequent... -

Page 32

...a 2.4 percent increase in 1997 average salary and benefits cost per Employee, partially offset by slower growth in the number of Employees. The increase in average salary and benefits cost per Employee primarily is due to increased health care costs. The Company's Flight Attendants are subject to an... -

Page 33

...SIX ST ORIES OF FREEDOM On August 1, 1997, the Company signed a ten-year engine maintenance contract with General Electric Engine Services, Inc. (General Electric). Under the terms of the contract, Southwest will pay General Electric a rate per flight hour in exchange for General Electric performing... -

Page 34

... payments for future aircraft deliveries. In February 1998, the Company redeemed $100 million of senior unsecured 9 1/4% Notes originally issued in February 1991. At December 31, 1998, capital commitments of the Company primarily consisted of scheduled aircraft acquisitions and related flight... -

Page 35

... related to jet fuel prices and interest rates. Airline operators are inherently dependent upon energy to operate and, therefore, are impacted by changes in jet fuel prices. Jet fuel consumed in 1998 and 1997 represented approximately 11.2 and 15.0 percent of Southwest's operating expenses... -

Page 36

... 31, 1998, prices would correspondingly change the fair value of these derivative commodity instruments and their related cash flows by approximately $10 million. Airline operators are also inherently capital intensive, as the vast majority of the Company's assets are aircraft, which are long lived... -

Page 37

... of the Company's publicly traded long-term debt or its short-term cash investments. The Company does not purchase or hold any derivative financial instruments for trading purposes. IMPACT OF THE YEAR 2000 The Company is in the process of converting its computer systems to be Year 2000 ready. This... -

Page 38

...-1999. INTERNAL SYSTEMS The Company's critical internal systems include computer hardware, software, and related equipment for customer reservations, ticketing, flight and crew scheduling, revenue management, accounting functions, and payroll, as well as airport activities including aircraft ground... -

Page 39

...is presently estimated at approximately $7 million, which will be expensed as incurred. RISK OF YEAR 2000 ISSUES The Company believes its project to convert its computer systems to be Year 2000 ready will be completed in a timely manner and Year 2000 issues will not have a material adverse effect on... -

Page 40

...AIRLINES CO. ¤ SIX ST ORIES OF FREEDOM The costs of the project, the dates on which the Company believes it will complete the Year 2000 modifications and assessments, and the Company's analysis of its risk in this area are based on management's best... the availability and cost of personnel trained in... -

Page 41

SOUT HWEST AIRLINES CO. ¤ SIX ST ORIES OF FREEDOM CONSOLIDATED BALANCE SHEET (In thousands except share and per share amounts) ASSETS Current assets: Cash and cash equivalents Accounts receivable Inventories of parts and supplies, at cost Deferred income taxes (Note 10) Prepaid expenses and other ... -

Page 42

...HWEST AIRLINES CO. ¤ SIX ST ORIES OF FREEDOM CONSOLIDATED STATEMENT OF INCOME (In thousands except per share amounts) Operating Revenues: Passenger Freight Other Total operating revenues Operating Expenses: Salaries, wages, and benefits (Note 9) Fuel and oil Maintenance materials and repairs Agency... -

Page 43

...-two stock split (Note 7) Purchase of shares of treasury stock (Note 7) Issuance of common and treasury stock upon exercise of executive stock options and pursuant to Employee stock option and purchase plans (Note 8) Tax benefit of options exercised Cash dividends, $.0283 per share Net income - 1998... -

Page 44

... on sale and leaseback of aircraft Amortization of scheduled airframe overhauls Changes in certain assets and liabilities: Accounts receivable Other current assets Accounts payable and accrued liabilities Air traffic liability Other current liabilities Other Net cash provided by operating activities... -

Page 45

...are carried at cost, which approximates market value. INVENTORIES Inventories of flight equipment expendable parts, materials, and supplies are carried at average cost. These items are charged to expense when issued for use. PROPERTY AND EQUIPMENT Depreciation is provided by the straight-line method... -

Page 46

... included in results of operations for the periods in which the evaluations are completed. FREQUENT FLYER PROGRAM The Company accrues the estimated incremental cost of providing free travel awards earned under its Rapid Rewards frequent flyer program. The Company also sells flight segment credits to... -

Page 47

... of the hedged assets, liabilities, or firm commitments through earnings or recognized in other comprehensive income until the hedged item is recognized in earnings. The ineffective portion of a derivative's change in fair value will be immediately recognized in earnings. The Company has not yet... -

Page 48

... SIX ST ORIES OF FREEDOM $520.2 million in 2000, $498.7 million in 2001, $515.8 million in 2002, $152.8 million in 2003,and $89.1 million in 2004. 3. ACCRUED LIABILITIES (In thousands) Employee profitsharing and savings plans (Note 9) Aircraft rentals Vacation pay Other 1998 $123,195 121,868 54,781... -

Page 49

...December 31, 1998 or 1997. 5. LEASES Total rental expense for operating leases charged to operations in 1998, 1997, and 1996 was $306,629,000, $297,158,000, and $280,389,000, respectively. The majority of the Company's terminal operations space, as well as 99 aircraft, were under operating leases at... -

Page 50

... or near the end of the lease term at fair market value, but generally not to exceed a stated percentage of the lessor's defined cost of the aircraft. 6. FINANCIAL INSTRUMENTS The Company utilizes purchased crude oil call options and fixed price swap agreements to hedge a portion of its exposure to... -

Page 51

... counterparties. The Company does not hold or issue any financial instruments for trading purposes. The fair values of the Company's long-term debt were based on quoted market prices. The carrying amounts and estimated fair values of the Company's long-term debt at December 31, 1998, were as follows... -

Page 52

SOUT HWEST AIRLINES CO. ¤ SIX ST ORIES OF FREEDOM At December 31, 1998, the Company had common stock reserved for issuance pursuant to Employee stock benefit plans (69,453,206 shares) and upon exercise of rights (405,357,512 shares) pursuant to the Common Stock Rights Agreement, as amended (... -

Page 53

... APB 25 and related Interpretations in accounting for its stock-based compensation. Accordingly, no compensation expense is recognized for its fixed option plans because the exercise prices of the Company's Employee stock options equal or exceed the market prices of the underlying stock on the dates... -

Page 54

...grant type. Under the 1998 Southwest Airlines Employee Association Non-Qualified Stock Option Plan (SAEA Plan), the Company may grant options to Dispatchers for up to 1,050,000 shares of common stock. An initial grant of 738,000 shares was made on September 10, 1998, at an option price of $19.62 per... -

Page 55

...AIRLINES CO. ¤ SIX ST ORIES OF FREEDOM INCENTIVE PLANS AVERAGE EXERCISE OPTIONS PRICE OPTIONS NON-QUALIFIED PLANS AVERAGE EXERCISE PRICE...Other Non-Qualified Plans Exercised Surrendered Outstanding December 31, 1998 Exercisable December 31, 1998 Available for granting in future periods 11,726,729 3,... -

Page 56

..., 1997, and 1996, respectively. Under the 1991 Employee Stock Purchase Plan (ESPP), at December 31, 1998, the Company is authorized to issue up to a balance of 855,000 shares of common stock to Employees of the Company at a price equal to 90 percent of the market value at the end of each purchase... -

Page 57

... HWEST AIRLINES CO. ¤ SIX ST ORIES OF FREEDOM Pro forma information regarding net income and net income per share is required by SFAS 123 and has been determined as if the Company had accounted for its Employee stock-based compensation plans and other stock options under the fair value method of... -

Page 58

... PLANS Substantially all of Southwest's Employees are members of the Southwest Airlines Co. Profitsharing Plan. Total profitsharing expense charged to operations in 1998, 1997, and 1996 was $120,697,000, $91,256,000, and $59,927,000, respectively. The Company sponsors Employee savings plans under... -

Page 59

...) DEFERRED TAX LIABILITIES: Accelerated depreciation Scheduled airframe maintenance Other Total deferred tax liabilities DEFERRED TAX ASSETS: Deferred gains from sale and leaseback of aircraft Capital and operating leases Other Total deferred tax assets Net deferred tax liability 1998 $641,673... -

Page 60

... OF FREEDOM The Company received a statutory notice of deficiency from the Internal Revenue Service (IRS) in July 1995 in which the IRS proposed to disallow deductions claimed by the Company on its federal income tax returns for the taxable years 1989 through 1991 for the costs of certain aircraft... -

Page 61

... stockholders - numerator for basic and diluted earnings per share 1998 1997 1996 $433,431 DENOMINATOR: Weighted-average shares outstanding, basic Dilutive effect of Employee stock options Adjusted weighted-average shares outstanding, diluted NET INCOME PER SHARE: Basic Diluted $317,772 $207,337... -

Page 62

...position of Southwest Airlines Co. at December 31, 1998 and 1997, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 1998, in conformity with generally accepted accounting principles. ERNST & YOUNG, LLP Dallas, Texas January... -

Page 63

... DIVIDENDS Southwest's common stock is listed on the New York Stock Exchange and is traded under the symbol LUV. The high and low sales prices of the common stock on the Composite Tape and the quarterly dividends per share, as adjusted for the November 1997 and July 1998 three-for-two stock splits... -

Page 64

... (2) Revenue passengers carried RPMs (000s) ASMs (000s) Passenger load factor Average length of passenger haul Trips flown Average passenger fare Passenger revenue yield per RPM Operating revenue yield per ASM Operating expenses per ASM Fuel cost per gallon (average) Number of Employees at yearend... -

Page 65

... million ($.05 per share) (5) Excludes cumulative effect of accounting change of $12.5 million ($.04 per share) (6) Includes $2.6 million gains on sales of aircraft and $3.1 million from the sale of certain financial assets (7) Includes $10.8 million gains on sales of aircraft, $5.9 million from the... -

Page 66

... at 10:00 a.m. on May 20, 1999, at the Southwest Airlines Corporate Headquarters, 2702 Love Field Drive, Dallas, Texas. FINANCIAL INFORMATION A copy of the Company's Annual Report on Form 10-K as filed with the U.S. Securities and Exchange Commission (SEC) may be obtained without charge, as well as... -

Page 67

... Executive Officer of Southwest Airlines Co., Dallas, Texas; Executive Committee Rollin W. King Retired, Dallas, Texas; Audit and Executive Committees Walter M. Mischer, Sr. Managing Partner Wheatstone Investments, L.P., Houston, Texas (Real Estate Development); Audit and Compensation Committees... -

Page 68

... - Inflight Service and Provisioning Alan S. Davis Vice President - Internal Audit and Special Projects Michael P. Golden Vice President - Purchasing Ginger C. Hardage Vice President - Public Relations and Corporate Communications Ross W. Holman Vice President - Systems Robert E. Jordan Controller... -

Page 69

... President - People Jim Sokol Vice President - Maintenance and Engineering Paul E. Sterbenz Vice President - Flight Operations Keith L. Taylor Vice President - Revenue Management Laura H. Wright Treasurer *Member of Executive Planning Committee Southwest Airlines ® P.O. BOX 36611 Dallas, TX 75235...