Sonic 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DAILY CRUISER PAGE 6

PRIME

TIME

■By Holly Wood

Entertainment

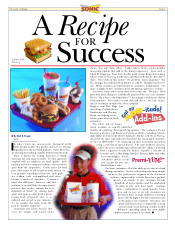

You’ve seen them. Those clever commercials promoting the

newest drink concoction at Sonic, the latest innovation in

Toaster®Sandwiches, or the truly distinctive service aspects

of the Sonic concept. (Where else do they skate like that?)

Increasingly you’ve seen them on cable, during a football game,

and elsewhere on prime-time television. But did you ever wonder

where the ads come from - not the agency or the creative folks, but

just what makes that national exposure possible for Sonic?

It was not so long ago that Sonic was unable to promote its brand

over the networks. Even late-night advertising on some of the more obscure

cable channels was possible only in the most densely penetrated markets.

The company’s franchising relationship simply was not structured to provide

the resources needed to mount a large-scale advertising campaign, and without

that exposure to potential customers - to build top-of-mind awareness of the

Sonic brand - expansion would be difficult. It truly was a dilemma, the

successful solution to which, if

possible, would unleash

the growth potential of

the chain.

That solution

came in 1994 with

the implementation

of a new license

agreement that

would generate

greater funds for

Sonic, the franchisor,

to use in supporting

the brand, and the

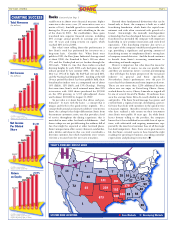

impact of this change would be dramatic. Marketing expenditures began

to ramp up almost immediately with the new royalty rates and by 1999 the

annual increase in Sonic’s media expenditures was $10 million. To put

this into a longer-term perspective, consider that Sonic spent $80 million

in 2001 for media and advertising support, almost triple the amount

spent just five years earlier.

In retrospect, it’s easy to see the relationship between Sonic’s growing

media budget and its increasing franchising income, for they go hand-

in-hand. And of course, that higher franchising income reflects the

considerable increases that have occurred in average unit volumes in

the meantime, benefiting Sonic and its franchisees alike. This prosperity

continues to serve as a strong draw for new franchisees and ongoing

expansion among current franchisees, adding additional momentum

to the growth of the Sonic chain. Need proof? Just look at the number

of Sonic’s franchisee-operated locations, which jumped almost 50%

between 1996 and 2001. ■

■By Macon Green

Business

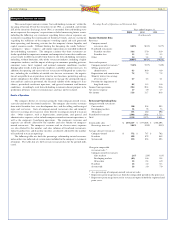

For those familiar with the restaurant industry, especially the quick-service segment, Sonic is unquestionably

a growth story. Few companies can match its 15-year record of same-store sales expansion, its consistent

earnings growth, or its high return on equity. For growth-stock investors, these are the things of which

dreams are made, and the price appreciation in the company’s common stock over the past decade

proves that investors have taken note.

While many factors clearly have played a role in this long-term record of success, one of the more

important drivers has been the sheer physical growth of the Sonic chain. While more than doubling

its locations over the past decade, the real acceleration in drive-in development has occurred over

the past four years as the chain grew by more than 160 drive-ins in each year since 1998 - including

record growth of 191 drive-ins in the most recent fiscal year. By way of comparison, the Sonic chain

grew by 113 drive-ins in fiscal 1997 - the previous record to that point.

Importantly, this accelerating growth strategy is led by the company’s franchisees, who operate

about 80% of the chain, spearhead the development of new markets for the company, and account for

System-Wide

Marketing Expenditures

(In millions)

System-Wide Sales

(In millions)

SONIC ADD$ UP

See Adds Up on Page 7