Sonic 2001 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2001 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DAILY CRUISER PAGE 2

which are the cornerstones of the Sonic brand - unique, made-to-order

menu items and great carhop service, combined in a drive-in setting that

is as much fun as it is efficient. It’s our unwavering commitment to these

brand treasures, and the high level of quality and service that underscore

them, that makes Sonic a favorite and frequent stop for so many people.

We can trace Sonic’s prosperity to other catalysts as well, most notably

our multi-layered growth strategies that build on and extend our brand

in a number of ways to sustain industry-leading results. These strategies

are grounded in Sonic’s initial orientation as a

franchising organization. Considering that

more than 80% of our drive-ins are operated by

franchisees under ascending royalty rate agree-

ments, which is uncommon in the restaurant

industry, our strong drive-in expansion pro-

gram provides a significant, reliable and increas-

ing base of franchising income to complement

our now-substantial company operations. Add

to this our increasing commitment to marketing

support for our brand and a steady stream of

new product news to surprise and delight our

customers, and you can begin to appreciate how

Sonic also continues to drive higher average

unit volume and system-wide same-store sales.

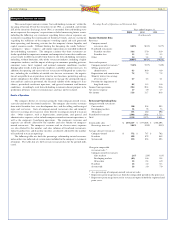

In terms of drive-in development, fiscal

2001 was another record year for us as we

added a total of 191 new restaurants to the chain, topping the previous

record of 174 last year. With these openings, we ended the year with

2,359 drive-in restaurants in operation across 29 states and one new

drive-in opened in Mexico by one of our long-standing franchisees.

Importantly, our drive-in development is led by franchisees, who added

157 new restaurants in 2001, up from 150 in 2000. We think this record

pace will likely continue as we target a total of 190 to 200 new franchisee

and company drive-in openings next year. This momentum enhances

the outlook in fiscal 2002 for sustained growth in revenues from an

expanding base of company-owned and franchised drive-ins.

As with any consumer product, and perhaps especially important in

the restaurant industry, strong advertising and marketing support is

essential to achieve the top-of-mind brand awareness that is crucial to

sales growth. At Sonic, we have increased our marketing expenditures

an average of 23% over the past five years, topping $80 million in 2001.

More important, we continue to explore new and effective ways to

deploy those resources. For instance, during the past year we established

an exclusive sponsorship with NASCAR Winston Cup Driver and Busch

Series Driver Kevin Harvick and the Richard Childress Racing Team

and, more recently, signed on as a sponsor of NCAA college football on

CBS. Both of these initiatives have produced strong early results for us,

taking our brand message to viewers who typically have a high frequency

of fast-food dining. The outlook for next year is just as strong consider-

ing our plans to boost marketing expenditures to more than $90 million.

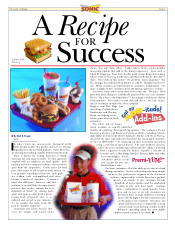

When customers arrive at our drive-ins, they find plenty to like about

Sonic - from old favorites to fresh taste sensations that are destined to

become new favorites. During fiscal 2001, we implemented a new menu

to make our signature Toaster®Sandwiches and Cream Pie Shakes a per-

manent part of our offerings to go with our

classics like Coneys and Tater Tots. We also

continued to enhance our menu with a

constant flow of new drink and sandwich

ideas, coupled with our promotions for

Premi-Yum!™ Shakes and our invitation for

customers to develop an ADD-itude™ by

experimenting with special drink flavors

and sandwich condiments.

With an increasing marketing budget,

strong new product news, and an emphasis

on food quality, we witnessed the continu-

ation of some very positive trends last year.

After some very difficult winter months with

the coldest weather on record in many of our

markets, Sonic’s same-store sales during the

last half of the year increased 4.9% - our best

results since the fall of 1999. For all of 2001, same-store sales rose 1.8%,

the fifteenth consecutive year of such gains and a truly phenomenal

accomplishment in our industry. Likewise, system-wide average unit

volumes increased 2.5% during the year.

Sonic today is a highly differentiated, $2 billion brand, one that took

some 44 years to reach the $1 billion mark and only four more years to

double. When you consider the power of our brand, the proven success

of our multi-layered growth strategies, and the increasing operating

leverage that comes with an expanding chain, it’s easy to get excited

about Sonic’s future. The opportunities for continued expansion across

our markets remain abundant, even in our core states. Moreover, new

product news and expanded day part initiatives, such as the ongoing

rollout of our breakfast menu and other initiatives, should continue to

WOW our customers. With these things in mind, we remain enthusiastic

about the prospects of another record year in the making for fiscal 2002.

While it is difficult to assess the lasting impact of the tragic events in

September on consumer confidence and behavior, we believe our proven

growth strategies will continue to drive the company’s sales and earnings

to new levels in the coming year. ■

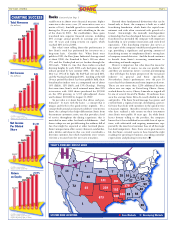

Booms Continued from Page 1

Sonic Snapshot

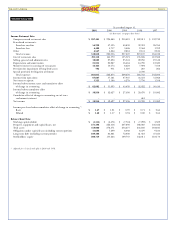

($ in thousands, except per share data) Percent

2001

2000 Change

Operations (for the year)

Total revenues. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 330,638

$ 280,056 18%

Income from operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 67,607

$ 57,181 18%

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 38,956

$ 32,627 19%

Net income per diluted share . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 1.40

$ 1.17 20%

Return on average stockholders’ equity . . . . . . . . . . . . . . . . . . . . .

21.9%

21.4%

Financial Position (at year’s end)

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 358,000

$ 278,371 29%

Stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 200,719

$ 155,263 29%

System-wide Information

Total sales (for the year) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$1,971,477

$ 1,778,828 11%

Average unit sales (for the year) . . . . . . . . . . . . . . . . . . . . . . . . . .

$ 874

$ 853 2%

Company-owned restaurants (at year’s end) . . . . . . . . . . . . . . . . .

393

312 26%

Franchised restaurants (at year’s end) . . . . . . . . . . . . . . . . . . . . . .

1,966

1,863 6%

Total restaurants (at year’s end) . . . . . . . . . . . . . . . . . . . . . . . . . . .

2,359

2,175 8%

We can trace Sonic’s

prosperity to other catalysts

as well, most notably our

multi-layered growth

strategies that build on and

extend our brand in a

number of ways to sustain

industry-leading results.

S

onic Corp., founded in Shawnee,

Oklahoma in 1953, franchises and operates

the largest chain of drive-in restaurants in

the United States. Sonic ended the most recent

fiscal year on August 31, 2001, with more than

2,350 drive-ins across 29 states.

Sonic Drive-Ins offer made-to-order sand-

wiches and feature signature items such as

Toaster®Sandwiches, Extra-Long Cheese

Coneys, hand-battered Onion Rings, Tater

Tots, and a variety of Frozen Favorites®desserts

and Fountain Favorites®drinks, including

Cherry Limeades, Slushes, Cream Pie Shakes,

and a complete soft-serve dessert menu. At a

typical Sonic Drive-In, customers drive into

one of 24 to 36 covered parking spaces and

place orders through an intercom speaker

system. A carhop delivers the customer’s order

curbside, usually within four minutes.

Publisher Profile