Sonic 2001 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2001 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DAILY CRUISER PAGE 18

cash flows indicates that the remaining carrying amounts as of August 31, 2001 are

expected to be recovered. However, it is reasonably possible that the estimate of cash

flows may change in the near future resulting in the need to write-down one or more

of the identified assets to fair value.

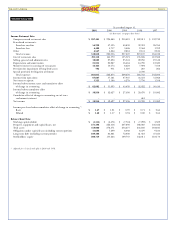

4. Accounts and Notes Receivable

Accounts and notes receivable consist of the following at August 31, 2001 and

2000:

2001 2000

Royalties and other trade receivables $ 7,187 $ 5,168

Notes receivable—current 1,797 1,223

Other 4,039 3,787

13,023 10,178

Less allowance for doubtful accounts

and notes receivable 881 493

$ 12,142 $ 9,685

Notes receivable—noncurrent $ 7,761 $ 7,898

Less allowance for doubtful notes receivable 386 219

$ 7,375 $ 7,679

As of August 31, 2001 and 2000, notes receivable from one franchisee totaled

$3,725 and $4,007 respectively.

5. Goodwill, Intangibles and Other Assets

Goodwill, intangibles and other assets consist of the following at August 31, 2001

and 2000:

2001 2000

Goodwill $ 45,615 $ 20,966

Trademarks and trade names 8,872 8,872

Franchise agreements 1,870 1,870

Other intangibles 2,054 1,302

Other assets 976 1,233

59,387 34,243

Less accumulated amortization 12,637 9,966

$ 46,750 $ 24,277

On April 1, 2001, the company acquired 35 existing franchise restaurants located

in the Tulsa, Oklahoma market from a franchisee and other minority investors. The

acquisitions have been accounted for under the purchase method of accounting, with

the results of operations of these restaurants included with that of the company’s

commencing April 1, 2001. The company’s cash acquisition cost, prior to post-clos-

ing adjustments, of approximately $21.9 million consisted of the drive-ins’ operating

assets ($0.2 million), equipment ($4.4 million) and goodwill ($17.3 million). The

company also entered into long-term real estate leases on each of these drive-in

restaurants, which have future minimum rental payments aggregating $1.8 million

annually over the next 15 years ($5.1 million of which was recorded as capital leases

related to the buildings). The company funded this acquisition through the avail-

ability under its existing $80 million bank line of credit.

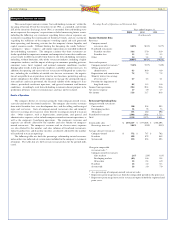

6. Leases

Description of Leasing Arrangements

The company’s leasing operations consist principally of leasing certain land, build-

ings and equipment (including signs) and subleasing certain buildings to franchise

operators. The land and building portions of these leases are classified as operating

leases and expire over the next fifteen years. The equipment portions of these leases

are classified principally as direct financing leases and expire principally over the next

ten years. These leases include provisions for contingent rentals which may be received

on the basis of a percentage of sales in excess of stipulated amounts. Income is not rec-

ognized on contingent rentals until sales exceed the stipulated amounts. Some leases

contain escalation clauses over the lives of the leases. Most of the leases contain one to

four renewal options at the end of the initial term for periods of five years. These

options enable the company to retain use of properties in desirable operating areas.

Certain company-owned restaurants lease land and buildings from third parties.

These leases, which expire over the next nineteen years, include provisions for contin-

gent rentals which may be paid on the basis of a percentage of sales in excess of stipu-

lated amounts. The land portions of these leases are classified as operating leases

and the buildings portions are classified as capital leases.

Direct Financing Leases

Components of net investment in direct financing leases are as follows at August

31, 2001 and 2000:

2001 2000

Minimum lease payments receivable $ 12,656 $ 13,189

Less unearned income 4,825 5,344

Net investment in direct financing leases 7,831 7,845

Less amount due within one year 683 625

Amount due after one year $ 7,148 $ 7,220

Initial direct costs incurred in the negotiation and consummation of direct financ-

ing lease transactions have not been material. Accordingly, no portion of unearned

income has been recognized to offset those costs.

Future minimum rental payments receivable as of August 31, 2001 are as follows:

Direct

Operating Financing

Year ending August 31:

2002 $ 1,030 $ 1,721

2003 594 1,704

2004 601 1,671

2005 602 1,635

2006 615 1,619

Thereafter 3,854 4,306

7,296 12,656

Less unearned income – 4,825

$ 7,296 $ 7,831

Capital Leases

Components of obligations under capital leases are as follows at August 31, 2001

and 2000:

2001 2000

Total minimum lease payments $ 23,321 $ 11,754

Less amount representing interest

averaging 10% in 2001 and 12% in 2000 9,633 4,455

Present value of net minimum lease payments 13,688 7,299

Less amount due within one year 887 631

Amount due after one year $ 12,801 $ 6,668

Maturities of these obligations under capital leases and future minimum rental

payments required under operating leases that have initial or remaining noncance-

lable lease terms in excess of one year as of August 31, 2001 are as follows:

Operating Capital

Year ending August 31:

2002 $ 5,261 $ 2,142

2003 5,278 2,098

2004 4,623 2,097

2005 4,313 1,941

2006 4,287 1,875

Thereafter 32,014 13,168

55,776 23,321

Less amount representing interest - 9,633

$ 55,776 $ 13,688

Total minimum lease payments do not include contingent rentals on capital leases

which have not been material.

Total rent expense for all operating leases consists of the following for the years

ended August 31:

2001 2000 1999

Minimum rentals $ 5,012 $ 3,810 $ 3,573

Contingent rentals 108 126 134

Sublease rentals (135) (129) (176)

$ 4,985 $ 3,807 $ 3,531