Sonic 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Sonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STAR EDITION PAGE 1

THE DAILYCRU ISER

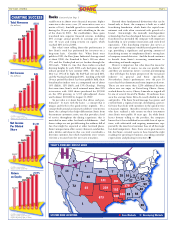

Sonic Booms

■By Clifford Hudson

Chairman and Chief Executive Officer

Extra. Extra. Read all about it.

Sonic’s continued success in

2001 is front-page news!

One quick glance at our financial

statements and operating statistics

for the year tells

the story: record

earnings and rev-

enues, the fif-

teenth consecutive

year of positive

same-store sales,

and a strong fran-

chising program

that continues to lead our drive-in

expansion. We’re very proud of

these results and we suspect that

you, as our stockholder, share our

enthusiasm for Sonic’s healthy top-

and bottom-line growth during a

year that saw many other fast-food

concepts continue to languish.

For the fiscal year ended

August 31, 2001, total revenues hit

$331 million, an 18% increase

from the $280 million reported

last year. Sonic’s net income for

fiscal 2001 increased 19% to $39

million from $33 million last year,

while net income per diluted share

increased 20% to $1.40 versus

$1.17 in fiscal 2000. These earn-

ings represented a return on

equity of 21.9% compared with

21.4% last year. Please note, all

per share amounts reflect the

impact of a three-for-two stock

split distributed in November

2000, the third such split the com-

pany has declared since going

public in 1991 and the second in

the last three years!

There are many reasons to

account for Sonic’s continued

strong showing, not the least of

See Booms on Page 2

CLIFF HUDSON

■From Wire Reports

F

rom time to time, many public companies celebrate

record financial and operational results, at least for

a quarter or two, perhaps even for a few years.

However, increasing uncertainty in today's economy

continues to thin the ranks of those who can lay claim to

such accomplishments. Even more rare now are com-

panies that can look back over an extended period of

time to demonstrate a pattern of progress - one that

provides a long-term perspective on the success of its

strategies, management and business execution.

Sonic is one of those companies that can point to

consistent growth over the past decade with as much

enthusiasm as it does in proclaiming record results for

the most recent fiscal year ended August 31, 2001.

The longer time frame is particularly relevant to Sonic

inasmuch as the company completed its initial public

offering of common stock during fiscal 1991, marking

the beginning of a new era in the company's opera-

tions and finances and providing a bright line for

gauging Sonic's future success. Sonic's results over

this extended period were sure and steady, providing

surprise and delight for those investors who were star-

struck by the meteoric rise of the dot com stocks and

their high-tech brethren in the 1990s, only to witness

a subsequent coup de grâce as the new century began.

In contrast to these once-hot sectors, and the

unrealistic expectations they briefly fostered, Sonic’s

consistent performance over the past decade can be

Sonic

2001

Annual

Report

MARCH 1991:

1000

shares at IPO

($12,500)

AUGUST 2001:

3,375

split-adjusted

shares worth

$102,938

SONIC STILL ROCKS

one bull market and a tech fizzle later

AUGUST 2001:

3,375

split-adjusted

shares worth

$102,938

MARCH 1991:

1000

shares at IPO

($12,500)

Sonic

2001

Annual

Report

1

0

Y

E

A

R

S

P

U

B

L

I

C

L

Y

H

E

L

D

1

0

Y

E

A

R

S

P

U

B

L

I

C

L

Y

H

E

L

D

FORECAST

Heating Up

A change in

store for most

of the country.

page 3

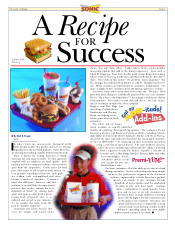

FOOD

Power hungry?

New menu

satisfies every

urge.

page 8

See Rocks on Page 3

SPORTS

On a Roll

When it comes

to service,

carhops score!

page 4

Table of contents

-

Page 1

..., 2001. The longer time frame is particularly relevant to Sonic inasmuch as the company completed its initial public offering of common stock during fiscal 1991, marking the beginning of a new era in the company's operations and finances and providing a bright line for gauging Sonic's future success... -

Page 2

... company operations. Add to this our increasing commitment to marketing support for our brand and a steady stream of new product news to surprise and delight our customers, and you can begin to appreciate how Sonic also continues to drive higher average unit volume and system-wide same-store sales... -

Page 3

... Cream Pie Shakes. Franchisees have seen the average Sonic Drive-In nearly double in sales and profits. The Sonic brand message has grown and evolved from a regional concept, developing a powerful voice that clicks with customers in the quick-service restaurant segment. Benefits extend to investors... -

Page 4

..., plenty of them on skates, check back during the meal to see if anything else is needed, setting a high standard for personal service and, coincidentally, preserving the skating legacy. Along the way, Sonic has built a class of carhops who love connecting with customers, as well as a loyal fan base... -

Page 5

...store sales and higher unit volumes and profits in the years following its extended implementation by franchisees. More important, it provided an immeasurable catalyst to the company's efforts to build the value of its brand in the eyes of its customers. â- O f course, re-imaging the entire Sonic... -

Page 6

... with the restaurant industry, especially the quick-service segment, Sonic is unquestionably a growth story. Few companies can match its 15-year record of same-store sales expansion, its consistent earnings growth, or its high return on equity. For growth-stock investors, these are the things of... -

Page 7

...result of higher royalty rates, but the system, and improve financial returns both they also reflect the increased sales and profits to franchisees and stockholders. flowing from Sonic's successful Frozen System-Wide Average Sales Per Restaurant Growth in Franchising Income (In millions) $59 $25... -

Page 8

... drinks and ice cream now account for over onethird of Sonic's sales. For Sonic customers, all of this adds up to a one-of-a-kind dining experience. It starts with perhaps the most unique menu in the quick-service segment of the restaurant industry, augmented by a steady flow of new product specials... -

Page 9

... desserts and Fountain Favorites® drinks program, Sonic already has developed an enviable balance in its day parts compared with the rest of the fast-food segment. Second, the breakfast menu integrates easily into the daily routine of a Sonic Drive-In, enhances store-level management infrastructure... -

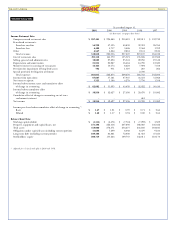

Page 10

... Franchise fees Other Total revenues Cost of restaurant sales Selling, general and administrative Depreciation and amortization Minority interest in earnings of restaurants Provision for impairment of long-lived assets Special provision for litigation settlement Total expenses Income from operations... -

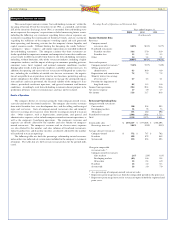

Page 11

... also affected by the number and sales volumes of franchised restaurants. Initial franchise fees and franchise royalties are directly affected by the number of franchised restaurant openings. The following table sets forth the percentage relationship to total revenues, unless otherwise indicated, of... -

Page 12

... and new franchise store openings to result in $7.0 million to $8.0 million in incremental franchise royalties and an increase of approximately 10 basis points in the average royalty rate. Restaurant cost of operations, as a percentage of company-owned restaurant sales, was 73.0% in fiscal year 2001... -

Page 13

...be payable semi-annually in arrears at an average annual rate of approximately 6.8%. The company used the proceeds from the notes to pay down the outstanding borrowings under the line of credit (discussed above), to repurchase common stock of the company and for general corporate purposes. See Note... -

Page 14

... Balance Sheets August 31, 2001 2000 (In thousands) Assets Current assets: Cash and cash equivalents Accounts and notes receivable, net Net investment in direct financing leases Inventories Deferred income taxes Prepaid expenses Total current assets Notes receivable, net Net investment in direct... -

Page 15

...419 40,859 3,468 2,861 257,607 2001 Revenues: Company-owned restaurant sales Franchised restaurants: Franchise royalties Franchise fees Other Costs and expenses: Company-owned restaurants: Food and packaging Payroll and other employee benefits Other operating expenses $ 267,463 54,220 4,408 4,547... -

Page 16

...: Accounts payable Accrued and other liabilities Total adjustments Net cash provided by operating activities Cash flows from investing activities Purchases of property and equipment Acquisition of businesses, net of cash received Investments in direct financing leases Collections on direct financing... -

Page 17

..., except share data) 1. Summary of Significant Accounting Policies Operations Sonic Corp. (the "company") operates and franchises a chain of quick-service drivein restaurants in the United States. It derives its revenues primarily from companyowned restaurant sales and royalty fees from franchisees... -

Page 18

... the purchase method of accounting, with the results of operations of these restaurants included with that of the company's commencing April 1, 2001. The company's cash acquisition cost, prior to post-closing adjustments, of approximately $21.9 million consisted of the drive-ins' operating assets... -

Page 19

..., 2001 and 2000: 2001 Home office: Land and leasehold improvements Computer and other equipment Restaurants, including those leased to others: Land Buildings Equipment Property and equipment, at cost Less accumulated depreciation Property and equipment, net Leased restaurant buildings and equipment... -

Page 20

... shares. The purchase price will be between 85% and 100% of the stock's fair market value. Such price will be determined by the company's board of directors. Stock Options In January 2001, the stockholders of the company adopted the 2001 Sonic Corp. Stock Option Plan (the "2001 Employee Plan") and... -

Page 21

...trade separately from the common stock. The company will generally be entitled to redeem the rights at $0.01 per right at any time until 10 days (subject to extension) following a public announcement that a 15% position has been acquired. 13. Net Revenue Incentive Plan The company has a Net Revenue... -

Page 22

... sales Other Total revenues Company-owned restaurants operating expenses Selling, general and administrative Other Total expenses Income from operations Interest expense, net Income before income taxes Provision for income taxes Net income Net income per share: Basic Diluted Weighted average shares... -

Page 23

..., Oklahoma City, Oklahoma. PATTYE L. MOORE 1 Executive Vice President Sonic Corp. FEDERICO F. PEÃ'A 1, 3, 4 Managing Director Vestar Capital Partners H. E. "GENE" RAINBOLT Chairman BancFirst 1, 2 $ $ $ Market Information $ $ $ The company's common stock trades on the Nasdaq National Market System... -

Page 24

101 Park Avenue Oklahoma City, Oklahoma 73102 405/280-7654 www.sonicdrivein.com